Blair William & Co. IL increased its stake in shares of Citigroup Inc. (NYSE:C - Free Report) by 2.7% during the 2nd quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 165,591 shares of the company's stock after acquiring an additional 4,401 shares during the period. Blair William & Co. IL's holdings in Citigroup were worth $14,095,000 as of its most recent filing with the Securities & Exchange Commission.

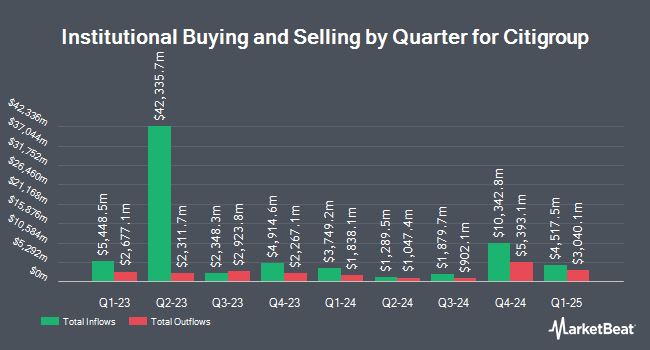

A number of other large investors also recently bought and sold shares of the stock. Capital Advisors Ltd. LLC increased its holdings in shares of Citigroup by 42.2% during the 2nd quarter. Capital Advisors Ltd. LLC now owns 549 shares of the company's stock valued at $47,000 after purchasing an additional 163 shares in the last quarter. MFA Wealth Services raised its position in shares of Citigroup by 3.6% in the second quarter. MFA Wealth Services now owns 6,986 shares of the company's stock worth $595,000 after acquiring an additional 244 shares during the period. Leo Wealth LLC boosted its stake in shares of Citigroup by 39.3% during the 2nd quarter. Leo Wealth LLC now owns 10,771 shares of the company's stock worth $917,000 after acquiring an additional 3,041 shares in the last quarter. McElhenny Sheffield Capital Management LLC acquired a new stake in shares of Citigroup during the 2nd quarter valued at about $12,768,000. Finally, Hager Investment Management Services LLC increased its stake in shares of Citigroup by 602.2% in the 2nd quarter. Hager Investment Management Services LLC now owns 941 shares of the company's stock valued at $80,000 after purchasing an additional 807 shares in the last quarter. 71.72% of the stock is owned by institutional investors and hedge funds.

Citigroup Price Performance

Shares of NYSE C opened at $93.87 on Friday. The firm has a 50-day simple moving average of $97.00 and a 200-day simple moving average of $83.71. The company has a quick ratio of 0.99, a current ratio of 0.99 and a debt-to-equity ratio of 1.61. The stock has a market capitalization of $172.81 billion, a price-to-earnings ratio of 13.87, a price-to-earnings-growth ratio of 0.84 and a beta of 1.37. Citigroup Inc. has a 52 week low of $55.51 and a 52 week high of $105.59.

Citigroup (NYSE:C - Get Free Report) last announced its quarterly earnings data on Tuesday, July 15th. The company reported $1.96 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.61 by $0.35. The company had revenue of $21.67 billion during the quarter, compared to analysts' expectations of $20.75 billion. Citigroup had a net margin of 8.44% and a return on equity of 7.29%. Citigroup's revenue was up 8.2% compared to the same quarter last year. During the same quarter in the prior year, the company earned $1.52 EPS. Citigroup has set its FY 2025 guidance at EPS. On average, equities analysts predict that Citigroup Inc. will post 7.53 earnings per share for the current fiscal year.

Citigroup Increases Dividend

The business also recently disclosed a quarterly dividend, which was paid on Friday, August 22nd. Shareholders of record on Monday, August 4th were paid a dividend of $0.60 per share. This represents a $2.40 dividend on an annualized basis and a yield of 2.6%. This is an increase from Citigroup's previous quarterly dividend of $0.56. The ex-dividend date of this dividend was Monday, August 4th. Citigroup's dividend payout ratio is presently 35.45%.

Insider Transactions at Citigroup

In other Citigroup news, Director Peter B. Henry sold 3,000 shares of the firm's stock in a transaction on Wednesday, July 16th. The stock was sold at an average price of $90.40, for a total value of $271,200.00. Following the completion of the sale, the director directly owned 2,140 shares of the company's stock, valued at $193,456. This trade represents a 58.37% decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. 0.08% of the stock is currently owned by insiders.

Analyst Ratings Changes

Several brokerages have commented on C. Truist Financial raised their price objective on Citigroup from $105.00 to $112.00 and gave the company a "buy" rating in a report on Wednesday, September 24th. Piper Sandler lifted their price target on shares of Citigroup from $84.00 to $104.00 and gave the company an "overweight" rating in a research note on Wednesday, July 16th. Zacks Research cut shares of Citigroup from a "strong-buy" rating to a "hold" rating in a research report on Monday, September 15th. UBS Group reaffirmed a "neutral" rating and set a $89.00 price objective on shares of Citigroup in a report on Tuesday, July 15th. Finally, Dbs Bank cut shares of Citigroup from a "moderate buy" rating to a "hold" rating in a research note on Monday, September 22nd. Eleven equities research analysts have rated the stock with a Buy rating and seven have assigned a Hold rating to the company. According to data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and an average price target of $99.68.

View Our Latest Stock Analysis on C

Citigroup Company Profile

(

Free Report)

Citigroup Inc, a diversified financial service holding company, provides various financial product and services to consumers, corporations, governments, and institutions worldwide. It operates through five segments: Services, Markets, Banking, U.S. Personal Banking, and Wealth. The Services segment includes Treasury and Trade Solutions, which provides cash management, trade, and working capital solutions to multinational corporations, financial institutions, and public sector organizations; and Securities Services, such as cross-border support for clients, local market expertise, post-trade technologies, data solutions, and various securities services solutions.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Citigroup, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Citigroup wasn't on the list.

While Citigroup currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.