Bank of New York Mellon Corp raised its position in AMC Entertainment Holdings, Inc. (NYSE:AMC - Free Report) by 12.9% in the first quarter, according to its most recent disclosure with the SEC. The firm owned 1,069,693 shares of the company's stock after acquiring an additional 121,905 shares during the period. Bank of New York Mellon Corp owned approximately 0.25% of AMC Entertainment worth $3,070,000 as of its most recent filing with the SEC.

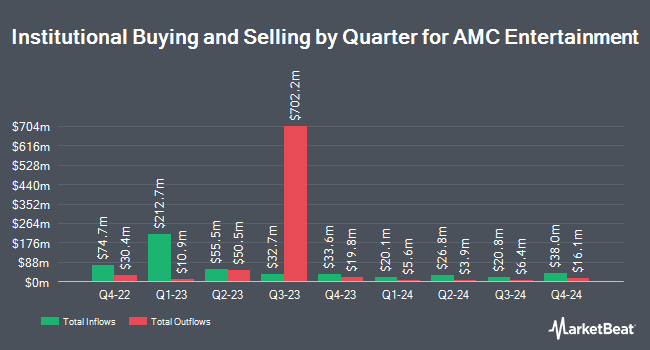

Other hedge funds and other institutional investors have also recently modified their holdings of the company. Legacy Financial Strategies LLC bought a new stake in shares of AMC Entertainment in the 1st quarter worth approximately $29,000. Sowell Financial Services LLC purchased a new position in AMC Entertainment in the 1st quarter worth $36,000. Sterling Capital Management LLC lifted its stake in AMC Entertainment by 831.5% in the fourth quarter. Sterling Capital Management LLC now owns 10,843 shares of the company's stock worth $43,000 after purchasing an additional 9,679 shares during the last quarter. Abacus Planning Group Inc. purchased a new position in shares of AMC Entertainment in the first quarter worth about $47,000. Finally, Traphagen Investment Advisors LLC increased its holdings in shares of AMC Entertainment by 48.1% in the first quarter. Traphagen Investment Advisors LLC now owns 23,756 shares of the company's stock worth $68,000 after buying an additional 7,720 shares during the period. Institutional investors own 28.80% of the company's stock.

Analyst Ratings Changes

A number of equities research analysts have weighed in on AMC shares. B. Riley began coverage on AMC Entertainment in a research report on Friday, May 16th. They set a "neutral" rating and a $3.00 target price for the company. Roth Mkm reduced their price target on shares of AMC Entertainment from $3.25 to $3.00 and set a "neutral" rating for the company in a report on Wednesday, April 16th. Wedbush upgraded shares of AMC Entertainment from a "neutral" rating to an "outperform" rating and increased their price objective for the company from $3.00 to $4.00 in a research note on Friday, July 11th. Finally, Citigroup restated a "sell" rating and set a $2.60 target price (up previously from $2.30) on shares of AMC Entertainment in a report on Thursday, May 29th. Three equities research analysts have rated the stock with a sell rating, five have assigned a hold rating and one has issued a buy rating to the stock. According to MarketBeat.com, AMC Entertainment presently has a consensus rating of "Hold" and a consensus target price of $4.26.

Read Our Latest Research Report on AMC

AMC Entertainment Stock Performance

Shares of NYSE AMC traded down $0.04 during midday trading on Wednesday, reaching $2.92. 9,758,621 shares of the stock were exchanged, compared to its average volume of 12,679,734. The stock has a market capitalization of $1.26 billion, a P/E ratio of -2.98 and a beta of 1.43. The company has a 50 day simple moving average of $3.21 and a 200 day simple moving average of $3.10. AMC Entertainment Holdings, Inc. has a twelve month low of $2.45 and a twelve month high of $5.56.

AMC Entertainment (NYSE:AMC - Get Free Report) last posted its earnings results on Wednesday, May 7th. The company reported ($0.58) earnings per share for the quarter, beating the consensus estimate of ($0.61) by $0.03. The company had revenue of $862.50 million during the quarter, compared to analyst estimates of $983.23 million. During the same quarter last year, the business posted ($0.62) EPS. The firm's revenue for the quarter was down 9.3% on a year-over-year basis. On average, research analysts expect that AMC Entertainment Holdings, Inc. will post -1.38 earnings per share for the current year.

AMC Entertainment Company Profile

(

Free Report)

AMC Entertainment Holdings, Inc, through its subsidiaries, engages in the theatrical exhibition business. It owns, operates, or has interests in theatres in the United States and Europe. The company was founded in 1920 and is headquartered in Leawood, Kansas.

Recommended Stories

Before you consider AMC Entertainment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AMC Entertainment wasn't on the list.

While AMC Entertainment currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.