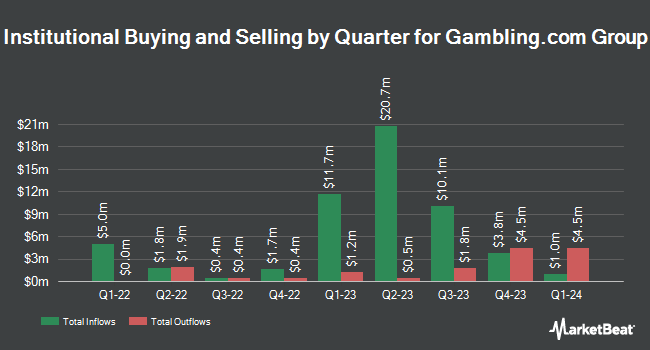

Bastion Asset Management Inc. purchased a new position in shares of Gambling.com Group Limited (NASDAQ:GAMB - Free Report) in the 1st quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor purchased 66,267 shares of the company's stock, valued at approximately $833,000. Bastion Asset Management Inc. owned about 0.19% of Gambling.com Group at the end of the most recent reporting period.

Several other large investors have also modified their holdings of the stock. Bank of New York Mellon Corp raised its position in Gambling.com Group by 12.1% in the fourth quarter. Bank of New York Mellon Corp now owns 34,540 shares of the company's stock worth $486,000 after acquiring an additional 3,729 shares in the last quarter. Intech Investment Management LLC purchased a new position in Gambling.com Group in the fourth quarter worth $146,000. Quantbot Technologies LP raised its position in Gambling.com Group by 12,853.2% in the fourth quarter. Quantbot Technologies LP now owns 10,233 shares of the company's stock worth $144,000 after acquiring an additional 10,154 shares in the last quarter. Virtu Financial LLC purchased a new position in Gambling.com Group in the fourth quarter worth $146,000. Finally, American Century Companies Inc. raised its position in Gambling.com Group by 22.8% in the fourth quarter. American Century Companies Inc. now owns 39,550 shares of the company's stock worth $557,000 after acquiring an additional 7,341 shares in the last quarter. Hedge funds and other institutional investors own 72.26% of the company's stock.

Analyst Ratings Changes

Several research firms have weighed in on GAMB. Jefferies Financial Group lowered their target price on Gambling.com Group from $20.00 to $18.00 and set a "buy" rating on the stock in a report on Thursday, July 3rd. Wall Street Zen raised Gambling.com Group from a "hold" rating to a "buy" rating in a report on Friday, May 30th. Finally, Truist Financial lowered their target price on Gambling.com Group from $18.00 to $17.00 and set a "buy" rating on the stock in a report on Wednesday, April 23rd. Nine research analysts have rated the stock with a buy rating, Based on data from MarketBeat, the company presently has a consensus rating of "Buy" and a consensus target price of $17.88.

Check Out Our Latest Analysis on GAMB

Gambling.com Group Trading Up 1.8%

Shares of Gambling.com Group stock traded up $0.19 during trading hours on Wednesday, reaching $10.72. The stock had a trading volume of 111,599 shares, compared to its average volume of 403,121. The firm has a 50 day simple moving average of $11.72 and a two-hundred day simple moving average of $12.88. The firm has a market capitalization of $372.45 million, a price-to-earnings ratio of 11.05 and a beta of 0.93. The company has a current ratio of 1.06, a quick ratio of 1.06 and a debt-to-equity ratio of 0.55. Gambling.com Group Limited has a 1 year low of $8.49 and a 1 year high of $17.14.

Gambling.com Group (NASDAQ:GAMB - Get Free Report) last announced its earnings results on Thursday, May 15th. The company reported $0.46 EPS for the quarter, beating the consensus estimate of $0.19 by $0.27. Gambling.com Group had a return on equity of 34.63% and a net margin of 24.97%. The business had revenue of $40.64 million for the quarter, compared to the consensus estimate of $40.07 million. As a group, equities research analysts anticipate that Gambling.com Group Limited will post 0.88 earnings per share for the current year.

About Gambling.com Group

(

Free Report)

Gambling.com Group Limited operates as a performance marketing company for the online gambling industry worldwide. It provides digital marketing services for the iGaming and social casino products. The company's focus is on online casino, online sports betting, and fantasy sports industry. It publishes various branded websites, including Gambling.com, Casinos.com, RotoWire.com, and Bookies.com.

Read More

Before you consider Gambling.com Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Gambling.com Group wasn't on the list.

While Gambling.com Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.