Banco BTG Pactual S.A. boosted its stake in Ares Management Corporation (NYSE:ARES - Free Report) by 102.3% during the 1st quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 16,000 shares of the asset manager's stock after buying an additional 8,090 shares during the period. Banco BTG Pactual S.A.'s holdings in Ares Management were worth $2,346,000 as of its most recent SEC filing.

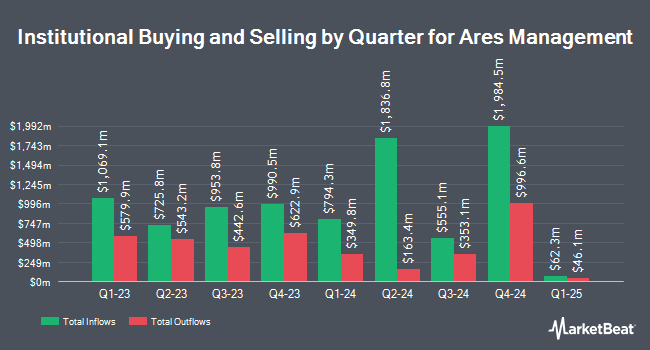

Several other institutional investors and hedge funds also recently modified their holdings of ARES. Redmont Wealth Advisors LLC bought a new position in shares of Ares Management in the first quarter worth $28,000. Transce3nd LLC bought a new position in Ares Management during the fourth quarter valued at about $29,000. Johnson Financial Group Inc. boosted its stake in Ares Management by 104.8% during the fourth quarter. Johnson Financial Group Inc. now owns 170 shares of the asset manager's stock valued at $30,000 after buying an additional 87 shares in the last quarter. Financial Network Wealth Advisors LLC bought a new position in Ares Management during the first quarter valued at about $31,000. Finally, Elequin Capital LP bought a new position in Ares Management during the fourth quarter valued at about $33,000. Institutional investors own 50.03% of the company's stock.

Analyst Ratings Changes

Several research analysts recently weighed in on ARES shares. Oppenheimer cut Ares Management from an "outperform" rating to a "market perform" rating in a research note on Thursday, May 15th. Wolfe Research set a $193.00 target price on Ares Management and gave the company an "outperform" rating in a research note on Tuesday, May 6th. Wells Fargo & Company raised their target price on Ares Management from $189.00 to $202.00 and gave the company an "overweight" rating in a research note on Friday, July 11th. Barclays raised their target price on Ares Management from $182.00 to $200.00 and gave the company an "overweight" rating in a research note on Thursday, July 10th. Finally, Raymond James Financial assumed coverage on Ares Management in a report on Monday, July 28th. They set a "market perform" rating for the company. Thirteen equities research analysts have rated the stock with a Buy rating and five have given a Hold rating to the company's stock. According to data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and an average price target of $180.06.

View Our Latest Stock Analysis on ARES

Ares Management Trading Up 1.5%

Shares of NYSE ARES traded up $2.5950 during mid-day trading on Friday, hitting $180.8550. 1,500,347 shares of the company traded hands, compared to its average volume of 1,350,245. Ares Management Corporation has a 1 year low of $110.63 and a 1 year high of $200.49. The stock has a market capitalization of $59.09 billion, a price-to-earnings ratio of 104.54, a PEG ratio of 1.42 and a beta of 1.40. The company has a quick ratio of 1.08, a current ratio of 1.08 and a debt-to-equity ratio of 0.64. The business has a 50 day moving average of $179.73 and a two-hundred day moving average of $165.93.

Ares Management (NYSE:ARES - Get Free Report) last announced its earnings results on Friday, August 1st. The asset manager reported $1.03 EPS for the quarter, missing the consensus estimate of $1.15 by ($0.12). The company had revenue of $1.35 billion for the quarter, compared to analysts' expectations of $1.02 billion. Ares Management had a net margin of 9.47% and a return on equity of 15.81%. During the same period in the prior year, the company earned $0.99 earnings per share. On average, sell-side analysts anticipate that Ares Management Corporation will post 5.28 earnings per share for the current fiscal year.

Ares Management Dividend Announcement

The firm also recently disclosed a quarterly dividend, which will be paid on Tuesday, September 30th. Investors of record on Tuesday, September 16th will be paid a $1.12 dividend. This represents a $4.48 annualized dividend and a yield of 2.5%. The ex-dividend date of this dividend is Tuesday, September 16th. Ares Management's dividend payout ratio is currently 258.96%.

Insider Buying and Selling

In related news, Chairman Bennett Rosenthal sold 85,000 shares of the stock in a transaction dated Thursday, June 12th. The stock was sold at an average price of $168.79, for a total value of $14,347,150.00. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. Also, Chairman Antony P. Ressler sold 105,394 shares of the stock in a transaction dated Friday, August 22nd. The stock was sold at an average price of $181.65, for a total value of $19,144,820.10. Following the completion of the sale, the chairman directly owned 1,733,257 shares of the company's stock, valued at approximately $314,846,134.05. This represents a 5.73% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders sold 992,628 shares of company stock valued at $177,736,922. Corporate insiders own 36.86% of the company's stock.

Ares Management Company Profile

(

Free Report)

Ares Management Corporation operates as an alternative asset manager in the United States, Europe, and Asia. The company's Tradable Credit Group segment manages various types of investment funds, such as commingled and separately managed accounts for institutional investors, and publicly traded vehicles and sub-advised funds for retail investors in the tradable and non-investment grade corporate credit markets.

Further Reading

Before you consider Ares Management, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ares Management wasn't on the list.

While Ares Management currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.