Bayforest Capital Ltd decreased its position in Tencent Music Entertainment Group Sponsored ADR (NYSE:TME - Free Report) by 45.2% during the second quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm owned 35,351 shares of the company's stock after selling 29,108 shares during the quarter. Bayforest Capital Ltd's holdings in Tencent Music Entertainment Group were worth $689,000 at the end of the most recent quarter.

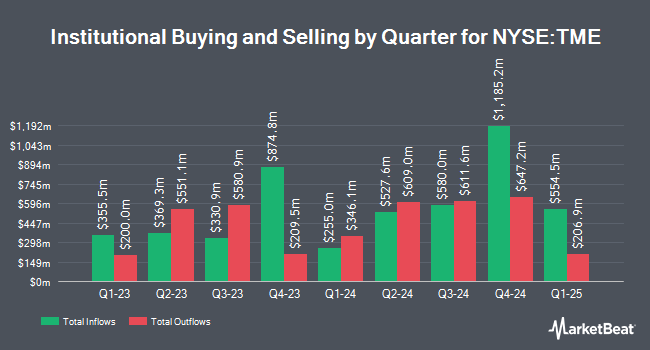

A number of other hedge funds have also recently modified their holdings of TME. Exchange Traded Concepts LLC increased its position in shares of Tencent Music Entertainment Group by 16.0% in the first quarter. Exchange Traded Concepts LLC now owns 149,852 shares of the company's stock valued at $2,159,000 after acquiring an additional 20,682 shares during the period. Matthews International Capital Management LLC increased its position in shares of Tencent Music Entertainment Group by 5.7% during the first quarter. Matthews International Capital Management LLC now owns 799,880 shares of the company's stock valued at $11,526,000 after buying an additional 42,923 shares during the period. Oppenheimer Asset Management Inc. increased its position in shares of Tencent Music Entertainment Group by 35.6% during the first quarter. Oppenheimer Asset Management Inc. now owns 13,609 shares of the company's stock valued at $196,000 after buying an additional 3,570 shares during the period. Asset Management One Co. Ltd. increased its position in shares of Tencent Music Entertainment Group by 0.5% during the first quarter. Asset Management One Co. Ltd. now owns 504,632 shares of the company's stock valued at $7,272,000 after buying an additional 2,549 shares during the period. Finally, Mirae Asset Global Investments Co. Ltd. increased its position in shares of Tencent Music Entertainment Group by 3,382.1% during the first quarter. Mirae Asset Global Investments Co. Ltd. now owns 4,481,537 shares of the company's stock valued at $64,579,000 after buying an additional 4,352,834 shares during the period. Hedge funds and other institutional investors own 24.32% of the company's stock.

Analyst Ratings Changes

A number of equities research analysts have weighed in on TME shares. Sanford C. Bernstein set a $27.50 price objective on shares of Tencent Music Entertainment Group and gave the stock an "outperform" rating in a report on Wednesday, August 13th. Daiwa Capital Markets upgraded shares of Tencent Music Entertainment Group from a "neutral" rating to an "outperform" rating in a report on Tuesday, August 12th. Zacks Research upgraded shares of Tencent Music Entertainment Group from a "hold" rating to a "strong-buy" rating in a report on Tuesday, August 26th. Barclays restated an "overweight" rating and issued a $27.00 price objective (up previously from $16.00) on shares of Tencent Music Entertainment Group in a report on Tuesday, August 12th. Finally, Macquarie set a $29.80 price target on shares of Tencent Music Entertainment Group and gave the company an "outperform" rating in a report on Tuesday, August 12th. Two equities research analysts have rated the stock with a Strong Buy rating and ten have given a Buy rating to the company. Based on data from MarketBeat, the company has an average rating of "Buy" and a consensus price target of $24.47.

Get Our Latest Research Report on Tencent Music Entertainment Group

Tencent Music Entertainment Group Stock Up 3.4%

Shares of Tencent Music Entertainment Group stock opened at $23.20 on Tuesday. The company has a market cap of $39.80 billion, a price-to-earnings ratio of 25.49 and a beta of 0.51. The company's 50 day moving average is $24.31 and its 200 day moving average is $19.56. Tencent Music Entertainment Group Sponsored ADR has a twelve month low of $10.11 and a twelve month high of $26.70. The company has a quick ratio of 1.87, a current ratio of 1.87 and a debt-to-equity ratio of 0.04.

Tencent Music Entertainment Group Profile

(

Free Report)

Tencent Music Entertainment Group operates online music entertainment platforms to provide music streaming, online karaoke, and live streaming services in the People's Republic of China. It offers QQ Music, Kugou Music, and Kuwo Music that enable users to discover music in personalized ways; long-form audio content, including audiobooks, podcasts and talk shows, as well as music-oriented video content comprising music videos, live performances, and short videos; and WeSing, which enables users to sing along from its library of karaoke songs and share their performances in audio or video formats with friends.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Tencent Music Entertainment Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tencent Music Entertainment Group wasn't on the list.

While Tencent Music Entertainment Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.