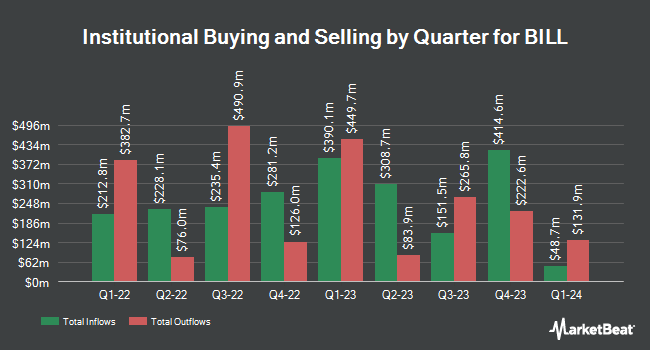

Two Sigma Advisers LP raised its holdings in BILL Holdings, Inc. (NYSE:BILL - Free Report) by 61.0% in the fourth quarter, according to the company in its most recent disclosure with the SEC. The firm owned 1,112,500 shares of the company's stock after acquiring an additional 421,700 shares during the quarter. Two Sigma Advisers LP owned 1.07% of BILL worth $94,240,000 as of its most recent filing with the SEC.

Other hedge funds and other institutional investors also recently bought and sold shares of the company. Crewe Advisors LLC lifted its holdings in BILL by 129.1% in the fourth quarter. Crewe Advisors LLC now owns 307 shares of the company's stock valued at $26,000 after acquiring an additional 173 shares during the period. Fifth Third Bancorp acquired a new stake in BILL in the fourth quarter valued at $27,000. CoreCap Advisors LLC acquired a new stake in BILL in the fourth quarter valued at $30,000. Global Retirement Partners LLC lifted its holdings in BILL by 12,566.7% in the fourth quarter. Global Retirement Partners LLC now owns 380 shares of the company's stock valued at $32,000 after acquiring an additional 377 shares during the period. Finally, Coppell Advisory Solutions LLC lifted its holdings in BILL by 202.5% in the fourth quarter. Coppell Advisory Solutions LLC now owns 369 shares of the company's stock valued at $32,000 after acquiring an additional 247 shares during the period. Institutional investors and hedge funds own 97.99% of the company's stock.

BILL Trading Down 1.2%

Shares of BILL stock opened at $46.27 on Monday. The firm has a 50-day moving average price of $44.77 and a 200 day moving average price of $67.14. BILL Holdings, Inc. has a twelve month low of $36.55 and a twelve month high of $100.19. The company has a market capitalization of $4.77 billion, a price-to-earnings ratio of -4,627.00, a PEG ratio of 29.46 and a beta of 1.44. The company has a current ratio of 1.66, a quick ratio of 1.66 and a debt-to-equity ratio of 0.44.

BILL (NYSE:BILL - Get Free Report) last announced its earnings results on Thursday, May 8th. The company reported $0.50 earnings per share for the quarter, beating the consensus estimate of $0.37 by $0.13. BILL had a net margin of 5.90% and a return on equity of 1.53%. The firm had revenue of $358.22 million during the quarter, compared to the consensus estimate of $355.85 million. During the same quarter in the previous year, the company posted $0.60 EPS. The firm's revenue for the quarter was up 10.9% on a year-over-year basis. Research analysts forecast that BILL Holdings, Inc. will post 0.12 earnings per share for the current fiscal year.

Wall Street Analyst Weigh In

A number of equities research analysts have commented on BILL shares. Oppenheimer raised their target price on BILL from $50.00 to $55.00 and gave the company an "outperform" rating in a report on Friday, May 9th. Seaport Res Ptn lowered shares of BILL from a "strong-buy" rating to a "hold" rating in a research report on Thursday, April 17th. The Goldman Sachs Group decreased their price objective on shares of BILL from $90.00 to $60.00 and set a "buy" rating on the stock in a research report on Wednesday, April 2nd. Keefe, Bruyette & Woods decreased their price objective on shares of BILL from $77.00 to $54.00 and set a "market perform" rating on the stock in a research report on Monday, March 31st. Finally, Canaccord Genuity Group decreased their price objective on shares of BILL from $105.00 to $75.00 and set a "buy" rating on the stock in a research report on Tuesday, May 13th. One research analyst has rated the stock with a sell rating, seven have given a hold rating and twelve have assigned a buy rating to the stock. Based on data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and a consensus price target of $63.67.

Get Our Latest Stock Report on BILL

About BILL

(

Free Report)

BILL Holdings, Inc provides financial automation software for small and midsize businesses worldwide. The company provides software-as-a-service, cloud-based payments, and spend management products, which allow users to automate accounts payable and accounts receivable transactions, as well as enable users to connect with their suppliers and/or customers to do business, eliminate expense reports, manage cash flows, and improve office efficiency.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider BILL, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BILL wasn't on the list.

While BILL currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.