McGuire Investment Group LLC lifted its stake in BigBear.ai Holdings, Inc. (NYSE:BBAI - Free Report) by 89.0% in the 2nd quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 86,658 shares of the company's stock after purchasing an additional 40,806 shares during the period. McGuire Investment Group LLC's holdings in BigBear.ai were worth $588,000 as of its most recent SEC filing.

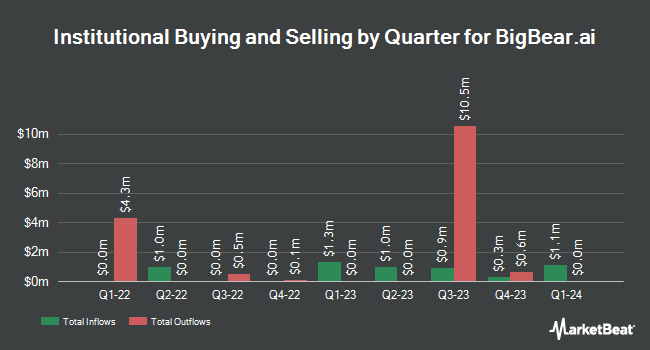

Several other hedge funds and other institutional investors have also recently made changes to their positions in the stock. Vanguard Group Inc. lifted its stake in shares of BigBear.ai by 9.2% in the first quarter. Vanguard Group Inc. now owns 6,325,571 shares of the company's stock valued at $18,091,000 after purchasing an additional 534,963 shares during the period. Goldman Sachs Group Inc. raised its position in BigBear.ai by 569.0% during the first quarter. Goldman Sachs Group Inc. now owns 2,340,713 shares of the company's stock worth $6,694,000 after acquiring an additional 1,990,822 shares during the last quarter. Cubist Systematic Strategies LLC acquired a new position in BigBear.ai during the first quarter worth about $3,811,000. Headlands Technologies LLC acquired a new position in BigBear.ai during the first quarter worth about $1,806,000. Finally, MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. raised its position in BigBear.ai by 54.0% during the first quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 456,661 shares of the company's stock worth $1,306,000 after acquiring an additional 160,096 shares during the last quarter. Institutional investors and hedge funds own 7.55% of the company's stock.

Analyst Ratings Changes

Separately, HC Wainwright cut their target price on shares of BigBear.ai from $9.00 to $8.00 and set a "buy" rating for the company in a research report on Tuesday, August 12th. Two investment analysts have rated the stock with a Buy rating and two have assigned a Hold rating to the company. According to data from MarketBeat, BigBear.ai has a consensus rating of "Moderate Buy" and a consensus target price of $6.00.

View Our Latest Research Report on BBAI

Insider Activity at BigBear.ai

In other news, CFO Sean Raymond Ricker sold 11,978 shares of BigBear.ai stock in a transaction dated Wednesday, August 27th. The shares were sold at an average price of $5.35, for a total transaction of $64,082.30. Following the completion of the sale, the chief financial officer directly owned 296,345 shares in the company, valued at $1,585,445.75. The trade was a 3.88% decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available through the SEC website. 1.10% of the stock is currently owned by company insiders.

BigBear.ai Stock Performance

Shares of NYSE BBAI opened at $7.01 on Thursday. The company has a market cap of $2.60 billion, a PE ratio of -4.86 and a beta of 3.43. BigBear.ai Holdings, Inc. has a 12 month low of $1.37 and a 12 month high of $10.36. The company has a debt-to-equity ratio of 0.42, a current ratio of 1.91 and a quick ratio of 1.91. The company has a 50-day simple moving average of $6.07 and a 200-day simple moving average of $4.86.

BigBear.ai (NYSE:BBAI - Get Free Report) last issued its quarterly earnings results on Monday, August 11th. The company reported ($0.06) EPS for the quarter, topping analysts' consensus estimates of ($0.07) by $0.01. The business had revenue of $32.47 million during the quarter, compared to the consensus estimate of $41.18 million. BigBear.ai had a negative net margin of 269.28% and a negative return on equity of 48.11%. The company's quarterly revenue was down 18.3% compared to the same quarter last year. During the same period in the previous year, the firm posted ($0.06) earnings per share. BigBear.ai has set its FY 2025 guidance at EPS. On average, equities analysts anticipate that BigBear.ai Holdings, Inc. will post -0.28 earnings per share for the current year.

BigBear.ai Company Profile

(

Free Report)

BigBear.ai Holdings, Inc provides artificial intelligence-powered decision intelligence solutions. It offers national security, supply chain management, and digital identity and biometrics solutions. The company also provides data ingestion, data enrichment, data processing, artificial intelligence, machine learning, predictive analytics, and predictive visualization solutions and services.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider BigBear.ai, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BigBear.ai wasn't on the list.

While BigBear.ai currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.