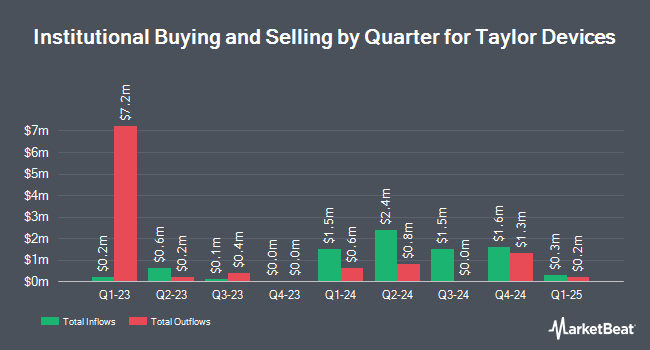

Bank of New York Mellon Corp bought a new position in Taylor Devices, Inc. (NASDAQ:TAYD - Free Report) in the first quarter, according to the company in its most recent Form 13F filing with the SEC. The fund bought 6,585 shares of the industrial products company's stock, valued at approximately $212,000. Bank of New York Mellon Corp owned about 0.21% of Taylor Devices as of its most recent filing with the SEC.

Other hedge funds have also bought and sold shares of the company. Dimensional Fund Advisors LP increased its position in shares of Taylor Devices by 28.8% during the 4th quarter. Dimensional Fund Advisors LP now owns 45,772 shares of the industrial products company's stock valued at $1,905,000 after purchasing an additional 10,224 shares during the last quarter. JPMorgan Chase & Co. increased its position in shares of Taylor Devices by 577.9% during the 4th quarter. JPMorgan Chase & Co. now owns 7,010 shares of the industrial products company's stock valued at $292,000 after purchasing an additional 5,976 shares during the last quarter. Geode Capital Management LLC increased its position in shares of Taylor Devices by 9.1% during the 4th quarter. Geode Capital Management LLC now owns 67,425 shares of the industrial products company's stock valued at $2,807,000 after purchasing an additional 5,611 shares during the last quarter. Arrowstreet Capital Limited Partnership increased its position in shares of Taylor Devices by 23.7% during the 4th quarter. Arrowstreet Capital Limited Partnership now owns 24,505 shares of the industrial products company's stock valued at $1,020,000 after purchasing an additional 4,700 shares during the last quarter. Finally, Northern Trust Corp increased its position in shares of Taylor Devices by 16.8% during the 4th quarter. Northern Trust Corp now owns 27,587 shares of the industrial products company's stock valued at $1,148,000 after purchasing an additional 3,958 shares during the last quarter. Hedge funds and other institutional investors own 17.62% of the company's stock.

Taylor Devices Stock Performance

Shares of NASDAQ TAYD traded down $0.46 during midday trading on Friday, hitting $44.12. 2,602 shares of the company's stock traded hands, compared to its average volume of 8,976. Taylor Devices, Inc. has a 1 year low of $29.50 and a 1 year high of $64.50. The stock has a market capitalization of $138.54 million, a price-to-earnings ratio of 17.65 and a beta of 0.89. The firm has a fifty day moving average of $42.42 and a 200 day moving average of $36.39.

Taylor Devices Company Profile

(

Free Report)

Taylor Devices, Inc engages in design, development, manufacture, and marketing of shock absorption, rate control, and energy storage devices for use in machinery, equipment, and structures in the United States, Asia, and internationally. Its products include seismic dampers that are designed to mitigate the effects of earthquakes on structures; Fluidicshoks, which are compact shock absorbers primarily used in defense, aerospace, and commercial industries; and crane and industrial buffers, which are larger versions of the Fluidicshoks for industrial application on cranes and crane trolleys, truck docks, ladle and ingot cars, ore trolleys, and train car stops.

Featured Stories

Before you consider Taylor Devices, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Taylor Devices wasn't on the list.

While Taylor Devices currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.