Bank of New York Mellon Corp decreased its holdings in Cushman & Wakefield PLC (NYSE:CWK - Free Report) by 4.2% during the 1st quarter, according to the company in its most recent disclosure with the SEC. The institutional investor owned 1,573,000 shares of the company's stock after selling 69,784 shares during the quarter. Bank of New York Mellon Corp owned approximately 0.68% of Cushman & Wakefield worth $16,076,000 as of its most recent filing with the SEC.

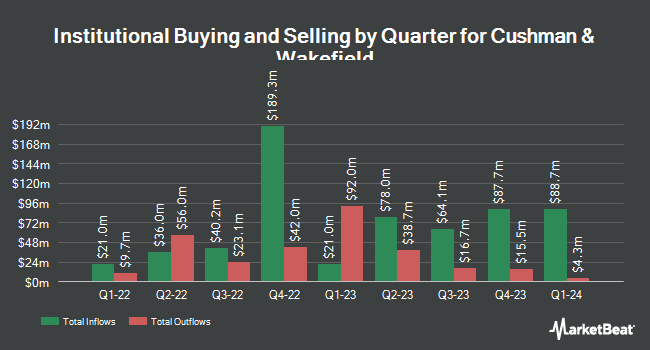

Several other institutional investors have also modified their holdings of CWK. Norges Bank acquired a new stake in Cushman & Wakefield during the fourth quarter valued at approximately $38,720,000. Raymond James Financial Inc. acquired a new stake in Cushman & Wakefield during the fourth quarter valued at approximately $25,964,000. Next Century Growth Investors LLC acquired a new stake in Cushman & Wakefield during the fourth quarter valued at approximately $16,580,000. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC raised its stake in Cushman & Wakefield by 54.7% during the fourth quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 3,067,526 shares of the company's stock valued at $40,123,000 after buying an additional 1,084,940 shares in the last quarter. Finally, Jane Street Group LLC raised its stake in Cushman & Wakefield by 101.8% during the fourth quarter. Jane Street Group LLC now owns 14,542 shares of the company's stock valued at $190,000 after buying an additional 837,554 shares in the last quarter. Institutional investors and hedge funds own 95.56% of the company's stock.

Cushman & Wakefield Stock Performance

CWK stock traded up $0.17 on Wednesday, reaching $11.75. The company's stock had a trading volume of 2,067,822 shares, compared to its average volume of 1,953,855. Cushman & Wakefield PLC has a 52 week low of $7.64 and a 52 week high of $16.11. The company has a market capitalization of $2.72 billion, a P/E ratio of 17.03 and a beta of 1.43. The firm has a fifty day moving average of $10.76 and a two-hundred day moving average of $10.98. The company has a debt-to-equity ratio of 1.64, a current ratio of 1.18 and a quick ratio of 1.18.

Cushman & Wakefield (NYSE:CWK - Get Free Report) last issued its quarterly earnings results on Tuesday, April 29th. The company reported $0.09 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.02 by $0.07. The firm had revenue of $2.28 billion during the quarter, compared to analyst estimates of $2.26 billion. Cushman & Wakefield had a return on equity of 13.50% and a net margin of 1.70%. The firm's revenue was up 4.6% on a year-over-year basis. As a group, analysts predict that Cushman & Wakefield PLC will post 1.2 EPS for the current fiscal year.

Wall Street Analysts Forecast Growth

CWK has been the subject of several recent research reports. JMP Securities initiated coverage on Cushman & Wakefield in a report on Monday. They set a "market outperform" rating and a $15.00 target price for the company. JPMorgan Chase & Co. lowered their target price on Cushman & Wakefield from $17.00 to $14.00 and set a "neutral" rating for the company in a report on Thursday, April 10th. UBS Group upped their target price on Cushman & Wakefield from $9.00 to $12.00 and gave the company a "neutral" rating in a report on Wednesday, July 2nd. Wall Street Zen lowered Cushman & Wakefield from a "strong-buy" rating to a "buy" rating in a report on Sunday. Finally, Citizens Jmp initiated coverage on Cushman & Wakefield in a report on Monday. They set a "strong-buy" rating and a $15.00 target price for the company. One investment analyst has rated the stock with a sell rating, four have given a hold rating, four have given a buy rating and one has issued a strong buy rating to the stock. According to MarketBeat, the stock has a consensus rating of "Moderate Buy" and an average price target of $13.78.

Check Out Our Latest Report on Cushman & Wakefield

Cushman & Wakefield Profile

(

Free Report)

Cushman & Wakefield Plc engages in the provision of commercial real estate services. It operates through the following geographical segments: Americas, Europe, Middle East and Africa (EMEA), and Asia Pacific (APAC). The Americas segment consists of operations located in the United States, Canada and key markets in Latin America.

Recommended Stories

Before you consider Cushman & Wakefield, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cushman & Wakefield wasn't on the list.

While Cushman & Wakefield currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.