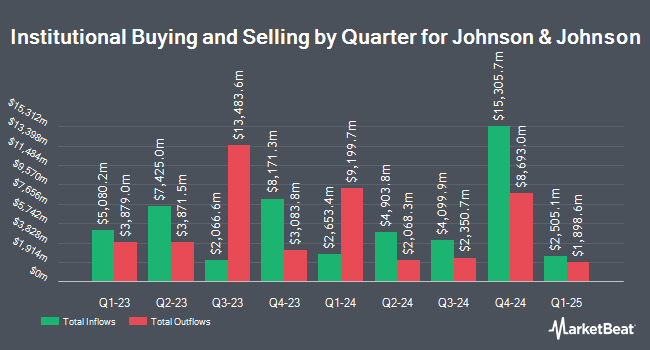

Berger Financial Group Inc increased its holdings in shares of Johnson & Johnson (NYSE:JNJ - Free Report) by 24.3% during the first quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund owned 49,985 shares of the company's stock after acquiring an additional 9,767 shares during the quarter. Berger Financial Group Inc's holdings in Johnson & Johnson were worth $8,290,000 as of its most recent SEC filing.

A number of other institutional investors have also made changes to their positions in the business. Brighton Jones LLC boosted its stake in Johnson & Johnson by 13.9% in the 4th quarter. Brighton Jones LLC now owns 51,876 shares of the company's stock valued at $7,502,000 after purchasing an additional 6,332 shares during the period. Hudson Value Partners LLC boosted its stake in Johnson & Johnson by 2.5% in the 4th quarter. Hudson Value Partners LLC now owns 41,403 shares of the company's stock valued at $5,648,000 after purchasing an additional 1,022 shares during the period. Eley Financial Management Inc boosted its stake in Johnson & Johnson by 5.9% in the 4th quarter. Eley Financial Management Inc now owns 21,452 shares of the company's stock valued at $3,102,000 after purchasing an additional 1,203 shares during the period. Jaffetilchin Investment Partners LLC boosted its stake in Johnson & Johnson by 3.4% in the 4th quarter. Jaffetilchin Investment Partners LLC now owns 35,615 shares of the company's stock valued at $5,151,000 after purchasing an additional 1,179 shares during the period. Finally, Prepared Retirement Institute LLC boosted its stake in Johnson & Johnson by 26.8% in the 4th quarter. Prepared Retirement Institute LLC now owns 1,804 shares of the company's stock valued at $261,000 after purchasing an additional 381 shares during the period. 69.55% of the stock is owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

Several analysts have recently issued reports on JNJ shares. Raymond James Financial reduced their target price on Johnson & Johnson from $165.00 to $162.00 and set an "outperform" rating on the stock in a report on Monday, April 14th. Barclays increased their target price on Johnson & Johnson from $165.00 to $176.00 and gave the stock an "equal weight" rating in a report on Thursday, July 17th. Erste Group Bank raised Johnson & Johnson from a "hold" rating to a "buy" rating in a report on Wednesday, July 23rd. Guggenheim reissued a "neutral" rating and set a $167.00 target price (up from $164.00) on shares of Johnson & Johnson in a report on Thursday, July 17th. Finally, Leerink Partnrs lowered Johnson & Johnson from a "strong-buy" rating to a "hold" rating in a report on Tuesday, May 13th. Nine investment analysts have rated the stock with a hold rating, ten have issued a buy rating and two have given a strong buy rating to the company. According to data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and an average target price of $174.50.

Read Our Latest Report on JNJ

Johnson & Johnson Price Performance

Shares of JNJ stock traded up $1.87 on Friday, hitting $173.40. 7,686,049 shares of the company's stock were exchanged, compared to its average volume of 9,496,232. The company has a debt-to-equity ratio of 0.50, a current ratio of 1.01 and a quick ratio of 0.76. Johnson & Johnson has a 12 month low of $140.68 and a 12 month high of $173.96. The stock has a market cap of $417.61 billion, a P/E ratio of 18.55, a price-to-earnings-growth ratio of 2.21 and a beta of 0.41. The company has a 50 day moving average of $159.26 and a 200 day moving average of $157.52.

Johnson & Johnson (NYSE:JNJ - Get Free Report) last posted its earnings results on Wednesday, July 16th. The company reported $2.77 EPS for the quarter, beating the consensus estimate of $2.68 by $0.09. Johnson & Johnson had a return on equity of 32.49% and a net margin of 25.00%. The firm had revenue of $23.74 billion during the quarter, compared to the consensus estimate of $22.85 billion. During the same period last year, the company earned $2.82 earnings per share. The business's quarterly revenue was up 5.8% on a year-over-year basis. On average, equities research analysts predict that Johnson & Johnson will post 10.58 EPS for the current year.

Johnson & Johnson Announces Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Tuesday, September 9th. Investors of record on Tuesday, August 26th will be issued a $1.30 dividend. This represents a $5.20 dividend on an annualized basis and a yield of 3.0%. The ex-dividend date is Tuesday, August 26th. Johnson & Johnson's dividend payout ratio (DPR) is 55.61%.

Johnson & Johnson Profile

(

Free Report)

Johnson & Johnson is a holding company, which engages in the research, development, manufacture, and sale of products in the healthcare field. It operates through the Innovative Medicine and MedTech segments. The Innovative Medicine segment focuses on immunology, infectious diseases, neuroscience, oncology, cardiovascular and metabolism, and pulmonary hypertension.

Further Reading

Before you consider Johnson & Johnson, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Johnson & Johnson wasn't on the list.

While Johnson & Johnson currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.