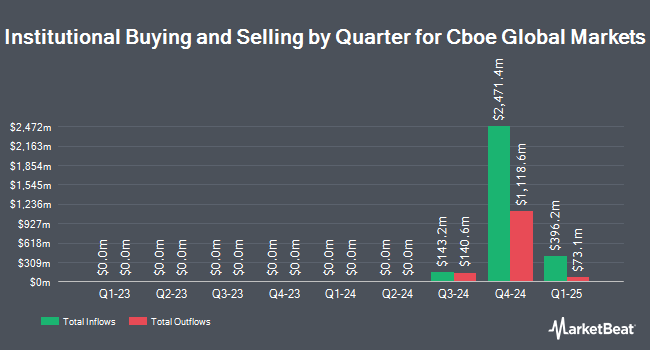

BI Asset Management Fondsmaeglerselskab A S lowered its position in shares of Cboe Global Markets, Inc. (NASDAQ:CBOE - Free Report) by 71.5% during the 1st quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 5,061 shares of the company's stock after selling 12,700 shares during the quarter. BI Asset Management Fondsmaeglerselskab A S's holdings in Cboe Global Markets were worth $1,145,000 as of its most recent SEC filing.

Other large investors have also added to or reduced their stakes in the company. OneDigital Investment Advisors LLC purchased a new position in Cboe Global Markets during the first quarter valued at approximately $265,000. Capital Investment Advisory Services LLC purchased a new position in Cboe Global Markets during the first quarter valued at approximately $277,000. Harel Insurance Investments & Financial Services Ltd. lifted its holdings in Cboe Global Markets by 31.9% during the first quarter. Harel Insurance Investments & Financial Services Ltd. now owns 29,561 shares of the company's stock valued at $6,689,000 after purchasing an additional 7,146 shares in the last quarter. GAM Holding AG purchased a new position in Cboe Global Markets during the first quarter valued at approximately $1,541,000. Finally, Teacher Retirement System of Texas purchased a new position in Cboe Global Markets during the first quarter valued at approximately $3,463,000. Hedge funds and other institutional investors own 82.67% of the company's stock.

Wall Street Analyst Weigh In

Several equities analysts have weighed in on the stock. Citigroup lifted their price target on shares of Cboe Global Markets from $230.00 to $245.00 and gave the company a "neutral" rating in a report on Tuesday, July 8th. Cowen reiterated a "hold" rating on shares of Cboe Global Markets in a research report on Monday, May 5th. Morgan Stanley set a $218.00 price objective on shares of Cboe Global Markets and gave the company an "underweight" rating in a research report on Tuesday, July 15th. Royal Bank Of Canada reiterated a "sector perform" rating and set a $254.00 price objective on shares of Cboe Global Markets in a research report on Monday, August 4th. Finally, Barclays lifted their price objective on shares of Cboe Global Markets from $243.00 to $256.00 and gave the company an "equal weight" rating in a research report on Monday, August 4th. Two research analysts have rated the stock with a Buy rating, nine have issued a Hold rating and three have issued a Sell rating to the company's stock. Based on data from MarketBeat, the company currently has an average rating of "Reduce" and an average price target of $231.38.

View Our Latest Report on CBOE

Cboe Global Markets Price Performance

Shares of Cboe Global Markets stock traded up $2.66 on Monday, hitting $249.09. 828,632 shares of the company traded hands, compared to its average volume of 874,456. The business has a 50-day simple moving average of $238.77 and a 200 day simple moving average of $225.10. Cboe Global Markets, Inc. has a 52 week low of $187.30 and a 52 week high of $255.27. The stock has a market capitalization of $26.05 billion, a P/E ratio of 34.50, a price-to-earnings-growth ratio of 1.75 and a beta of 0.46. The company has a debt-to-equity ratio of 0.34, a quick ratio of 1.39 and a current ratio of 1.78.

Cboe Global Markets (NASDAQ:CBOE - Get Free Report) last announced its quarterly earnings results on Friday, August 1st. The company reported $2.46 earnings per share for the quarter, topping the consensus estimate of $2.43 by $0.03. Cboe Global Markets had a net margin of 18.64% and a return on equity of 22.02%. During the same period in the previous year, the firm earned $2.15 EPS. Cboe Global Markets's revenue for the quarter was up 14.3% on a year-over-year basis. Research analysts expect that Cboe Global Markets, Inc. will post 8.96 earnings per share for the current fiscal year.

Cboe Global Markets Increases Dividend

The firm also recently declared a quarterly dividend, which will be paid on Monday, September 15th. Investors of record on Friday, August 29th will be given a $0.72 dividend. This is a boost from Cboe Global Markets's previous quarterly dividend of $0.63. This represents a $2.88 annualized dividend and a yield of 1.2%. The ex-dividend date is Friday, August 29th. Cboe Global Markets's dividend payout ratio (DPR) is presently 33.76%.

Cboe Global Markets Profile

(

Free Report)

Cboe Global Markets, Inc is one of the largest stock exchange operators by volume in the United States and a leading market globally for ETP trading. Cboe offers trading across a diverse range of products in multiple asset classes and geographies, including options, futures, U.S. and European equities, exchange-traded products (ETPs), global foreign exchange (FX) and multi-asset volatility products based on the VIX Index.

Recommended Stories

Before you consider Cboe Global Markets, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cboe Global Markets wasn't on the list.

While Cboe Global Markets currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.