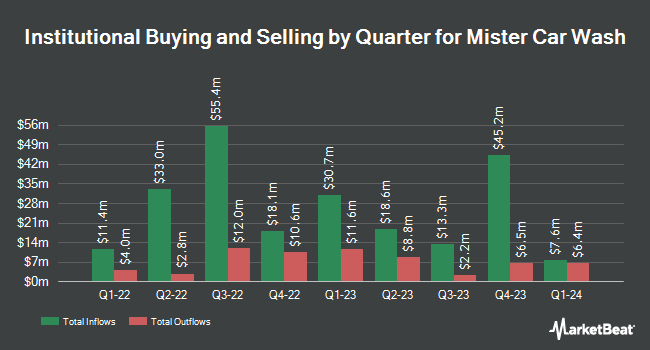

Bleakley Financial Group LLC raised its stake in shares of Mister Car Wash, Inc. (NYSE:MCW - Free Report) by 50.9% in the second quarter, according to the company in its most recent disclosure with the SEC. The firm owned 165,583 shares of the company's stock after acquiring an additional 55,853 shares during the quarter. Bleakley Financial Group LLC owned approximately 0.05% of Mister Car Wash worth $995,000 as of its most recent filing with the SEC.

Other hedge funds and other institutional investors also recently made changes to their positions in the company. Brown Advisory Inc. raised its holdings in shares of Mister Car Wash by 6.8% in the first quarter. Brown Advisory Inc. now owns 13,291,516 shares of the company's stock valued at $104,870,000 after buying an additional 843,225 shares during the last quarter. Vanguard Group Inc. increased its stake in shares of Mister Car Wash by 0.4% in the 1st quarter. Vanguard Group Inc. now owns 10,686,795 shares of the company's stock valued at $84,319,000 after acquiring an additional 40,236 shares during the last quarter. The Manufacturers Life Insurance Company increased its stake in shares of Mister Car Wash by 6.5% in the 1st quarter. The Manufacturers Life Insurance Company now owns 4,839,088 shares of the company's stock valued at $38,180,000 after acquiring an additional 294,972 shares during the last quarter. Driehaus Capital Management LLC bought a new stake in shares of Mister Car Wash in the 1st quarter valued at about $12,415,000. Finally, Millennium Management LLC increased its stake in shares of Mister Car Wash by 72.9% in the 1st quarter. Millennium Management LLC now owns 1,540,524 shares of the company's stock valued at $12,155,000 after acquiring an additional 649,448 shares during the last quarter.

Mister Car Wash Price Performance

Shares of MCW opened at $5.03 on Friday. The company has a debt-to-equity ratio of 0.92, a quick ratio of 0.24 and a current ratio of 0.53. The stock has a 50 day simple moving average of $5.36 and a 200 day simple moving average of $6.24. Mister Car Wash, Inc. has a 52-week low of $4.61 and a 52-week high of $8.60. The firm has a market capitalization of $1.65 billion, a PE ratio of 22.86, a P/E/G ratio of 1.65 and a beta of 1.46.

Mister Car Wash (NYSE:MCW - Get Free Report) last issued its quarterly earnings data on Wednesday, July 30th. The company reported $0.11 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.13 by ($0.02). Mister Car Wash had a net margin of 7.06% and a return on equity of 10.49%. The business had revenue of $265.42 million during the quarter, compared to analyst estimates of $271.83 million. During the same quarter in the prior year, the firm posted $0.11 earnings per share. Mister Car Wash's revenue for the quarter was up 4.1% compared to the same quarter last year. Mister Car Wash has set its FY 2025 guidance at 0.420-0.430 EPS. Sell-side analysts predict that Mister Car Wash, Inc. will post 0.33 EPS for the current fiscal year.

Analysts Set New Price Targets

A number of analysts have recently commented on the company. Mizuho lowered their price target on Mister Car Wash from $11.00 to $9.00 and set an "outperform" rating for the company in a research note on Monday, August 4th. BTIG Research assumed coverage on Mister Car Wash in a research note on Monday, June 30th. They issued a "neutral" rating for the company. Stifel Nicolaus lowered their price target on Mister Car Wash from $8.50 to $7.50 and set a "hold" rating for the company in a research note on Thursday, July 31st. UBS Group decreased their price objective on Mister Car Wash from $8.25 to $7.25 and set a "neutral" rating for the company in a research report on Thursday, July 31st. Finally, Morgan Stanley decreased their price objective on Mister Car Wash from $9.00 to $7.50 and set an "equal weight" rating for the company in a research report on Thursday, July 31st. Five analysts have rated the stock with a Buy rating, six have given a Hold rating and one has assigned a Sell rating to the company. According to MarketBeat, Mister Car Wash presently has an average rating of "Hold" and a consensus price target of $7.82.

Check Out Our Latest Report on MCW

Mister Car Wash Company Profile

(

Free Report)

Mister Car Wash, Inc, together with its subsidiaries, provides conveyorized car wash services in the United States. It offers express exterior and interior cleaning services. The company serves individual retail and corporate customers. The company was formerly known as Hotshine Holdings, Inc and changed its name to Mister Car Wash, Inc in March 2021.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Mister Car Wash, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mister Car Wash wasn't on the list.

While Mister Car Wash currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.