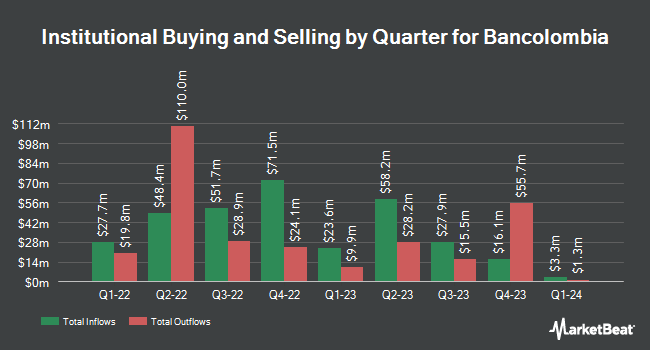

Zurcher Kantonalbank Zurich Cantonalbank increased its stake in shares of BanColombia S.A. (NYSE:CIB - Free Report) by 15.1% in the first quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 135,528 shares of the bank's stock after buying an additional 17,755 shares during the quarter. Zurcher Kantonalbank Zurich Cantonalbank owned about 0.06% of BanColombia worth $5,448,000 at the end of the most recent quarter.

Several other large investors have also recently added to or reduced their stakes in the stock. Whipplewood Advisors LLC increased its holdings in shares of BanColombia by 4,800.9% in the 1st quarter. Whipplewood Advisors LLC now owns 5,195 shares of the bank's stock worth $209,000 after acquiring an additional 5,089 shares during the period. Mercer Global Advisors Inc. ADV boosted its position in shares of BanColombia by 16.1% during the 4th quarter. Mercer Global Advisors Inc. ADV now owns 7,824 shares of the bank's stock valued at $247,000 after purchasing an additional 1,085 shares in the last quarter. Wealthquest Corp bought a new position in shares of BanColombia during the 1st quarter valued at about $290,000. Quadrant Capital Group LLC boosted its position in shares of BanColombia by 13.3% during the 4th quarter. Quadrant Capital Group LLC now owns 9,587 shares of the bank's stock valued at $302,000 after purchasing an additional 1,128 shares in the last quarter. Finally, Laird Norton Wetherby Wealth Management LLC boosted its position in shares of BanColombia by 7.5% during the 4th quarter. Laird Norton Wetherby Wealth Management LLC now owns 9,628 shares of the bank's stock valued at $303,000 after purchasing an additional 668 shares in the last quarter.

Analyst Ratings Changes

Separately, UBS Group restated a "neutral" rating and set a $38.00 price objective (up previously from $35.00) on shares of BanColombia in a research report on Monday, June 2nd. Three investment analysts have rated the stock with a sell rating, one has issued a hold rating and one has issued a buy rating to the stock. According to data from MarketBeat.com, the stock presently has an average rating of "Hold" and a consensus price target of $39.00.

Get Our Latest Research Report on CIB

BanColombia Trading Up 0.7%

Shares of CIB traded up $0.29 during midday trading on Monday, hitting $44.41. The stock had a trading volume of 82,513 shares, compared to its average volume of 396,256. BanColombia S.A. has a fifty-two week low of $30.25 and a fifty-two week high of $46.81. The business has a 50-day simple moving average of $43.99 and a two-hundred day simple moving average of $41.67. The firm has a market cap of $10.68 billion, a P/E ratio of 7.12, a price-to-earnings-growth ratio of 0.96 and a beta of 0.92. The company has a current ratio of 1.00, a quick ratio of 1.00 and a debt-to-equity ratio of 0.26.

BanColombia Profile

(

Free Report)

Bancolombia SA, together with its subsidiaries, provides banking products and services in Colombia and internationally. The company operates through nine segments: Banking Colombia, Banking Panama, Banking El Salvador, Banking Guatemala, Trust, Investment Banking, Brokerage, International Banking, and All Other.

Further Reading

Before you consider BanColombia, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BanColombia wasn't on the list.

While BanColombia currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.