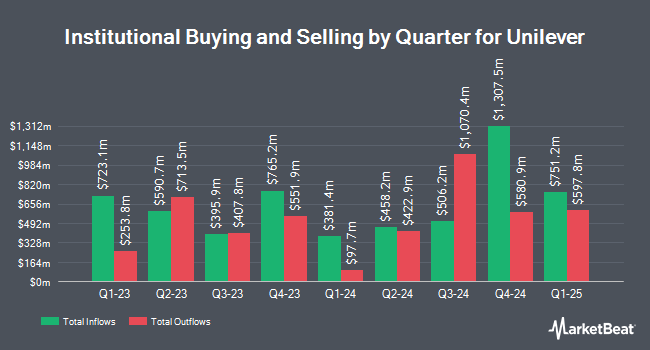

Bessemer Group Inc. boosted its holdings in Unilever PLC (NYSE:UL - Free Report) by 164.6% during the first quarter, according to the company in its most recent disclosure with the SEC. The firm owned 6,638 shares of the company's stock after purchasing an additional 4,129 shares during the quarter. Bessemer Group Inc.'s holdings in Unilever were worth $395,000 at the end of the most recent quarter.

A number of other hedge funds and other institutional investors have also bought and sold shares of the business. Aurora Private Wealth Inc. grew its holdings in Unilever by 5,716.2% in the first quarter. Aurora Private Wealth Inc. now owns 244,572 shares of the company's stock worth $14,564,000 after purchasing an additional 240,367 shares during the period. Spire Wealth Management grew its holdings in shares of Unilever by 3.6% during the first quarter. Spire Wealth Management now owns 16,063 shares of the company's stock valued at $957,000 after buying an additional 553 shares during the last quarter. Slocum Gordon & Co LLP grew its holdings in shares of Unilever by 232.0% during the first quarter. Slocum Gordon & Co LLP now owns 75,613 shares of the company's stock valued at $4,503,000 after buying an additional 52,838 shares during the last quarter. Golden State Equity Partners grew its holdings in shares of Unilever by 22.2% during the first quarter. Golden State Equity Partners now owns 12,831 shares of the company's stock valued at $764,000 after buying an additional 2,330 shares during the last quarter. Finally, Berry Wealth Group LP grew its holdings in shares of Unilever by 41.4% during the first quarter. Berry Wealth Group LP now owns 5,639 shares of the company's stock valued at $336,000 after buying an additional 1,651 shares during the last quarter. Hedge funds and other institutional investors own 9.67% of the company's stock.

Analyst Ratings Changes

A number of research firms have recently commented on UL. BNP Paribas Exane began coverage on shares of Unilever in a report on Thursday, May 29th. They set an "outperform" rating and a $73.00 price target on the stock. Wall Street Zen cut shares of Unilever from a "buy" rating to a "hold" rating in a report on Tuesday, May 6th. UBS Group upgraded shares of Unilever from a "strong sell" rating to a "hold" rating in a report on Friday, May 2nd. Finally, BNP Paribas upgraded shares of Unilever to a "strong-buy" rating in a report on Thursday, May 29th. One research analyst has rated the stock with a sell rating, three have issued a hold rating, four have given a buy rating and two have given a strong buy rating to the stock. According to MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and a consensus price target of $70.67.

View Our Latest Report on Unilever

Unilever Trading Down 0.2%

Shares of UL stock opened at $61.38 on Thursday. Unilever PLC has a 12-month low of $54.32 and a 12-month high of $65.87. The firm's 50 day moving average is $62.65 and its 200 day moving average is $59.67. The stock has a market capitalization of $150.66 billion, a P/E ratio of 17.59, a P/E/G ratio of 3.83 and a beta of 0.41.

Unilever Increases Dividend

The firm also recently declared a quarterly dividend, which was paid on Friday, June 13th. Stockholders of record on Friday, May 16th were paid a dividend of $0.5151 per share. This represents a $2.06 annualized dividend and a dividend yield of 3.36%. The ex-dividend date was Friday, May 16th. This is a boost from Unilever's previous quarterly dividend of $0.47. Unilever's dividend payout ratio (DPR) is currently 59.03%.

Unilever Profile

(

Free Report)

Unilever PLC operates as a fast-moving consumer goods company in the Asia Pacific, Africa, the Americas, and Europe. It operates through five segments: Beauty & Wellbeing, Personal Care, Home Care, Nutrition, and Ice Cream. The Beauty & Wellbeing segment engages in the sale of hair care products, such as shampoo, conditioner, and styling; skin care products including face, hand, and body moisturizer; and prestige beauty and health & wellbeing products consist of the vitamins, minerals, and supplements.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Unilever, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Unilever wasn't on the list.

While Unilever currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.