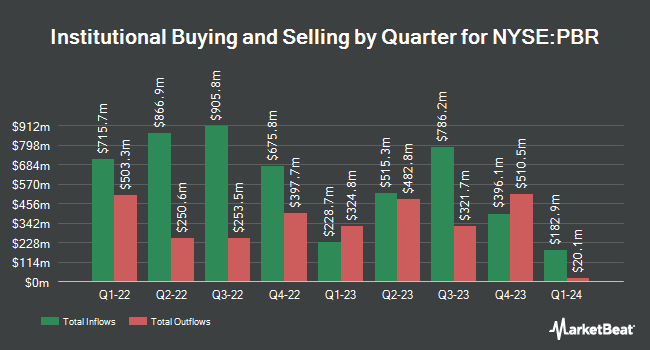

BI Asset Management Fondsmaeglerselskab A S lowered its position in Petroleo Brasileiro S.A.- Petrobras (NYSE:PBR - Free Report) by 47.9% in the 1st quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 49,369 shares of the oil and gas exploration company's stock after selling 45,417 shares during the period. BI Asset Management Fondsmaeglerselskab A S's holdings in Petroleo Brasileiro S.A.- Petrobras were worth $708,000 at the end of the most recent reporting period.

Several other large investors also recently modified their holdings of the company. Quantbot Technologies LP bought a new stake in shares of Petroleo Brasileiro S.A.- Petrobras in the first quarter worth $3,083,000. Tocqueville Asset Management L.P. grew its holdings in Petroleo Brasileiro S.A.- Petrobras by 14.8% during the first quarter. Tocqueville Asset Management L.P. now owns 23,812 shares of the oil and gas exploration company's stock valued at $341,000 after purchasing an additional 3,074 shares during the period. Fox Run Management L.L.C. bought a new stake in Petroleo Brasileiro S.A.- Petrobras during the first quarter valued at about $1,415,000. Vestmark Advisory Solutions Inc. grew its holdings in Petroleo Brasileiro S.A.- Petrobras by 150.6% during the first quarter. Vestmark Advisory Solutions Inc. now owns 40,514 shares of the oil and gas exploration company's stock valued at $581,000 after purchasing an additional 24,350 shares during the period. Finally, Ted Buchan & Co grew its holdings in Petroleo Brasileiro S.A.- Petrobras by 2.6% during the first quarter. Ted Buchan & Co now owns 221,923 shares of the oil and gas exploration company's stock valued at $3,182,000 after purchasing an additional 5,524 shares during the period.

Petroleo Brasileiro S.A.- Petrobras Price Performance

Shares of Petroleo Brasileiro S.A.- Petrobras stock traded up $0.19 during trading hours on Thursday, hitting $12.39. The company's stock had a trading volume of 6,146,412 shares, compared to its average volume of 21,036,758. The business has a 50 day moving average price of $12.52 and a two-hundred day moving average price of $12.60. Petroleo Brasileiro S.A.- Petrobras has a 12-month low of $11.03 and a 12-month high of $15.50. The company has a market cap of $79.81 billion, a PE ratio of 5.79 and a beta of 0.85. The company has a debt-to-equity ratio of 0.76, a quick ratio of 0.47 and a current ratio of 0.72.

Petroleo Brasileiro S.A.- Petrobras (NYSE:PBR - Get Free Report) last announced its quarterly earnings data on Friday, August 8th. The oil and gas exploration company reported $0.64 EPS for the quarter, missing the consensus estimate of $0.70 by ($0.06). Petroleo Brasileiro S.A.- Petrobras had a net margin of 15.99% and a return on equity of 34.11%. The business had revenue of $21.04 billion during the quarter, compared to analysts' expectations of $20.78 billion. Analysts expect that Petroleo Brasileiro S.A.- Petrobras will post 2.14 earnings per share for the current fiscal year.

Petroleo Brasileiro S.A.- Petrobras Dividend Announcement

The firm also recently disclosed a special dividend, which will be paid on Tuesday, December 30th. Stockholders of record on Monday, August 25th will be given a $0.0739 dividend. The ex-dividend date is Monday, August 25th. Petroleo Brasileiro S.A.- Petrobras's payout ratio is presently 48.13%.

Analyst Upgrades and Downgrades

Several research firms have issued reports on PBR. Wall Street Zen raised Petroleo Brasileiro S.A.- Petrobras from a "hold" rating to a "buy" rating in a report on Wednesday, May 14th. Bank of America lowered Petroleo Brasileiro S.A.- Petrobras from a "buy" rating to a "neutral" rating in a report on Monday, June 9th. Jefferies Financial Group raised Petroleo Brasileiro S.A.- Petrobras from a "hold" rating to a "buy" rating and set a $15.30 price target for the company in a report on Thursday, May 15th. Zacks Research raised Petroleo Brasileiro S.A.- Petrobras from a "hold" rating to a "strong-buy" rating in a report on Wednesday, August 20th. Finally, UBS Group cut their price target on Petroleo Brasileiro S.A.- Petrobras from $15.80 to $14.40 and set a "buy" rating for the company in a report on Friday, August 22nd. Two investment analysts have rated the stock with a Strong Buy rating, five have assigned a Buy rating and one has assigned a Hold rating to the company. According to MarketBeat.com, the company has a consensus rating of "Buy" and an average price target of $16.14.

Check Out Our Latest Analysis on PBR

Petroleo Brasileiro S.A.- Petrobras Profile

(

Free Report)

Petróleo Brasileiro SA - Petrobras explores, produces, and sells oil and gas in Brazil and internationally. The company operates through three segments: Exploration and Production; Refining, Transportation and Marketing; and Gas and Power. The Exploration and Production segment explores, develops, and produces crude oil, natural gas liquids, and natural gas primarily for supplies to the domestic refineries.

Featured Stories

Before you consider Petroleo Brasileiro S.A.- Petrobras, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Petroleo Brasileiro S.A.- Petrobras wasn't on the list.

While Petroleo Brasileiro S.A.- Petrobras currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.