Ballentine Partners LLC lowered its position in AppLovin Corporation (NASDAQ:APP - Free Report) by 4.7% during the second quarter, according to its most recent filing with the SEC. The institutional investor owned 8,279 shares of the company's stock after selling 407 shares during the period. Ballentine Partners LLC's holdings in AppLovin were worth $2,898,000 at the end of the most recent quarter.

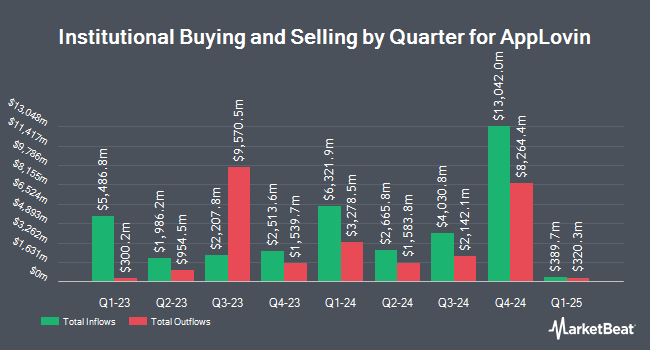

A number of other hedge funds and other institutional investors also recently added to or reduced their stakes in APP. Revolve Wealth Partners LLC purchased a new position in shares of AppLovin during the 4th quarter worth $294,000. Bison Wealth LLC purchased a new position in shares of AppLovin during the 4th quarter worth $239,000. Woodline Partners LP purchased a new position in shares of AppLovin during the 4th quarter worth $274,000. Toronto Dominion Bank raised its holdings in shares of AppLovin by 22.0% during the 4th quarter. Toronto Dominion Bank now owns 30,705 shares of the company's stock worth $9,943,000 after acquiring an additional 5,531 shares during the period. Finally, Mackenzie Financial Corp raised its holdings in shares of AppLovin by 235.9% during the 4th quarter. Mackenzie Financial Corp now owns 30,499 shares of the company's stock worth $9,876,000 after acquiring an additional 21,419 shares during the period. Hedge funds and other institutional investors own 41.85% of the company's stock.

Insider Buying and Selling at AppLovin

In other AppLovin news, insider Victoria Valenzuela sold 35,000 shares of the business's stock in a transaction dated Thursday, September 4th. The shares were sold at an average price of $502.23, for a total transaction of $17,578,050.00. Following the sale, the insider directly owned 269,955 shares in the company, valued at $135,579,499.65. This represents a 11.48% decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. Also, CEO Arash Adam Foroughi sold 26,200 shares of the business's stock in a transaction dated Friday, August 22nd. The stock was sold at an average price of $440.23, for a total transaction of $11,534,026.00. Following the sale, the chief executive officer owned 2,590,054 shares in the company, valued at $1,140,219,472.42. This trade represents a 1.00% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 1,156,788 shares of company stock valued at $514,863,333 over the last three months. 13.66% of the stock is currently owned by company insiders.

Analyst Upgrades and Downgrades

APP has been the topic of several analyst reports. Wells Fargo & Company lifted their price target on AppLovin from $480.00 to $491.00 and gave the stock an "overweight" rating in a report on Thursday, August 21st. BTIG Research lifted their price target on AppLovin from $547.00 to $664.00 and gave the stock a "buy" rating in a report on Monday, September 15th. JPMorgan Chase & Co. lifted their price target on AppLovin from $400.00 to $425.00 and gave the stock a "neutral" rating in a report on Thursday, August 7th. Jefferies Financial Group raised their price objective on AppLovin from $560.00 to $615.00 and gave the stock a "buy" rating in a research report on Friday, September 5th. Finally, Oppenheimer raised their price objective on AppLovin from $500.00 to $740.00 and gave the stock an "outperform" rating in a research report on Tuesday. Two research analysts have rated the stock with a Strong Buy rating, eighteen have assigned a Buy rating, three have given a Hold rating and one has given a Sell rating to the company's stock. According to data from MarketBeat, AppLovin presently has an average rating of "Moderate Buy" and a consensus price target of $513.38.

Read Our Latest Report on AppLovin

AppLovin Stock Down 1.4%

Shares of NASDAQ:APP opened at $641.92 on Thursday. The company has a debt-to-equity ratio of 3.01, a current ratio of 2.74 and a quick ratio of 2.74. The firm has a market capitalization of $217.13 billion, a PE ratio of 91.18, a price-to-earnings-growth ratio of 3.61 and a beta of 2.44. The firm's 50-day moving average is $468.97 and its two-hundred day moving average is $370.86. AppLovin Corporation has a 1 year low of $125.62 and a 1 year high of $670.19.

AppLovin (NASDAQ:APP - Get Free Report) last issued its quarterly earnings results on Wednesday, August 6th. The company reported $2.26 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $2.05 by $0.21. The company had revenue of $1.26 billion for the quarter, compared to analyst estimates of $1.37 billion. AppLovin had a net margin of 45.72% and a return on equity of 252.67%. The business's revenue for the quarter was up 77.1% compared to the same quarter last year. During the same period in the prior year, the firm earned $0.89 earnings per share. Analysts predict that AppLovin Corporation will post 6.87 EPS for the current year.

About AppLovin

(

Free Report)

AppLovin Corporation engages in building a software-based platform for advertisers to enhance the marketing and monetization of their content in the United States and internationally. It operates through two segments, Software Platform and Apps. The company's software solutions include AppDiscovery, a marketing software solution, which matches advertiser demand with publisher supply through auctions; MAX, an in-app bidding software that optimizes the value of a publisher's advertising inventory by running a real-time competitive auction; Adjust, a measurement and analytics marketing platform that provides marketers with the visibility, insights, and tools needed to grow their apps from early stage to maturity; and Wurl, a connected TV platform, which distributes streaming video for content companies and provides advertising and publishing solutions through its AdPool, ContentDiscovery, and Global FAST Pass products.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider AppLovin, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AppLovin wasn't on the list.

While AppLovin currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.