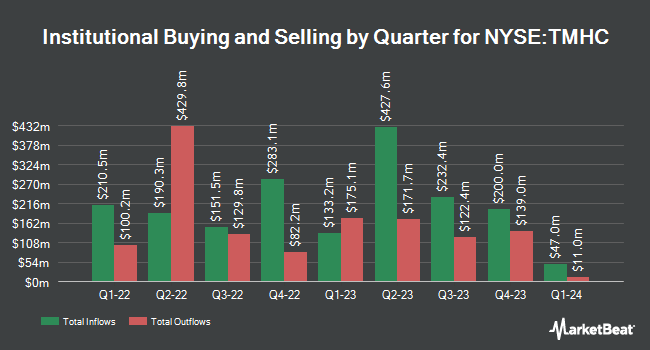

Bayview Asset Management LLC acquired a new stake in shares of Taylor Morrison Home Corporation (NYSE:TMHC - Free Report) in the 1st quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund acquired 16,087 shares of the construction company's stock, valued at approximately $966,000. Taylor Morrison Home accounts for approximately 0.4% of Bayview Asset Management LLC's holdings, making the stock its 12th largest holding.

A number of other institutional investors have also recently added to or reduced their stakes in the business. Nuveen LLC acquired a new stake in shares of Taylor Morrison Home during the first quarter valued at about $51,329,000. Long Pond Capital LP bought a new position in Taylor Morrison Home in the first quarter worth about $40,345,000. Victory Capital Management Inc. increased its stake in shares of Taylor Morrison Home by 197.2% in the first quarter. Victory Capital Management Inc. now owns 793,987 shares of the construction company's stock valued at $47,671,000 after purchasing an additional 526,819 shares during the period. Assenagon Asset Management S.A. increased its stake in shares of Taylor Morrison Home by 80.2% in the first quarter. Assenagon Asset Management S.A. now owns 912,064 shares of the construction company's stock valued at $54,760,000 after purchasing an additional 405,875 shares during the period. Finally, Cubist Systematic Strategies LLC acquired a new stake in shares of Taylor Morrison Home in the fourth quarter valued at approximately $14,736,000. 95.16% of the stock is owned by hedge funds and other institutional investors.

Analyst Upgrades and Downgrades

A number of research analysts recently commented on TMHC shares. Bank of America began coverage on shares of Taylor Morrison Home in a research note on Monday, May 5th. They set a "buy" rating and a $70.00 price objective on the stock. Seaport Res Ptn raised shares of Taylor Morrison Home from a "hold" rating to a "strong-buy" rating in a research note on Wednesday, July 23rd. Finally, Wall Street Zen lowered shares of Taylor Morrison Home from a "buy" rating to a "hold" rating in a research note on Sunday, June 1st. One equities research analyst has rated the stock with a Strong Buy rating and eight have given a Buy rating to the stock. Based on data from MarketBeat.com, the company currently has a consensus rating of "Buy" and an average price target of $76.88.

Get Our Latest Analysis on Taylor Morrison Home

Insider Transactions at Taylor Morrison Home

In related news, CEO Sheryl Palmer sold 25,000 shares of the firm's stock in a transaction dated Friday, August 22nd. The shares were sold at an average price of $70.20, for a total transaction of $1,755,000.00. Following the transaction, the chief executive officer directly owned 383,988 shares of the company's stock, valued at approximately $26,955,957.60. This trade represents a 6.11% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. Also, CFO Curtis Vanhyfte sold 9,754 shares of the firm's stock in a transaction dated Wednesday, August 6th. The stock was sold at an average price of $65.22, for a total transaction of $636,155.88. Following the transaction, the chief financial officer directly owned 14,163 shares in the company, valued at approximately $923,710.86. This represents a 40.78% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders have sold 39,836 shares of company stock worth $2,746,743. 1.40% of the stock is owned by insiders.

Taylor Morrison Home Stock Down 1.2%

TMHC traded down $0.80 during trading hours on Tuesday, hitting $66.57. 151,443 shares of the company's stock were exchanged, compared to its average volume of 1,078,081. Taylor Morrison Home Corporation has a 1-year low of $51.90 and a 1-year high of $75.49. The stock's 50-day moving average is $64.32 and its two-hundred day moving average is $60.72. The stock has a market cap of $6.68 billion, a price-to-earnings ratio of 7.70 and a beta of 1.58. The company has a quick ratio of 0.74, a current ratio of 6.54 and a debt-to-equity ratio of 0.35.

Taylor Morrison Home (NYSE:TMHC - Get Free Report) last announced its earnings results on Wednesday, July 23rd. The construction company reported $2.02 EPS for the quarter, topping the consensus estimate of $1.94 by $0.08. The business had revenue of $2.03 billion during the quarter, compared to analysts' expectations of $1.93 billion. Taylor Morrison Home had a net margin of 10.72% and a return on equity of 16.22%. The firm's revenue was up 2.0% on a year-over-year basis. During the same quarter in the prior year, the company posted $1.86 earnings per share. Sell-side analysts predict that Taylor Morrison Home Corporation will post 8.93 earnings per share for the current fiscal year.

Taylor Morrison Home Company Profile

(

Free Report)

Taylor Morrison Home Corporation, together with its subsidiaries, operates as a public homebuilder in the United States. The company designs, builds, and sells single and multi-family detached and attached homes; and develops lifestyle and master-planned communities. It develops and constructs multi-use properties consisting of commercial space, retail, and multi-family properties under the Urban Form brand name.

Featured Articles

Before you consider Taylor Morrison Home, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Taylor Morrison Home wasn't on the list.

While Taylor Morrison Home currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.