Bank of Nova Scotia lowered its holdings in Martin Marietta Materials, Inc. (NYSE:MLM - Free Report) by 21.8% in the 1st quarter, according to the company in its most recent filing with the SEC. The firm owned 6,385 shares of the construction company's stock after selling 1,777 shares during the quarter. Bank of Nova Scotia's holdings in Martin Marietta Materials were worth $3,053,000 at the end of the most recent quarter.

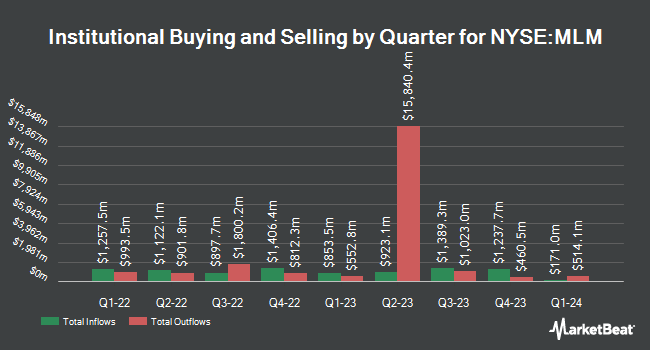

Several other institutional investors and hedge funds have also bought and sold shares of MLM. Wayfinding Financial LLC purchased a new stake in Martin Marietta Materials in the 1st quarter worth approximately $29,000. Chilton Capital Management LLC bought a new position in shares of Martin Marietta Materials in the 1st quarter worth approximately $30,000. IMA Advisory Services Inc. bought a new position in shares of Martin Marietta Materials in the 1st quarter worth approximately $40,000. Valley National Advisers Inc. raised its position in shares of Martin Marietta Materials by 193.9% in the 1st quarter. Valley National Advisers Inc. now owns 97 shares of the construction company's stock worth $45,000 after acquiring an additional 64 shares in the last quarter. Finally, Bellwether Advisors LLC bought a new position in shares of Martin Marietta Materials in the 4th quarter worth approximately $46,000. Hedge funds and other institutional investors own 95.04% of the company's stock.

Martin Marietta Materials Trading Up 1.0%

Shares of MLM stock opened at $608.34 on Wednesday. Martin Marietta Materials, Inc. has a 12-month low of $441.95 and a 12-month high of $633.23. The company has a current ratio of 2.25, a quick ratio of 0.99 and a debt-to-equity ratio of 0.58. The stock's 50-day moving average price is $558.08 and its 200-day moving average price is $527.27. The stock has a market capitalization of $36.67 billion, a price-to-earnings ratio of 35.04, a price-to-earnings-growth ratio of 5.52 and a beta of 0.89.

Martin Marietta Materials Announces Dividend

The company also recently announced a quarterly dividend, which was paid on Monday, June 30th. Stockholders of record on Monday, June 2nd were issued a $0.79 dividend. This represents a $3.16 annualized dividend and a dividend yield of 0.5%. The ex-dividend date of this dividend was Monday, June 2nd. Martin Marietta Materials's payout ratio is 18.20%.

Analysts Set New Price Targets

MLM has been the subject of several research reports. Royal Bank Of Canada initiated coverage on Martin Marietta Materials in a research report on Monday, June 16th. They issued a "sector perform" rating and a $515.00 target price for the company. Bank of America increased their target price on Martin Marietta Materials from $577.00 to $643.00 and gave the stock a "neutral" rating in a research report on Tuesday. Raymond James Financial decreased their target price on Martin Marietta Materials from $600.00 to $597.00 and set an "outperform" rating for the company in a research report on Tuesday, April 29th. UBS Group raised Martin Marietta Materials from a "neutral" rating to a "buy" rating and raised their price objective for the company from $548.00 to $634.00 in a research report on Friday, May 16th. Finally, Wall Street Zen lowered Martin Marietta Materials from a "hold" rating to a "sell" rating in a research report on Saturday, May 31st. One investment analyst has rated the stock with a sell rating, four have given a hold rating, twelve have given a buy rating and two have assigned a strong buy rating to the company's stock. According to data from MarketBeat, the stock has an average rating of "Moderate Buy" and an average target price of $608.40.

View Our Latest Analysis on MLM

Martin Marietta Materials Company Profile

(

Free Report)

Martin Marietta Materials, Inc, a natural resource-based building materials company, supplies aggregates and heavy-side building materials to the construction industry in the United States and internationally. It offers crushed stone, sand, and gravel products; ready mixed concrete and asphalt; paving products and services; and Portland and specialty cement for use in the infrastructure projects, and nonresidential and residential construction markets, as well as in the railroad, agricultural, utility, and environmental industries.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Martin Marietta Materials, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Martin Marietta Materials wasn't on the list.

While Martin Marietta Materials currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.