Banque Cantonale Vaudoise purchased a new stake in Dropbox, Inc. (NASDAQ:DBX - Free Report) during the first quarter, according to its most recent 13F filing with the SEC. The firm purchased 9,690 shares of the company's stock, valued at approximately $259,000.

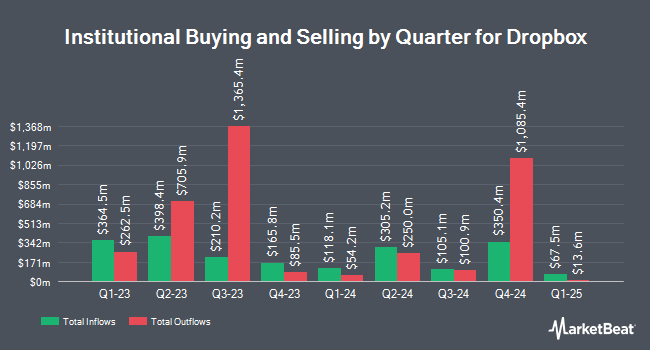

A number of other institutional investors also recently bought and sold shares of the stock. True Wealth Design LLC lifted its stake in shares of Dropbox by 191.0% in the 4th quarter. True Wealth Design LLC now owns 1,036 shares of the company's stock valued at $31,000 after purchasing an additional 680 shares during the period. Huntington National Bank boosted its holdings in Dropbox by 768.9% during the fourth quarter. Huntington National Bank now owns 1,538 shares of the company's stock worth $46,000 after buying an additional 1,361 shares in the last quarter. SBI Securities Co. Ltd. boosted its holdings in Dropbox by 33.4% during the first quarter. SBI Securities Co. Ltd. now owns 1,794 shares of the company's stock worth $48,000 after buying an additional 449 shares in the last quarter. Fifth Third Bancorp boosted its holdings in Dropbox by 27.3% during the first quarter. Fifth Third Bancorp now owns 2,288 shares of the company's stock worth $61,000 after buying an additional 490 shares in the last quarter. Finally, UMB Bank n.a. boosted its holdings in Dropbox by 115.0% during the first quarter. UMB Bank n.a. now owns 2,501 shares of the company's stock worth $67,000 after buying an additional 1,338 shares in the last quarter. 94.84% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

Several equities research analysts recently commented on DBX shares. Citigroup boosted their price target on shares of Dropbox from $30.00 to $32.00 and gave the stock a "neutral" rating in a report on Friday, May 9th. UBS Group boosted their price target on shares of Dropbox from $30.00 to $31.00 and gave the stock a "buy" rating in a report on Friday, May 9th.

Get Our Latest Report on DBX

Insider Activity

In related news, Director Karen Peacock sold 7,000 shares of the company's stock in a transaction that occurred on Tuesday, May 27th. The shares were sold at an average price of $28.53, for a total transaction of $199,710.00. Following the sale, the director directly owned 25,295 shares in the company, valued at approximately $721,666.35. This represents a 21.68% decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, insider Ashraf Alkarmi sold 10,098 shares of the stock in a transaction that occurred on Friday, June 13th. The shares were sold at an average price of $28.10, for a total transaction of $283,753.80. Following the completion of the transaction, the insider owned 492,856 shares in the company, valued at $13,849,253.60. This represents a 2.01% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 466,125 shares of company stock valued at $13,221,355 over the last three months. 28.59% of the stock is currently owned by corporate insiders.

Dropbox Stock Performance

Shares of DBX stock traded down $0.55 on Tuesday, hitting $26.13. 3,316,160 shares of the stock traded hands, compared to its average volume of 3,135,579. The firm's 50-day moving average price is $28.01 and its two-hundred day moving average price is $28.34. The stock has a market capitalization of $7.36 billion, a PE ratio of 17.08, a PEG ratio of 10.49 and a beta of 0.64. Dropbox, Inc. has a twelve month low of $21.32 and a twelve month high of $33.33.

Dropbox (NASDAQ:DBX - Get Free Report) last announced its quarterly earnings results on Thursday, May 8th. The company reported $0.70 earnings per share for the quarter, beating the consensus estimate of $0.62 by $0.08. The firm had revenue of $624.70 million for the quarter, compared to analysts' expectations of $619.56 million. Dropbox had a net margin of 18.50% and a negative return on equity of 79.66%. The company's revenue was down 1.0% compared to the same quarter last year. During the same quarter in the previous year, the company posted $0.58 EPS. On average, equities research analysts anticipate that Dropbox, Inc. will post 1.64 EPS for the current fiscal year.

Dropbox Profile

(

Free Report)

Dropbox, Inc provides a content collaboration platform worldwide. The company's platform allows individuals, families, teams, and organizations to collaborate and sign up for free through its website or app, as well as upgrade to a paid subscription plan for premium features. It serves customers in professional services, technology, media, education, industrial, consumer and retail, and financial services industries.

Featured Stories

Before you consider Dropbox, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dropbox wasn't on the list.

While Dropbox currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.