Boston Partners decreased its holdings in shares of Cenovus Energy Inc (NYSE:CVE - Free Report) TSE: CVE by 4.3% in the 1st quarter, according to its most recent 13F filing with the SEC. The fund owned 26,239,325 shares of the oil and gas company's stock after selling 1,167,810 shares during the period. Boston Partners owned approximately 1.44% of Cenovus Energy worth $364,989,000 at the end of the most recent reporting period.

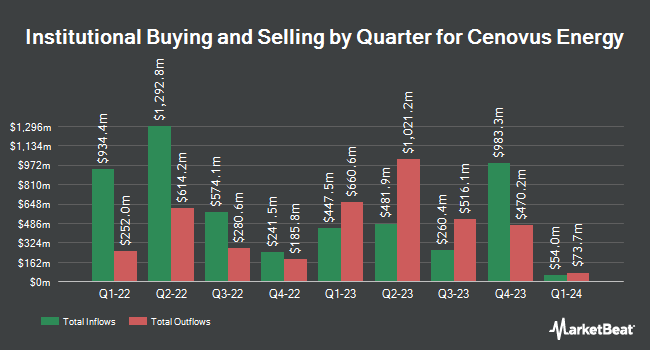

Other institutional investors and hedge funds also recently made changes to their positions in the company. Public Employees Retirement System of Ohio grew its holdings in shares of Cenovus Energy by 0.3% in the 4th quarter. Public Employees Retirement System of Ohio now owns 241,113 shares of the oil and gas company's stock valued at $3,653,000 after buying an additional 762 shares during the period. Alliancebernstein L.P. grew its holdings in shares of Cenovus Energy by 0.7% in the 4th quarter. Alliancebernstein L.P. now owns 106,532 shares of the oil and gas company's stock valued at $1,614,000 after buying an additional 779 shares during the period. NFP Retirement Inc. grew its holdings in shares of Cenovus Energy by 2.7% in the 1st quarter. NFP Retirement Inc. now owns 34,500 shares of the oil and gas company's stock valued at $480,000 after buying an additional 900 shares during the period. Guggenheim Capital LLC grew its holdings in shares of Cenovus Energy by 4.5% in the 4th quarter. Guggenheim Capital LLC now owns 20,974 shares of the oil and gas company's stock valued at $318,000 after buying an additional 908 shares during the period. Finally, Meridian Investment Counsel Inc. grew its holdings in shares of Cenovus Energy by 4.9% in the 1st quarter. Meridian Investment Counsel Inc. now owns 21,275 shares of the oil and gas company's stock valued at $296,000 after buying an additional 1,000 shares during the period. Institutional investors own 51.19% of the company's stock.

Cenovus Energy Stock Up 0.7%

NYSE CVE traded up $0.11 on Thursday, reaching $15.16. The company had a trading volume of 10,399,444 shares, compared to its average volume of 13,334,594. The company's fifty day moving average is $14.42 and its 200-day moving average is $13.70. Cenovus Energy Inc has a 1-year low of $10.23 and a 1-year high of $20.03. The company has a debt-to-equity ratio of 0.24, a quick ratio of 0.78 and a current ratio of 1.32. The firm has a market capitalization of $27.37 billion, a price-to-earnings ratio of 15.01 and a beta of 0.97.

Cenovus Energy (NYSE:CVE - Get Free Report) TSE: CVE last posted its quarterly earnings data on Thursday, July 31st. The oil and gas company reported $0.33 EPS for the quarter, topping analysts' consensus estimates of $0.14 by $0.19. Cenovus Energy had a net margin of 5.18% and a return on equity of 9.06%. The company had revenue of $10.66 billion during the quarter, compared to the consensus estimate of $10.64 billion. During the same period in the prior year, the business posted $0.62 EPS. The company's quarterly revenue was down 12.6% on a year-over-year basis. On average, research analysts forecast that Cenovus Energy Inc will post 1.49 earnings per share for the current fiscal year.

Cenovus Energy Increases Dividend

The firm also recently disclosed a dividend, which was paid on Monday, June 30th. Stockholders of record on Monday, June 16th were paid a dividend of $0.20 per share. The ex-dividend date was Friday, June 13th. This represents a dividend yield of 425.0%. This is a positive change from Cenovus Energy's previous dividend of $0.11. Cenovus Energy's dividend payout ratio (DPR) is currently 57.43%.

Wall Street Analyst Weigh In

Several equities analysts have recently issued reports on the stock. Wall Street Zen raised shares of Cenovus Energy from a "sell" rating to a "hold" rating in a report on Sunday, August 3rd. National Bankshares reaffirmed a "sector perform" rating on shares of Cenovus Energy in a research note on Friday, April 25th. Veritas lowered shares of Cenovus Energy from a "strong-buy" rating to a "hold" rating in a research note on Wednesday, May 14th. The Goldman Sachs Group reduced their target price on shares of Cenovus Energy from $18.00 to $16.00 and set a "buy" rating for the company in a research note on Wednesday, April 30th. Finally, Royal Bank Of Canada upped their target price on shares of Cenovus Energy from $25.00 to $26.00 and gave the stock an "outperform" rating in a research note on Friday, August 1st. Five investment analysts have rated the stock with a hold rating, four have issued a buy rating and one has assigned a strong buy rating to the company's stock. According to data from MarketBeat.com, Cenovus Energy presently has a consensus rating of "Moderate Buy" and an average price target of $23.33.

Check Out Our Latest Report on Cenovus Energy

Cenovus Energy Company Profile

(

Free Report)

Cenovus Energy Inc, together with its subsidiaries, develops, produces, refines, transports, and markets crude oil, natural gas, and refined petroleum products in Canada and internationally. The company operates through Oil Sands, Conventional, Offshore, Canadian Refining, and U.S. Refining segments.

Recommended Stories

Before you consider Cenovus Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cenovus Energy wasn't on the list.

While Cenovus Energy currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for August 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.