Bluefin Capital Management LLC acquired a new stake in Net Lease Office Properties (NYSE:NLOP - Free Report) in the first quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor acquired 30,485 shares of the company's stock, valued at approximately $957,000. Net Lease Office Properties comprises about 0.7% of Bluefin Capital Management LLC's portfolio, making the stock its 25th largest position. Bluefin Capital Management LLC owned approximately 0.21% of Net Lease Office Properties at the end of the most recent quarter.

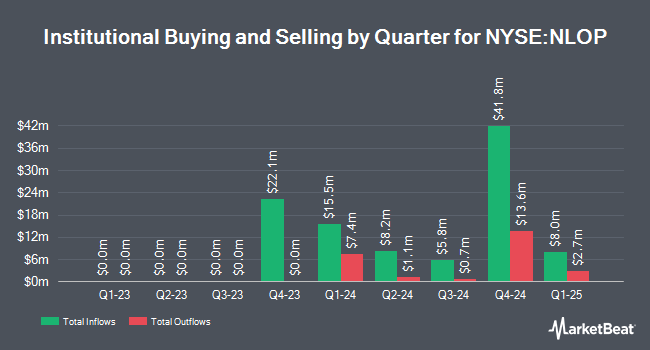

Other institutional investors have also bought and sold shares of the company. Jones Financial Companies Lllp grew its position in shares of Net Lease Office Properties by 498.7% in the first quarter. Jones Financial Companies Lllp now owns 1,407 shares of the company's stock valued at $44,000 after purchasing an additional 1,172 shares in the last quarter. Quantbot Technologies LP boosted its stake in Net Lease Office Properties by 163.4% during the first quarter. Quantbot Technologies LP now owns 5,924 shares of the company's stock worth $186,000 after buying an additional 3,675 shares during the last quarter. Resona Asset Management Co. Ltd. grew its holdings in Net Lease Office Properties by 8.0% in the 1st quarter. Resona Asset Management Co. Ltd. now owns 6,455 shares of the company's stock valued at $203,000 after buying an additional 478 shares in the last quarter. Raymond James Financial Inc. purchased a new stake in Net Lease Office Properties in the 4th quarter valued at $236,000. Finally, Fifth Lane Capital LP acquired a new stake in shares of Net Lease Office Properties in the 1st quarter worth $251,000. 58.33% of the stock is owned by hedge funds and other institutional investors.

Net Lease Office Properties Trading Down 0.3%

Shares of NLOP stock traded down $0.08 on Monday, hitting $29.02. 56,447 shares of the stock traded hands, compared to its average volume of 112,712. The firm's 50-day moving average price is $31.78 and its two-hundred day moving average price is $31.11. The company has a debt-to-equity ratio of 0.23, a quick ratio of 1.29 and a current ratio of 1.29. The stock has a market capitalization of $429.79 million, a PE ratio of -2.73 and a beta of 0.84. Net Lease Office Properties has a twelve month low of $26.10 and a twelve month high of $34.53.

Net Lease Office Properties Dividend Announcement

The company also recently announced a special dividend, which was paid on Wednesday, September 3rd. Shareholders of record on Monday, August 18th were issued a $3.10 dividend. The ex-dividend date was Monday, August 18th.

Net Lease Office Properties Profile

(

Free Report)

Net Lease Office Properties NYSE: NLOP is a publicly traded real estate investment trust with a portfolio of 59 high-quality office properties, totaling approximately 8.7 million leasable square feet primarily leased to corporate tenants on a single-tenant net lease basis. The vast majority of the office properties owned by NLOP are located in the U.S., with the balance in Europe.

See Also

Before you consider Net Lease Office Properties, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Net Lease Office Properties wasn't on the list.

While Net Lease Office Properties currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.