Boston Partners boosted its holdings in Qorvo, Inc. (NASDAQ:QRVO - Free Report) by 3.3% in the first quarter, according to its most recent filing with the SEC. The institutional investor owned 114,375 shares of the semiconductor company's stock after buying an additional 3,666 shares during the period. Boston Partners owned 0.12% of Qorvo worth $8,272,000 as of its most recent SEC filing.

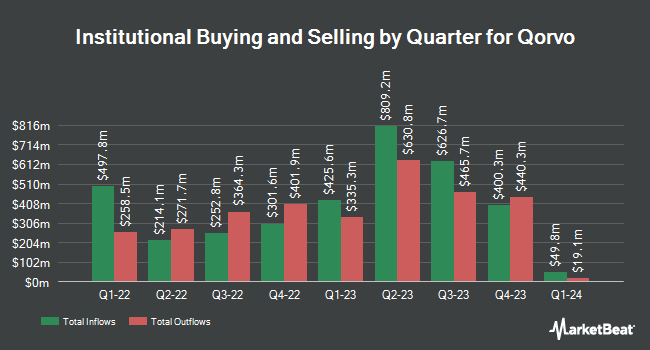

A number of other institutional investors have also bought and sold shares of the business. City Holding Co. purchased a new position in shares of Qorvo during the first quarter valued at about $25,000. Larson Financial Group LLC grew its position in shares of Qorvo by 222.6% during the first quarter. Larson Financial Group LLC now owns 429 shares of the semiconductor company's stock valued at $31,000 after purchasing an additional 296 shares in the last quarter. Curat Global LLC purchased a new position in shares of Qorvo during the first quarter valued at about $34,000. Migdal Insurance & Financial Holdings Ltd. purchased a new position in shares of Qorvo during the first quarter valued at about $34,000. Finally, Signaturefd LLC grew its position in shares of Qorvo by 34.6% during the first quarter. Signaturefd LLC now owns 662 shares of the semiconductor company's stock valued at $48,000 after purchasing an additional 170 shares in the last quarter. Hedge funds and other institutional investors own 88.57% of the company's stock.

Qorvo Trading Down 0.4%

NASDAQ QRVO traded down $0.3150 during trading on Thursday, hitting $88.7350. The stock had a trading volume of 152,149 shares, compared to its average volume of 2,378,000. The company has a debt-to-equity ratio of 0.45, a quick ratio of 2.01 and a current ratio of 2.81. The stock has a market capitalization of $8.22 billion, a price-to-earnings ratio of 104.45, a P/E/G ratio of 1.75 and a beta of 1.35. Qorvo, Inc. has a one year low of $49.46 and a one year high of $117.90. The stock has a 50 day simple moving average of $85.79 and a 200 day simple moving average of $76.48.

Qorvo (NASDAQ:QRVO - Get Free Report) last announced its quarterly earnings data on Tuesday, July 29th. The semiconductor company reported $0.92 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.62 by $0.30. The business had revenue of $818.80 million during the quarter, compared to the consensus estimate of $775.61 million. Qorvo had a net margin of 2.21% and a return on equity of 12.63%. The firm's quarterly revenue was down 7.7% compared to the same quarter last year. During the same quarter last year, the firm earned $0.87 earnings per share. Qorvo has set its Q2 2026 guidance at 1.750-2.250 EPS. Sell-side analysts predict that Qorvo, Inc. will post 4.09 earnings per share for the current year.

Wall Street Analyst Weigh In

A number of research analysts recently commented on QRVO shares. TD Cowen increased their price target on shares of Qorvo from $80.00 to $95.00 and gave the company a "hold" rating in a report on Wednesday, July 30th. Craig Hallum reaffirmed a "buy" rating on shares of Qorvo in a report on Wednesday, July 30th. Piper Sandler increased their price target on shares of Qorvo from $110.00 to $125.00 and gave the company an "overweight" rating in a report on Wednesday, July 30th. Wall Street Zen raised shares of Qorvo from a "hold" rating to a "strong-buy" rating in a report on Saturday, August 2nd. Finally, Barclays increased their price target on shares of Qorvo from $70.00 to $90.00 and gave the company an "equal weight" rating in a report on Wednesday, July 30th. Five analysts have rated the stock with a Buy rating, ten have issued a Hold rating and three have assigned a Sell rating to the company's stock. Based on data from MarketBeat, the stock presently has a consensus rating of "Hold" and an average price target of $95.35.

Read Our Latest Stock Report on Qorvo

About Qorvo

(

Free Report)

Qorvo, Inc engages in development and commercialization of technologies and products for wireless, wired, and power markets. It operates through three segments: High Performance Analog (HPA), Connectivity and Sensors Group (CSG), and Advanced Cellular Group (ACG). The HPA segment supplies radio frequency and power management solutions for automotive, defense and aerospace, cellular infrastructure, broadband, and other markets.

Read More

Before you consider Qorvo, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Qorvo wasn't on the list.

While Qorvo currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.