Banco Bilbao Vizcaya Argentaria S.A. raised its position in Amphenol Corporation (NYSE:APH - Free Report) by 7.7% during the first quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 121,691 shares of the electronics maker's stock after purchasing an additional 8,713 shares during the quarter. Banco Bilbao Vizcaya Argentaria S.A.'s holdings in Amphenol were worth $7,989,000 as of its most recent SEC filing.

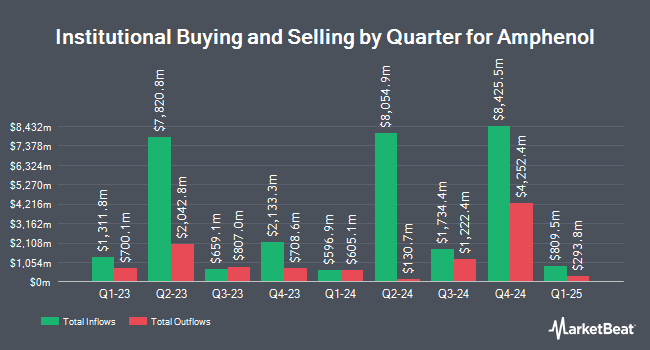

A number of other hedge funds and other institutional investors also recently added to or reduced their stakes in the company. Van Lanschot Kempen Investment Management N.V. purchased a new stake in Amphenol in the 1st quarter worth about $10,072,000. BI Asset Management Fondsmaeglerselskab A S grew its stake in Amphenol by 40.6% in the 1st quarter. BI Asset Management Fondsmaeglerselskab A S now owns 173,149 shares of the electronics maker's stock worth $11,357,000 after acquiring an additional 49,968 shares in the last quarter. Texas Capital Bank Wealth Management Services Inc bought a new position in Amphenol in the 1st quarter worth about $211,000. HITE Hedge Asset Management LLC grew its stake in Amphenol by 375.3% in the 1st quarter. HITE Hedge Asset Management LLC now owns 83,844 shares of the electronics maker's stock worth $5,499,000 after acquiring an additional 66,202 shares in the last quarter. Finally, BNP PARIBAS ASSET MANAGEMENT Holding S.A. grew its stake in Amphenol by 57.3% in the 1st quarter. BNP PARIBAS ASSET MANAGEMENT Holding S.A. now owns 253,276 shares of the electronics maker's stock worth $16,612,000 after acquiring an additional 92,273 shares in the last quarter. 97.01% of the stock is owned by hedge funds and other institutional investors.

Amphenol Stock Up 0.5%

Shares of NYSE APH traded up $0.5040 during trading hours on Friday, hitting $109.3140. 7,552,440 shares of the stock were exchanged, compared to its average volume of 7,896,059. The company has a quick ratio of 1.46, a current ratio of 2.02 and a debt-to-equity ratio of 0.61. The company has a market cap of $133.46 billion, a PE ratio of 43.55, a PEG ratio of 1.75 and a beta of 1.13. The firm has a fifty day moving average price of $102.54 and a 200-day moving average price of $83.55. Amphenol Corporation has a 12 month low of $56.45 and a 12 month high of $112.35.

Amphenol (NYSE:APH - Get Free Report) last posted its quarterly earnings data on Wednesday, July 23rd. The electronics maker reported $0.81 EPS for the quarter, topping the consensus estimate of $0.66 by $0.15. The firm had revenue of $5.65 billion during the quarter, compared to analyst estimates of $5.01 billion. Amphenol had a net margin of 16.90% and a return on equity of 30.58%. Amphenol's revenue was up 56.5% on a year-over-year basis. During the same quarter in the previous year, the business posted $0.44 EPS. Amphenol has set its Q3 2025 guidance at 0.770-0.790 EPS. On average, sell-side analysts expect that Amphenol Corporation will post 2.36 EPS for the current year.

Amphenol Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Wednesday, October 8th. Investors of record on Tuesday, September 16th will be paid a dividend of $0.165 per share. This represents a $0.66 annualized dividend and a dividend yield of 0.6%. The ex-dividend date is Tuesday, September 16th. Amphenol's payout ratio is 26.29%.

Insider Activity

In related news, VP David M. Silverman sold 100,000 shares of the business's stock in a transaction that occurred on Friday, May 30th. The shares were sold at an average price of $89.09, for a total transaction of $8,909,000.00. Following the completion of the transaction, the vice president owned 12,500 shares in the company, valued at $1,113,625. The trade was a 88.89% decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available through this link. Also, insider William J. Doherty sold 160,000 shares of the company's stock in a transaction that occurred on Friday, May 30th. The shares were sold at an average price of $89.54, for a total transaction of $14,326,400.00. The disclosure for this sale can be found here. Insiders have sold a total of 912,000 shares of company stock worth $88,763,320 over the last 90 days. 1.67% of the stock is currently owned by insiders.

Wall Street Analysts Forecast Growth

A number of equities analysts have commented on APH shares. TD Securities upped their target price on shares of Amphenol from $63.00 to $70.00 and gave the stock a "hold" rating in a research note on Thursday, May 1st. Citigroup upped their target price on shares of Amphenol from $115.00 to $125.00 and gave the stock a "buy" rating in a research note on Thursday, July 24th. Wall Street Zen downgraded shares of Amphenol from a "strong-buy" rating to a "buy" rating in a research note on Sunday, August 10th. Bank of America upped their target price on shares of Amphenol from $110.00 to $120.00 and gave the stock a "neutral" rating in a research note on Tuesday, August 5th. Finally, KGI Securities started coverage on shares of Amphenol in a research note on Thursday, June 26th. They set a "hold" rating on the stock. Eight investment analysts have rated the stock with a Buy rating and four have assigned a Hold rating to the stock. According to MarketBeat.com, Amphenol currently has a consensus rating of "Moderate Buy" and an average target price of $105.62.

Get Our Latest Analysis on APH

Amphenol Profile

(

Free Report)

Amphenol Corporation, together with its subsidiaries, primarily designs, manufactures, and markets electrical, electronic, and fiber optic connectors in the United States, China, and internationally. It operates through three segments: Harsh Environment Solutions, Communications Solutions, and Interconnect and Sensor Systems.

Further Reading

Before you consider Amphenol, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amphenol wasn't on the list.

While Amphenol currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.