BI Asset Management Fondsmaeglerselskab A S lowered its position in BioMarin Pharmaceutical Inc. (NASDAQ:BMRN - Free Report) by 54.8% during the 1st quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 12,695 shares of the biotechnology company's stock after selling 15,366 shares during the quarter. BI Asset Management Fondsmaeglerselskab A S's holdings in BioMarin Pharmaceutical were worth $897,000 as of its most recent SEC filing.

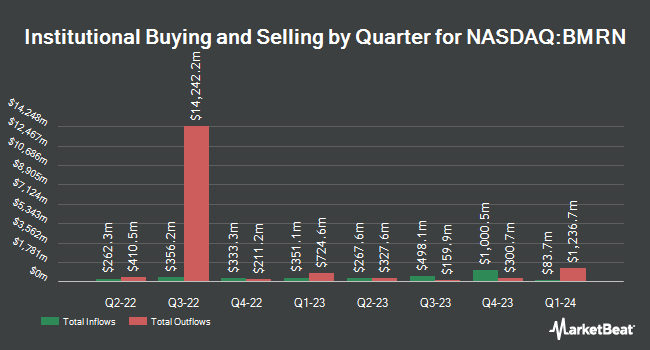

Other hedge funds and other institutional investors also recently bought and sold shares of the company. Vestal Point Capital LP grew its stake in BioMarin Pharmaceutical by 115.0% in the fourth quarter. Vestal Point Capital LP now owns 860,000 shares of the biotechnology company's stock worth $56,528,000 after purchasing an additional 460,000 shares in the last quarter. GAMMA Investing LLC boosted its position in BioMarin Pharmaceutical by 154.0% during the 1st quarter. GAMMA Investing LLC now owns 3,129 shares of the biotechnology company's stock valued at $221,000 after acquiring an additional 1,897 shares in the last quarter. Robeco Institutional Asset Management B.V. boosted its position in BioMarin Pharmaceutical by 12.3% during the 1st quarter. Robeco Institutional Asset Management B.V. now owns 97,261 shares of the biotechnology company's stock valued at $6,875,000 after acquiring an additional 10,687 shares in the last quarter. Asset Management One Co. Ltd. boosted its position in BioMarin Pharmaceutical by 5.3% during the 1st quarter. Asset Management One Co. Ltd. now owns 80,879 shares of the biotechnology company's stock valued at $5,717,000 after acquiring an additional 4,094 shares in the last quarter. Finally, Janney Montgomery Scott LLC boosted its position in BioMarin Pharmaceutical by 56.6% during the 1st quarter. Janney Montgomery Scott LLC now owns 12,016 shares of the biotechnology company's stock valued at $849,000 after acquiring an additional 4,345 shares in the last quarter. Institutional investors own 98.71% of the company's stock.

Wall Street Analysts Forecast Growth

Several brokerages have issued reports on BMRN. Citigroup dropped their target price on BioMarin Pharmaceutical from $82.00 to $78.00 and set a "neutral" rating on the stock in a research report on Friday, May 2nd. JPMorgan Chase & Co. increased their target price on BioMarin Pharmaceutical from $108.00 to $113.00 and gave the company an "overweight" rating in a research report on Monday, July 14th. Zacks Research cut BioMarin Pharmaceutical from a "strong-buy" rating to a "hold" rating in a research report on Wednesday, August 13th. Wedbush reissued an "outperform" rating and issued a $94.00 price objective on shares of BioMarin Pharmaceutical in a research report on Tuesday, August 5th. Finally, Guggenheim raised their target price on BioMarin Pharmaceutical from $101.00 to $106.00 and gave the stock a "buy" rating in a research note on Wednesday, August 6th. Eighteen analysts have rated the stock with a Buy rating and seven have given a Hold rating to the stock. According to MarketBeat, the company presently has an average rating of "Moderate Buy" and a consensus target price of $93.17.

View Our Latest Stock Report on BioMarin Pharmaceutical

BioMarin Pharmaceutical Price Performance

BMRN stock traded down $0.08 during trading on Monday, hitting $58.50. The stock had a trading volume of 1,720,244 shares, compared to its average volume of 2,557,992. The company has a debt-to-equity ratio of 0.10, a current ratio of 5.56 and a quick ratio of 3.60. BioMarin Pharmaceutical Inc. has a twelve month low of $52.93 and a twelve month high of $93.04. The stock has a market capitalization of $11.23 billion, a P/E ratio of 17.36, a PEG ratio of 0.75 and a beta of 0.18. The company's 50-day moving average price is $57.54 and its two-hundred day moving average price is $61.31.

BioMarin Pharmaceutical Company Profile

(

Free Report)

BioMarin Pharmaceutical Inc develops and commercializes therapies for people with serious and life-threatening rare diseases and medical conditions. Its commercial products include Vimizim, an enzyme replacement therapy for the treatment of mucopolysaccharidosis (MPS) IV type A, a lysosomal storage disorder; Naglazyme, a recombinant form of N-acetylgalactosamine 4-sulfatase for patients with MPS VI; and Kuvan, a proprietary synthetic oral form of 6R-BH4 that is used to treat patients with phenylketonuria (PKU), an inherited metabolic disease.

Recommended Stories

Before you consider BioMarin Pharmaceutical, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BioMarin Pharmaceutical wasn't on the list.

While BioMarin Pharmaceutical currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.