Blair William & Co. IL grew its position in shares of KKR & Co. Inc. (NYSE:KKR - Free Report) by 10.5% during the 1st quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 31,085 shares of the asset manager's stock after buying an additional 2,953 shares during the quarter. Blair William & Co. IL's holdings in KKR & Co. Inc. were worth $3,594,000 as of its most recent filing with the Securities & Exchange Commission.

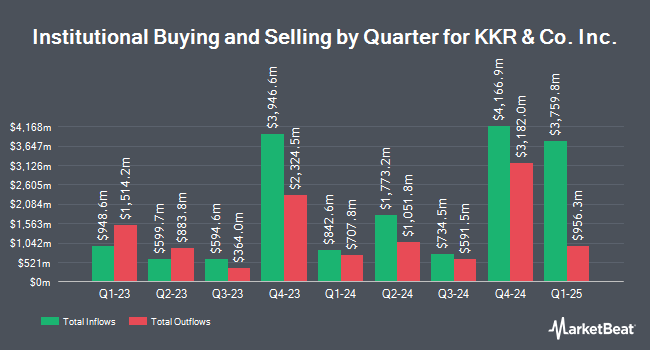

Several other hedge funds have also recently modified their holdings of the company. McIlrath & Eck LLC bought a new stake in shares of KKR & Co. Inc. in the 4th quarter worth approximately $26,000. Mascagni Wealth Management Inc. bought a new stake in shares of KKR & Co. Inc. in the 4th quarter worth approximately $31,000. Ameriflex Group Inc. bought a new stake in shares of KKR & Co. Inc. in the 4th quarter worth approximately $46,000. Mountain Hill Investment Partners Corp. bought a new stake in shares of KKR & Co. Inc. in the 1st quarter worth approximately $38,000. Finally, GW&K Investment Management LLC raised its holdings in shares of KKR & Co. Inc. by 44.6% in the 1st quarter. GW&K Investment Management LLC now owns 360 shares of the asset manager's stock worth $42,000 after purchasing an additional 111 shares during the period. Institutional investors own 76.26% of the company's stock.

KKR & Co. Inc. Price Performance

Shares of KKR traded up $0.63 during mid-day trading on Friday, reaching $142.82. 2,163,488 shares of the stock traded hands, compared to its average volume of 3,545,484. The firm has a fifty day moving average price of $135.44 and a 200 day moving average price of $127.77. The company has a market cap of $127.20 billion, a price-to-earnings ratio of 66.43, a price-to-earnings-growth ratio of 1.54 and a beta of 1.87. The company has a current ratio of 0.08, a quick ratio of 0.08 and a debt-to-equity ratio of 0.77. KKR & Co. Inc. has a 1 year low of $86.15 and a 1 year high of $170.40.

KKR & Co. Inc. (NYSE:KKR - Get Free Report) last announced its earnings results on Thursday, July 31st. The asset manager reported $1.18 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.14 by $0.04. KKR & Co. Inc. had a net margin of 12.95% and a return on equity of 6.42%. The company had revenue of $1.86 billion during the quarter, compared to analyst estimates of $1.81 billion. During the same period in the previous year, the business earned $1.09 earnings per share. As a group, equities research analysts predict that KKR & Co. Inc. will post 5.19 earnings per share for the current year.

KKR & Co. Inc. Increases Dividend

The business also recently announced a quarterly dividend, which will be paid on Tuesday, August 26th. Investors of record on Monday, August 11th will be given a $0.185 dividend. This is a positive change from KKR & Co. Inc.'s previous quarterly dividend of $0.18. This represents a $0.74 annualized dividend and a yield of 0.5%. KKR & Co. Inc.'s payout ratio is 34.42%.

Analyst Upgrades and Downgrades

A number of research analysts recently weighed in on KKR shares. Hsbc Global Res lowered shares of KKR & Co. Inc. from a "strong-buy" rating to a "hold" rating in a research note on Wednesday, July 9th. Barclays lifted their price objective on shares of KKR & Co. Inc. from $155.00 to $165.00 and gave the company an "overweight" rating in a research note on Monday, August 4th. Wells Fargo & Company lifted their price objective on shares of KKR & Co. Inc. from $140.00 to $156.00 and gave the company an "overweight" rating in a research note on Friday, July 11th. Citizens Jmp lowered shares of KKR & Co. Inc. from an "outperform" rating to a "market perform" rating in a research note on Monday, July 14th. Finally, Keefe, Bruyette & Woods lifted their price objective on shares of KKR & Co. Inc. from $155.00 to $162.00 and gave the company an "outperform" rating in a research note on Monday, August 4th. Five equities research analysts have rated the stock with a hold rating and thirteen have given a buy rating to the company. According to MarketBeat, the company has an average rating of "Moderate Buy" and a consensus target price of $157.73.

Get Our Latest Stock Analysis on KKR

Insider Activity at KKR & Co. Inc.

In related news, Director Timothy R. Barakett bought 35,000 shares of the business's stock in a transaction that occurred on Thursday, May 22nd. The stock was bought at an average cost of $117.92 per share, for a total transaction of $4,127,200.00. Following the completion of the transaction, the director owned 185,000 shares of the company's stock, valued at approximately $21,815,200. The trade was a 23.33% increase in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, major shareholder Genetic Disorder L.P. Kkr sold 6,000,000 shares of the company's stock in a transaction on Monday, May 12th. The stock was sold at an average price of $34.20, for a total transaction of $205,200,000.00. Following the completion of the transaction, the insider owned 13,260,971 shares of the company's stock, valued at $453,525,208.20. This trade represents a 31.15% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 9,281,394 shares of company stock valued at $618,358,033 over the last ninety days. 39.34% of the stock is currently owned by insiders.

KKR & Co. Inc. Company Profile

(

Free Report)

KKR & Co, Inc operates as an investment firm. It offers alternative asset management as well as capital markets and insurance solutions. The firm's business segments include Asset Management and Insurance Business. The Asset Management segment engages in providing private equity, real assets, credit and liquid strategies, capital markets, and principal activities.

Further Reading

Before you consider KKR & Co. Inc., you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and KKR & Co. Inc. wasn't on the list.

While KKR & Co. Inc. currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.