BNP PARIBAS ASSET MANAGEMENT Holding S.A. increased its position in shares of Carvana Co. (NYSE:CVNA - Free Report) by 72.3% in the first quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 6,060 shares of the company's stock after purchasing an additional 2,542 shares during the quarter. BNP PARIBAS ASSET MANAGEMENT Holding S.A.'s holdings in Carvana were worth $1,267,000 at the end of the most recent quarter.

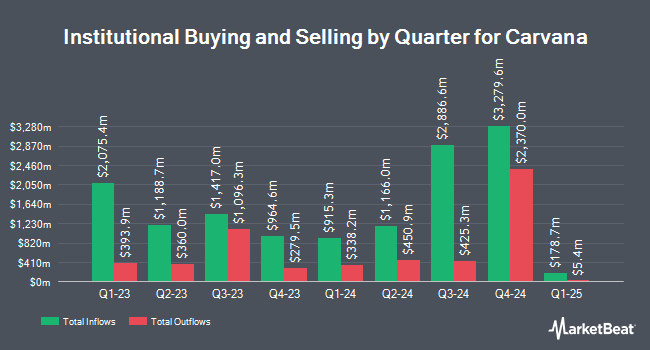

A number of other institutional investors and hedge funds have also recently added to or reduced their stakes in CVNA. Vanguard Group Inc. increased its holdings in shares of Carvana by 9.7% during the first quarter. Vanguard Group Inc. now owns 12,534,843 shares of the company's stock worth $2,620,785,000 after buying an additional 1,109,476 shares in the last quarter. Durable Capital Partners LP grew its position in Carvana by 6.3% during the 4th quarter. Durable Capital Partners LP now owns 2,168,232 shares of the company's stock worth $440,932,000 after acquiring an additional 129,246 shares during the last quarter. Whale Rock Capital Management LLC increased its holdings in Carvana by 29.8% during the 4th quarter. Whale Rock Capital Management LLC now owns 1,214,679 shares of the company's stock valued at $247,017,000 after purchasing an additional 278,760 shares in the last quarter. BNP Paribas Financial Markets raised its position in Carvana by 89.8% in the 4th quarter. BNP Paribas Financial Markets now owns 1,018,321 shares of the company's stock valued at $207,086,000 after purchasing an additional 481,912 shares during the last quarter. Finally, Palestra Capital Management LLC boosted its stake in Carvana by 15.5% in the fourth quarter. Palestra Capital Management LLC now owns 807,016 shares of the company's stock worth $164,115,000 after purchasing an additional 108,203 shares in the last quarter. 56.71% of the stock is currently owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

Several analysts have recently commented on the company. Stephens increased their target price on Carvana from $300.00 to $375.00 and gave the stock an "overweight" rating in a report on Monday, July 7th. Robert W. Baird upped their price target on shares of Carvana from $200.00 to $275.00 and gave the stock a "neutral" rating in a research report on Thursday, May 8th. Needham & Company LLC increased their price objective on shares of Carvana from $340.00 to $500.00 and gave the stock a "buy" rating in a report on Thursday, July 31st. Royal Bank Of Canada boosted their target price on shares of Carvana from $400.00 to $460.00 and gave the stock an "outperform" rating in a research note on Thursday, July 31st. Finally, Piper Sandler upped their target price on shares of Carvana from $340.00 to $440.00 and gave the stock an "overweight" rating in a research report on Thursday, July 31st. Twelve investment analysts have rated the stock with a Buy rating and six have given a Hold rating to the company. Based on data from MarketBeat.com, the company has an average rating of "Moderate Buy" and a consensus price target of $383.47.

View Our Latest Stock Report on CVNA

Carvana Trading Up 5.3%

Shares of NYSE:CVNA traded up $18.1040 during trading on Friday, hitting $357.1740. 3,475,072 shares of the company's stock were exchanged, compared to its average volume of 3,298,145. The company has a current ratio of 4.00, a quick ratio of 2.58 and a debt-to-equity ratio of 2.51. The firm has a market cap of $76.86 billion, a P/E ratio of 89.52, a PEG ratio of 1.12 and a beta of 3.57. The firm has a 50-day moving average price of $340.09 and a two-hundred day moving average price of $278.86. Carvana Co. has a 1-year low of $124.39 and a 1-year high of $413.33.

Carvana (NYSE:CVNA - Get Free Report) last posted its quarterly earnings results on Wednesday, July 30th. The company reported $1.28 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.09 by $0.19. Carvana had a return on equity of 40.57% and a net margin of 3.46%.The business had revenue of $4.84 billion for the quarter, compared to analyst estimates of $4.54 billion. During the same period last year, the company earned ($0.05) EPS. The firm's revenue was up 41.9% on a year-over-year basis. Equities analysts predict that Carvana Co. will post 2.85 earnings per share for the current year.

Insider Activity

In other news, major shareholder Ernest C. Garcia II sold 100,000 shares of the company's stock in a transaction dated Friday, June 6th. The stock was sold at an average price of $346.99, for a total value of $34,699,000.00. Following the completion of the sale, the insider directly owned 37,092,317 shares of the company's stock, valued at $12,870,663,075.83. This represents a 0.27% decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this hyperlink. In the last three months, insiders sold 3,056,140 shares of company stock worth $1,063,857,548. 17.12% of the stock is currently owned by insiders.

About Carvana

(

Free Report)

Carvana Co, together with its subsidiaries, operates an e-commerce platform for buying and selling used cars in the United States. Its platform allows customers to research and identify a vehicle; inspect it using company's 360-degree vehicle imaging technology; obtain financing and warranty coverage; purchase the vehicle; and schedule delivery or pick-up from their desktop or mobile devices.

See Also

Before you consider Carvana, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Carvana wasn't on the list.

While Carvana currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.