BI Asset Management Fondsmaeglerselskab A S cut its holdings in shares of Fifth Third Bancorp (NASDAQ:FITB - Free Report) by 47.6% in the first quarter, according to its most recent filing with the Securities and Exchange Commission. The firm owned 21,824 shares of the financial services provider's stock after selling 19,860 shares during the quarter. BI Asset Management Fondsmaeglerselskab A S's holdings in Fifth Third Bancorp were worth $856,000 at the end of the most recent quarter.

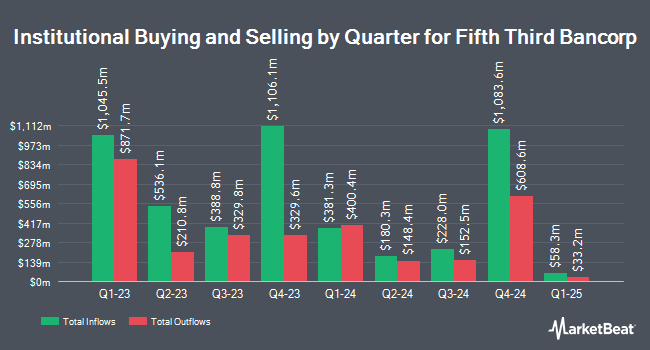

Several other institutional investors have also made changes to their positions in the company. Fuller & Thaler Asset Management Inc. lifted its holdings in shares of Fifth Third Bancorp by 8.5% during the 1st quarter. Fuller & Thaler Asset Management Inc. now owns 28,190 shares of the financial services provider's stock valued at $1,105,000 after buying an additional 2,215 shares during the last quarter. PL Capital Advisors LLC raised its stake in Fifth Third Bancorp by 3.6% during the first quarter. PL Capital Advisors LLC now owns 45,600 shares of the financial services provider's stock worth $1,788,000 after acquiring an additional 1,600 shares in the last quarter. Quantbot Technologies LP raised its stake in Fifth Third Bancorp by 114.2% during the first quarter. Quantbot Technologies LP now owns 36,004 shares of the financial services provider's stock worth $1,411,000 after acquiring an additional 19,197 shares in the last quarter. Wellington Management Group LLP increased its stake in shares of Fifth Third Bancorp by 11.9% in the first quarter. Wellington Management Group LLP now owns 364,163 shares of the financial services provider's stock valued at $14,275,000 after buying an additional 38,799 shares in the last quarter. Finally, Brooklyn Investment Group increased its stake in shares of Fifth Third Bancorp by 35.6% in the first quarter. Brooklyn Investment Group now owns 4,193 shares of the financial services provider's stock valued at $164,000 after buying an additional 1,100 shares in the last quarter. 83.79% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

A number of equities analysts have issued reports on the company. Cowen began coverage on Fifth Third Bancorp in a report on Wednesday, May 14th. They set a "buy" rating on the stock. Wells Fargo & Company boosted their price target on Fifth Third Bancorp from $48.00 to $52.00 and gave the stock an "overweight" rating in a research report on Tuesday, June 10th. DA Davidson upgraded Fifth Third Bancorp from a "hold" rating to a "strong-buy" rating and lifted their target price for the stock from $42.00 to $47.00 in a research note on Monday, June 9th. Jefferies Financial Group initiated coverage on Fifth Third Bancorp in a research note on Wednesday, May 21st. They set a "buy" rating and a $47.00 target price for the company. Finally, TD Cowen initiated coverage on Fifth Third Bancorp in a research note on Thursday, May 15th. They set a "buy" rating and a $52.00 target price for the company. Two research analysts have rated the stock with a Strong Buy rating, ten have given a Buy rating and five have assigned a Hold rating to the company. Based on data from MarketBeat.com, Fifth Third Bancorp presently has an average rating of "Moderate Buy" and an average target price of $47.80.

Check Out Our Latest Report on Fifth Third Bancorp

Fifth Third Bancorp Price Performance

FITB traded down $0.43 on Monday, reaching $44.36. The stock had a trading volume of 4,569,166 shares, compared to its average volume of 3,496,568. Fifth Third Bancorp has a fifty-two week low of $32.25 and a fifty-two week high of $49.07. The firm has a 50-day moving average of $42.18 and a 200-day moving average of $39.86. The company has a current ratio of 0.81, a quick ratio of 0.81 and a debt-to-equity ratio of 0.76. The company has a market capitalization of $29.36 billion, a price-to-earnings ratio of 13.78, a price-to-earnings-growth ratio of 1.45 and a beta of 0.91.

Fifth Third Bancorp Announces Dividend

The business also recently declared a quarterly dividend, which was paid on Tuesday, July 15th. Stockholders of record on Monday, June 30th were paid a $0.37 dividend. The ex-dividend date of this dividend was Monday, June 30th. This represents a $1.48 annualized dividend and a dividend yield of 3.3%. Fifth Third Bancorp's dividend payout ratio is presently 45.96%.

Fifth Third Bancorp announced that its Board of Directors has authorized a stock repurchase plan on Monday, June 16th that authorizes the company to repurchase 100,000,000 shares. This repurchase authorization authorizes the financial services provider to buy shares of its stock through open market purchases. Shares repurchase plans are typically an indication that the company's management believes its stock is undervalued.

Fifth Third Bancorp Company Profile

(

Free Report)

Fifth Third Bancorp operates as the bank holding company for Fifth Third Bank, National Association that engages in the provision of a range of financial products and services in the United States. It operates through three segments: Commercial Banking, Consumer and Small Business Banking, and Wealth and Asset Management.

Recommended Stories

Before you consider Fifth Third Bancorp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fifth Third Bancorp wasn't on the list.

While Fifth Third Bancorp currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.