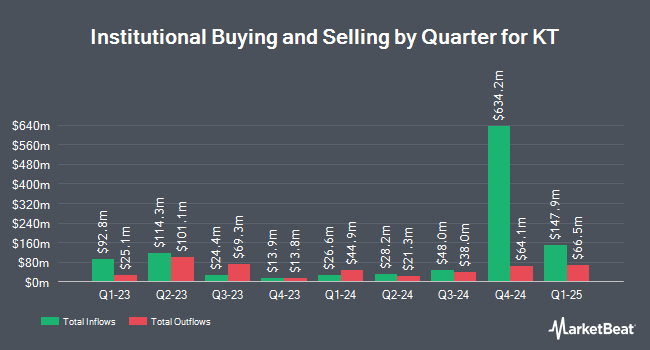

Boston Partners grew its stake in shares of KT Corporation (NYSE:KT - Free Report) by 193.2% in the first quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm owned 3,658,852 shares of the technology company's stock after purchasing an additional 2,410,971 shares during the quarter. Boston Partners owned approximately 0.71% of KT worth $64,806,000 at the end of the most recent quarter.

Other large investors have also recently made changes to their positions in the company. Cerity Partners LLC boosted its stake in shares of KT by 52.7% during the first quarter. Cerity Partners LLC now owns 66,781 shares of the technology company's stock valued at $1,183,000 after purchasing an additional 23,045 shares during the period. GAMMA Investing LLC boosted its stake in shares of KT by 20.4% during the first quarter. GAMMA Investing LLC now owns 7,820 shares of the technology company's stock valued at $138,000 after purchasing an additional 1,323 shares during the period. Envestnet Asset Management Inc. boosted its stake in shares of KT by 33.4% during the first quarter. Envestnet Asset Management Inc. now owns 753,320 shares of the technology company's stock valued at $13,341,000 after purchasing an additional 188,805 shares during the period. Ninety One UK Ltd boosted its stake in shares of KT by 28.3% during the first quarter. Ninety One UK Ltd now owns 4,890,767 shares of the technology company's stock valued at $86,615,000 after purchasing an additional 1,079,860 shares during the period. Finally, Rhumbline Advisers lifted its stake in KT by 3.0% in the first quarter. Rhumbline Advisers now owns 93,547 shares of the technology company's stock worth $1,657,000 after acquiring an additional 2,731 shares during the period. 18.86% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

Separately, Wall Street Zen lowered shares of KT from a "strong-buy" rating to a "buy" rating in a research note on Tuesday, May 20th. One equities research analyst has rated the stock with a Strong Buy rating and two have given a Buy rating to the stock. According to MarketBeat, the stock has an average rating of "Buy".

Check Out Our Latest Analysis on KT

KT Stock Up 0.8%

KT stock traded up $0.1740 during trading hours on Wednesday, reaching $20.9240. The stock had a trading volume of 2,247,648 shares, compared to its average volume of 1,364,885. The company has a market cap of $10.79 billion, a price-to-earnings ratio of 22.74, a PEG ratio of 0.15 and a beta of 0.69. The company has a debt-to-equity ratio of 0.41, a current ratio of 1.10 and a quick ratio of 1.04. The business's 50 day moving average price is $20.54 and its 200-day moving average price is $19.01. KT Corporation has a 52 week low of $14.53 and a 52 week high of $21.61.

KT (NYSE:KT - Get Free Report) last announced its earnings results on Tuesday, June 17th. The technology company reported $0.75 EPS for the quarter. The business had revenue of $4.71 billion during the quarter. KT had a net margin of 2.37% and a return on equity of 3.47%. Sell-side analysts anticipate that KT Corporation will post 0.73 EPS for the current year.

About KT

(

Free Report)

KT Corporation provides integrated telecommunications and platform services in Korea and internationally. The company offers mobile voice and data telecommunications services based on 5G, 4G LTE and 3G W-CDMA technology; fixed-line telephone services, including local, domestic long-distance, international long-distance, and voice over Internet protocol telephone services, as well as interconnection services; broadband Internet access service and other Internet-related services; and data communication services, such as fixed-line and leased line services, as well as broadband Internet connection services.

Read More

Before you consider KT, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and KT wasn't on the list.

While KT currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.