Banque Cantonale Vaudoise acquired a new position in Zoom Communications, Inc. (NASDAQ:ZM - Free Report) in the 1st quarter, according to its most recent Form 13F filing with the SEC. The institutional investor acquired 11,637 shares of the company's stock, valued at approximately $859,000.

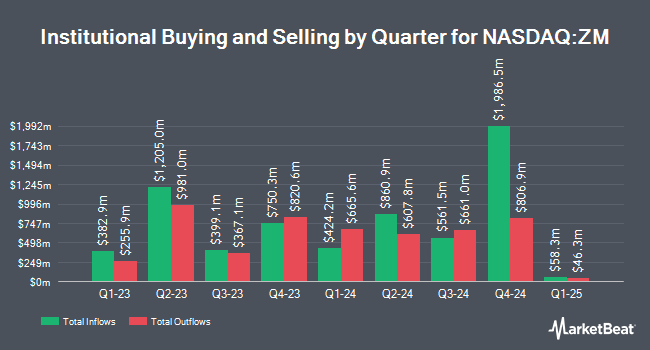

A number of other institutional investors have also recently bought and sold shares of the business. Altshuler Shaham Ltd grew its stake in shares of Zoom Communications by 285.9% in the 4th quarter. Altshuler Shaham Ltd now owns 2,056,277 shares of the company's stock valued at $167,813,000 after buying an additional 1,523,480 shares in the last quarter. T. Rowe Price Investment Management Inc. raised its holdings in shares of Zoom Communications by 24.3% during the 4th quarter. T. Rowe Price Investment Management Inc. now owns 6,385,523 shares of the company's stock valued at $521,123,000 after purchasing an additional 1,247,717 shares in the last quarter. Victory Capital Management Inc. lifted its stake in shares of Zoom Communications by 119.5% in the 1st quarter. Victory Capital Management Inc. now owns 1,405,311 shares of the company's stock valued at $103,670,000 after purchasing an additional 765,092 shares during the last quarter. Junto Capital Management LP bought a new position in Zoom Communications during the fourth quarter valued at about $36,580,000. Finally, Renaissance Technologies LLC boosted its stake in shares of Zoom Communications by 9.7% during the 4th quarter. Renaissance Technologies LLC now owns 4,304,848 shares of the company's stock worth $351,319,000 after acquiring an additional 380,900 shares in the last quarter. 66.54% of the stock is currently owned by institutional investors and hedge funds.

Analysts Set New Price Targets

A number of brokerages have issued reports on ZM. JMP Securities reaffirmed a "market perform" rating on shares of Zoom Communications in a research report on Thursday, May 22nd. Piper Sandler increased their target price on Zoom Communications from $77.00 to $85.00 and gave the company a "neutral" rating in a research note on Thursday, May 22nd. Scotiabank upped their target price on shares of Zoom Communications from $75.00 to $85.00 and gave the company a "sector perform" rating in a research note on Friday, May 16th. Wells Fargo & Company upped their price objective on shares of Zoom Communications from $75.00 to $80.00 and gave the company an "equal weight" rating in a research report on Thursday, May 22nd. Finally, Citigroup cut their price target on Zoom Communications from $85.00 to $84.00 and set a "neutral" rating for the company in a report on Thursday, May 15th. One research analyst has rated the stock with a sell rating, fifteen have given a hold rating, ten have given a buy rating and one has assigned a strong buy rating to the company's stock. According to MarketBeat, Zoom Communications has an average rating of "Hold" and a consensus target price of $87.00.

Get Our Latest Stock Analysis on ZM

Zoom Communications Price Performance

Shares of NASDAQ ZM traded up $0.17 during mid-day trading on Tuesday, hitting $72.23. The company's stock had a trading volume of 722,533 shares, compared to its average volume of 2,639,365. Zoom Communications, Inc. has a one year low of $55.06 and a one year high of $92.80. The company's fifty day simple moving average is $77.01 and its 200-day simple moving average is $77.65. The stock has a market cap of $21.85 billion, a price-to-earnings ratio of 21.69, a price-to-earnings-growth ratio of 11.63 and a beta of 0.68.

Zoom Communications (NASDAQ:ZM - Get Free Report) last released its earnings results on Wednesday, May 21st. The company reported $1.43 earnings per share for the quarter, beating the consensus estimate of $1.30 by $0.13. Zoom Communications had a return on equity of 11.08% and a net margin of 22.31%. The firm had revenue of $1.17 billion for the quarter, compared to analyst estimates of $1.17 billion. During the same quarter in the prior year, the firm posted $1.35 earnings per share. The company's quarterly revenue was up 2.9% on a year-over-year basis. On average, sell-side analysts predict that Zoom Communications, Inc. will post 2.93 EPS for the current year.

Insiders Place Their Bets

In related news, Director Janet Napolitano sold 2,617 shares of the stock in a transaction on Friday, June 13th. The shares were sold at an average price of $76.78, for a total transaction of $200,933.26. Following the completion of the transaction, the director owned 4,728 shares in the company, valued at approximately $363,015.84. This represents a 35.63% decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, Director Jonathan Chadwick sold 25,000 shares of Zoom Communications stock in a transaction on Tuesday, July 15th. The shares were sold at an average price of $74.86, for a total transaction of $1,871,500.00. Following the completion of the sale, the director owned 5,875 shares in the company, valued at $439,802.50. The trade was a 80.97% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 87,542 shares of company stock worth $6,609,623 in the last three months. 10.78% of the stock is owned by corporate insiders.

Zoom Communications Profile

(

Free Report)

Zoom Video Communications, Inc provides unified communications platform in the Americas, the Asia Pacific, Europe, the Middle East, and Africa. The company offers Zoom Meetings that offers HD video, voice, chat, and content sharing through mobile devices, desktops, laptops, telephones, and conference room systems; Zoom Phone, an enterprise cloud phone system; and Zoom Chat enables users to share messages, images, audio files, and content in desktop, laptop, tablet, and mobile devices.

Featured Articles

Before you consider Zoom Communications, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Zoom Communications wasn't on the list.

While Zoom Communications currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report