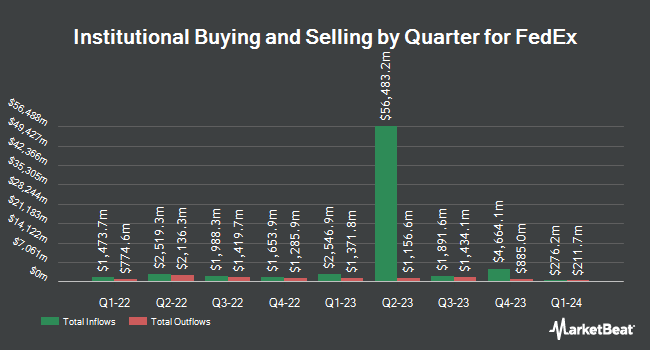

BNP PARIBAS ASSET MANAGEMENT Holding S.A. trimmed its holdings in FedEx Corporation (NYSE:FDX - Free Report) by 44.7% in the first quarter, according to its most recent disclosure with the SEC. The fund owned 106,493 shares of the shipping service provider's stock after selling 86,194 shares during the period. BNP PARIBAS ASSET MANAGEMENT Holding S.A.'s holdings in FedEx were worth $25,960,000 at the end of the most recent reporting period.

A number of other institutional investors and hedge funds have also made changes to their positions in the business. Korea Investment CORP raised its holdings in shares of FedEx by 31.8% in the first quarter. Korea Investment CORP now owns 216,706 shares of the shipping service provider's stock valued at $52,829,000 after buying an additional 52,273 shares during the last quarter. Aptus Capital Advisors LLC raised its holdings in shares of FedEx by 37.5% in the first quarter. Aptus Capital Advisors LLC now owns 12,579 shares of the shipping service provider's stock valued at $3,066,000 after buying an additional 3,430 shares during the last quarter. Brooklyn Investment Group raised its holdings in shares of FedEx by 21.1% in the first quarter. Brooklyn Investment Group now owns 1,913 shares of the shipping service provider's stock valued at $466,000 after buying an additional 333 shares during the last quarter. Versor Investments LP purchased a new stake in shares of FedEx in the first quarter valued at about $1,076,000. Finally, Mill Creek Capital Advisors LLC raised its position in FedEx by 6.7% during the 1st quarter. Mill Creek Capital Advisors LLC now owns 3,121 shares of the shipping service provider's stock worth $761,000 after buying an additional 195 shares during the last quarter. 84.47% of the stock is owned by hedge funds and other institutional investors.

FedEx Price Performance

Shares of FDX traded up $10.9110 during trading hours on Friday, reaching $236.1910. The company had a trading volume of 1,749,766 shares, compared to its average volume of 1,901,417. The firm has a 50 day simple moving average of $229.94 and a 200-day simple moving average of $230.99. The company has a current ratio of 1.19, a quick ratio of 1.15 and a debt-to-equity ratio of 0.68. The company has a market capitalization of $55.73 billion, a price-to-earnings ratio of 13.99, a PEG ratio of 1.17 and a beta of 1.30. FedEx Corporation has a 12-month low of $194.29 and a 12-month high of $308.53.

FedEx (NYSE:FDX - Get Free Report) last announced its quarterly earnings results on Tuesday, June 24th. The shipping service provider reported $6.07 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $5.98 by $0.09. The business had revenue of $22.20 billion during the quarter, compared to the consensus estimate of $21.86 billion. FedEx had a net margin of 4.65% and a return on equity of 16.34%. During the same quarter last year, the firm posted $5.41 EPS. FedEx has set its Q1 2026 guidance at 3.400-4.000 EPS. Research analysts expect that FedEx Corporation will post 19.14 earnings per share for the current year.

FedEx Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Wednesday, October 1st. Shareholders of record on Monday, September 8th will be issued a dividend of $1.45 per share. This represents a $5.80 annualized dividend and a yield of 2.5%. The ex-dividend date is Monday, September 8th. FedEx's dividend payout ratio (DPR) is 34.36%.

Insider Buying and Selling at FedEx

In other FedEx news, Director R Brad Martin sold 2,123 shares of the firm's stock in a transaction dated Monday, July 7th. The shares were sold at an average price of $241.75, for a total transaction of $513,235.25. Following the completion of the transaction, the director directly owned 8,935 shares in the company, valued at approximately $2,160,036.25. This trade represents a 19.20% decrease in their position. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this link. Also, Director Paul S. Walsh sold 3,610 shares of the firm's stock in a transaction dated Tuesday, July 8th. The shares were sold at an average price of $238.29, for a total transaction of $860,226.90. Following the transaction, the director owned 15,513 shares of the company's stock, valued at $3,696,592.77. This trade represents a 18.88% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last three months, insiders sold 9,343 shares of company stock worth $2,228,816. 8.87% of the stock is owned by corporate insiders.

Wall Street Analysts Forecast Growth

A number of brokerages have commented on FDX. Bank of America cut their price objective on shares of FedEx from $270.00 to $245.00 and set a "buy" rating for the company in a research report on Wednesday, June 25th. Barclays restated an "overweight" rating and set a $320.00 price objective (down previously from $330.00) on shares of FedEx in a research report on Wednesday, June 25th. TD Cowen cut their price objective on shares of FedEx from $310.00 to $269.00 and set a "buy" rating for the company in a research report on Wednesday, June 25th. Sanford C. Bernstein cut their price objective on shares of FedEx from $282.00 to $249.00 and set a "market perform" rating for the company in a research report on Friday, June 13th. Finally, Stifel Nicolaus set a $315.00 price objective on shares of FedEx in a research report on Wednesday, June 25th. One research analyst has rated the stock with a Strong Buy rating, eighteen have issued a Buy rating, nine have assigned a Hold rating and two have assigned a Sell rating to the stock. According to data from MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and an average target price of $283.13.

Check Out Our Latest Analysis on FDX

About FedEx

(

Free Report)

FedEx Corporation provides transportation, e-commerce, and business services in the United States and internationally. It operates through FedEx Express, FedEx Ground, FedEx Freight, and FedEx Services segments. The FedEx Express segment offers express transportation, small-package ground delivery, and freight transportation services; and time-critical transportation services.

See Also

Before you consider FedEx, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and FedEx wasn't on the list.

While FedEx currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report