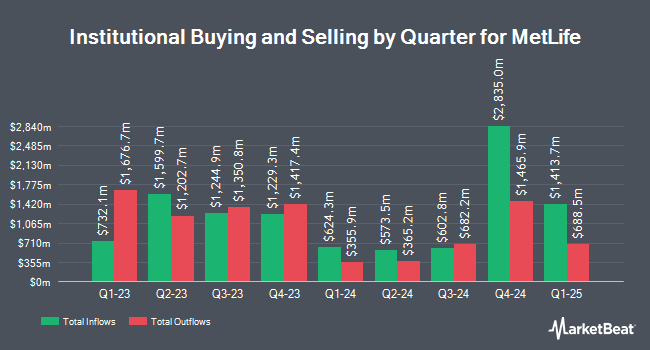

Bank of Nova Scotia grew its position in MetLife, Inc. (NYSE:MET - Free Report) by 6.6% in the 1st quarter, according to its most recent filing with the Securities & Exchange Commission. The firm owned 321,889 shares of the financial services provider's stock after buying an additional 19,934 shares during the period. Bank of Nova Scotia's holdings in MetLife were worth $25,841,000 at the end of the most recent quarter.

Other institutional investors and hedge funds also recently made changes to their positions in the company. Price T Rowe Associates Inc. MD lifted its position in MetLife by 33.7% in the 4th quarter. Price T Rowe Associates Inc. MD now owns 24,663,239 shares of the financial services provider's stock valued at $2,019,427,000 after acquiring an additional 6,213,923 shares in the last quarter. Diamond Hill Capital Management Inc. bought a new stake in MetLife in the 1st quarter valued at $336,965,000. Northern Trust Corp lifted its position in MetLife by 15.7% in the 4th quarter. Northern Trust Corp now owns 7,052,202 shares of the financial services provider's stock valued at $577,434,000 after acquiring an additional 958,458 shares in the last quarter. GAMMA Investing LLC lifted its position in MetLife by 8,789.6% in the 1st quarter. GAMMA Investing LLC now owns 815,889 shares of the financial services provider's stock valued at $65,508,000 after acquiring an additional 806,711 shares in the last quarter. Finally, Universal Beteiligungs und Servicegesellschaft mbH bought a new stake in MetLife in the 4th quarter valued at $62,265,000. Institutional investors and hedge funds own 94.99% of the company's stock.

Analysts Set New Price Targets

Several research firms recently commented on MET. Morgan Stanley reaffirmed an "overweight" rating and issued a $98.00 price objective (down from $99.00) on shares of MetLife in a research report on Monday, July 14th. Keefe, Bruyette & Woods cut their price target on shares of MetLife from $95.00 to $94.00 and set an "outperform" rating on the stock in a research report on Wednesday, July 9th. Wells Fargo & Company reissued an "overweight" rating and set a $97.00 price target (up from $94.00) on shares of MetLife in a research report on Thursday, July 10th. JPMorgan Chase & Co. boosted their price target on shares of MetLife from $86.00 to $95.00 and gave the stock an "overweight" rating in a research report on Tuesday, July 8th. Finally, Wall Street Zen cut shares of MetLife from a "buy" rating to a "hold" rating in a research report on Saturday, May 24th. Two research analysts have rated the stock with a hold rating and ten have issued a buy rating to the company's stock. According to MarketBeat, MetLife presently has a consensus rating of "Moderate Buy" and an average price target of $96.10.

Get Our Latest Stock Report on MET

MetLife Stock Performance

Shares of MetLife stock traded down $0.00 during trading on Tuesday, hitting $74.26. 461,541 shares of the stock were exchanged, compared to its average volume of 3,373,356. The stock has a market capitalization of $49.85 billion, a price-to-earnings ratio of 12.07, a price-to-earnings-growth ratio of 0.60 and a beta of 0.85. The company has a fifty day moving average price of $78.35 and a 200-day moving average price of $79.31. MetLife, Inc. has a 1-year low of $65.21 and a 1-year high of $89.05. The company has a current ratio of 0.16, a quick ratio of 0.16 and a debt-to-equity ratio of 0.55.

MetLife declared that its Board of Directors has approved a share buyback plan on Wednesday, April 30th that authorizes the company to repurchase $3.00 billion in outstanding shares. This repurchase authorization authorizes the financial services provider to reacquire up to 5.9% of its stock through open market purchases. Stock repurchase plans are often an indication that the company's board believes its shares are undervalued.

MetLife Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Tuesday, September 9th. Stockholders of record on Tuesday, August 5th will be paid a dividend of $0.5675 per share. The ex-dividend date is Tuesday, August 5th. This represents a $2.27 annualized dividend and a dividend yield of 3.1%. MetLife's payout ratio is currently 36.91%.

MetLife Profile

(

Free Report)

MetLife, Inc, a financial services company, provides insurance, annuities, employee benefits, and asset management services worldwide. It operates through six segments: Retirement and Income Solutions; Group Benefits; Asia; Latin America; Europe, the Middle East and Africa; and MetLife Holdings. The company offers life, dental, group short-and long-term disability, individual disability, pet insurance, accidental death and dismemberment, vision, and accident and health coverages, as well as prepaid legal plans; administrative services-only arrangements to employers; and general and separate account, and synthetic guaranteed interest contracts, as well as private floating rate funding agreements.

Further Reading

Before you consider MetLife, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MetLife wasn't on the list.

While MetLife currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.