Bank Pictet & Cie Europe AG increased its stake in shares of DexCom, Inc. (NASDAQ:DXCM - Free Report) by 28.1% in the second quarter, according to its most recent 13F filing with the SEC. The firm owned 150,642 shares of the medical device company's stock after purchasing an additional 33,067 shares during the period. Bank Pictet & Cie Europe AG's holdings in DexCom were worth $13,150,000 at the end of the most recent reporting period.

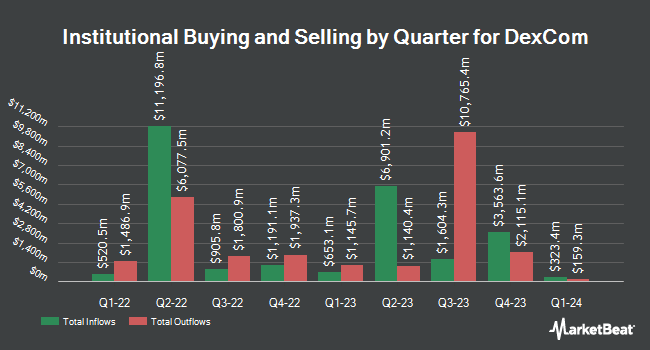

Several other institutional investors have also recently added to or reduced their stakes in the stock. Vanguard Group Inc. lifted its stake in DexCom by 2.0% during the first quarter. Vanguard Group Inc. now owns 47,455,899 shares of the medical device company's stock worth $3,240,763,000 after purchasing an additional 925,882 shares in the last quarter. Jennison Associates LLC raised its holdings in shares of DexCom by 37.7% in the 1st quarter. Jennison Associates LLC now owns 10,523,246 shares of the medical device company's stock valued at $718,632,000 after buying an additional 2,879,489 shares during the period. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC lifted its stake in DexCom by 22.6% during the 1st quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC now owns 10,123,525 shares of the medical device company's stock worth $691,336,000 after acquiring an additional 1,868,241 shares in the last quarter. Nuveen LLC purchased a new position in DexCom during the 1st quarter valued at about $554,893,000. Finally, Raymond James Financial Inc. boosted its holdings in DexCom by 21.8% during the 1st quarter. Raymond James Financial Inc. now owns 3,355,057 shares of the medical device company's stock valued at $229,117,000 after acquiring an additional 601,088 shares during the period. Institutional investors and hedge funds own 97.75% of the company's stock.

Insiders Place Their Bets

In other news, EVP Michael Jon Brown sold 500 shares of the firm's stock in a transaction dated Friday, August 15th. The stock was sold at an average price of $80.29, for a total transaction of $40,145.00. Following the sale, the executive vice president owned 94,102 shares of the company's stock, valued at approximately $7,555,449.58. This trade represents a 0.53% decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, Director Kyle Malady sold 667 shares of the business's stock in a transaction that occurred on Friday, September 5th. The stock was sold at an average price of $80.86, for a total value of $53,933.62. Following the sale, the director owned 22,667 shares of the company's stock, valued at approximately $1,832,853.62. The trade was a 2.86% decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders sold 6,849 shares of company stock valued at $564,733. 0.32% of the stock is owned by insiders.

DexCom Trading Up 1.2%

NASDAQ DXCM opened at $68.30 on Friday. DexCom, Inc. has a 52 week low of $57.52 and a 52 week high of $93.25. The firm has a 50 day moving average of $78.61 and a two-hundred day moving average of $78.03. The stock has a market capitalization of $26.78 billion, a PE ratio of 47.43, a price-to-earnings-growth ratio of 1.42 and a beta of 1.48. The company has a quick ratio of 1.35, a current ratio of 1.52 and a debt-to-equity ratio of 0.48.

DexCom (NASDAQ:DXCM - Get Free Report) last issued its earnings results on Wednesday, July 30th. The medical device company reported $0.48 EPS for the quarter, topping analysts' consensus estimates of $0.45 by $0.03. The firm had revenue of $1.16 billion during the quarter, compared to the consensus estimate of $1.13 billion. DexCom had a net margin of 13.29% and a return on equity of 30.41%. The company's revenue was up 15.2% compared to the same quarter last year. During the same quarter in the previous year, the firm posted $0.43 earnings per share. DexCom has set its FY 2025 guidance at EPS. As a group, research analysts expect that DexCom, Inc. will post 2.03 EPS for the current fiscal year.

Wall Street Analyst Weigh In

DXCM has been the topic of a number of recent research reports. Wall Street Zen lowered shares of DexCom from a "strong-buy" rating to a "buy" rating in a research note on Sunday, August 10th. William Blair raised shares of DexCom to a "strong-buy" rating in a research note on Thursday, July 31st. Mizuho increased their target price on shares of DexCom from $95.00 to $100.00 and gave the stock an "outperform" rating in a report on Wednesday, July 16th. Barclays boosted their price target on shares of DexCom from $93.00 to $98.00 and gave the stock an "equal weight" rating in a research note on Wednesday, July 30th. Finally, UBS Group increased their price objective on DexCom from $105.00 to $106.00 and gave the company a "buy" rating in a research note on Thursday, July 31st. Three equities research analysts have rated the stock with a Strong Buy rating, fourteen have issued a Buy rating and five have given a Hold rating to the stock. According to data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and a consensus price target of $99.89.

Get Our Latest Report on DexCom

DexCom Profile

(

Free Report)

DexCom, Inc, a medical device company, focuses on the design, development, and commercialization of continuous glucose monitoring (CGM) systems in the United States and internationally. The company provides its systems for use by people with diabetes, as well as for use by healthcare providers. Its products include Dexcom G6 and Dexcom G7, integrated CGM systems for diabetes management; Dexcom Share, a remote monitoring system; Dexcom Real-Time API, which enables authorized third-party software developers to integrate real-time CGM data into their digital health apps and devices; and Dexcom ONE, that is designed to replace finger stick blood glucose testing for diabetes treatment decisions.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider DexCom, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DexCom wasn't on the list.

While DexCom currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report