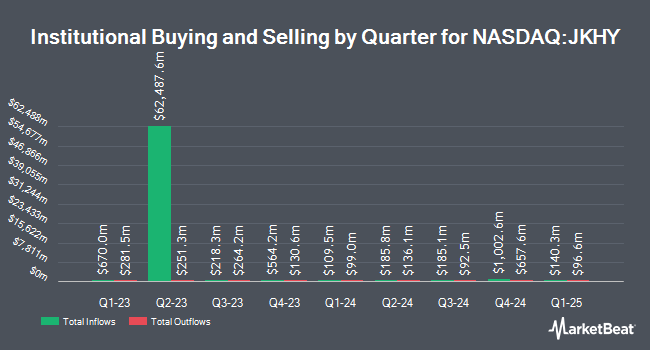

Boston Trust Walden Corp boosted its holdings in shares of Jack Henry & Associates, Inc. (NASDAQ:JKHY - Free Report) by 6.2% during the second quarter, according to its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 276,662 shares of the technology company's stock after purchasing an additional 16,256 shares during the quarter. Boston Trust Walden Corp owned approximately 0.38% of Jack Henry & Associates worth $49,846,000 at the end of the most recent reporting period.

A number of other hedge funds also recently bought and sold shares of JKHY. Axxcess Wealth Management LLC raised its stake in shares of Jack Henry & Associates by 2.3% during the 1st quarter. Axxcess Wealth Management LLC now owns 2,622 shares of the technology company's stock worth $479,000 after buying an additional 59 shares during the period. Bank Julius Baer & Co. Ltd Zurich increased its holdings in Jack Henry & Associates by 2.1% in the 1st quarter. Bank Julius Baer & Co. Ltd Zurich now owns 3,115 shares of the technology company's stock worth $569,000 after acquiring an additional 64 shares in the last quarter. Strengthening Families & Communities LLC grew its position in shares of Jack Henry & Associates by 12.1% in the first quarter. Strengthening Families & Communities LLC now owns 632 shares of the technology company's stock valued at $105,000 after purchasing an additional 68 shares during the period. Blue Trust Inc. grew its position in shares of Jack Henry & Associates by 11.3% in the second quarter. Blue Trust Inc. now owns 670 shares of the technology company's stock valued at $121,000 after purchasing an additional 68 shares during the period. Finally, Phillips Wealth Planners LLC grew its position in shares of Jack Henry & Associates by 4.7% in the second quarter. Phillips Wealth Planners LLC now owns 1,611 shares of the technology company's stock valued at $290,000 after purchasing an additional 73 shares during the period. Hedge funds and other institutional investors own 98.75% of the company's stock.

Insider Transactions at Jack Henry & Associates

In other news, Director David B. Foss sold 5,780 shares of Jack Henry & Associates stock in a transaction on Monday, August 4th. The stock was sold at an average price of $167.28, for a total value of $966,878.40. Following the completion of the sale, the director directly owned 139,265 shares of the company's stock, valued at approximately $23,296,249.20. The trade was a 3.98% decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which can be accessed through this hyperlink. 0.60% of the stock is currently owned by insiders.

Wall Street Analysts Forecast Growth

A number of research analysts recently weighed in on the stock. Weiss Ratings reaffirmed a "hold (c)" rating on shares of Jack Henry & Associates in a research note on Wednesday, October 8th. Wall Street Zen cut Jack Henry & Associates from a "buy" rating to a "hold" rating in a research report on Saturday. Royal Bank Of Canada dropped their price target on Jack Henry & Associates from $203.00 to $185.00 and set a "sector perform" rating for the company in a research report on Thursday, August 21st. DA Davidson set a $204.00 target price on shares of Jack Henry & Associates in a research note on Friday, August 22nd. Finally, Robert W. Baird lowered their target price on shares of Jack Henry & Associates from $195.00 to $185.00 and set a "neutral" rating on the stock in a research note on Wednesday, August 20th. Two investment analysts have rated the stock with a Buy rating, eight have issued a Hold rating and one has issued a Sell rating to the stock. According to data from MarketBeat.com, Jack Henry & Associates currently has a consensus rating of "Hold" and a consensus price target of $174.88.

Read Our Latest Stock Analysis on JKHY

Jack Henry & Associates Price Performance

Jack Henry & Associates stock opened at $152.19 on Tuesday. The firm has a 50 day simple moving average of $157.51 and a 200-day simple moving average of $170.41. Jack Henry & Associates, Inc. has a 1-year low of $144.12 and a 1-year high of $196.00. The stock has a market cap of $11.06 billion, a price-to-earnings ratio of 24.39, a price-to-earnings-growth ratio of 2.71 and a beta of 0.78.

Jack Henry & Associates (NASDAQ:JKHY - Get Free Report) last posted its earnings results on Tuesday, August 19th. The technology company reported $1.75 EPS for the quarter, beating analysts' consensus estimates of $1.50 by $0.25. Jack Henry & Associates had a net margin of 19.19% and a return on equity of 22.60%. The company had revenue of $615.37 million for the quarter, compared to analysts' expectations of $602.20 million. During the same quarter in the prior year, the company posted $1.33 earnings per share. Jack Henry & Associates's revenue for the quarter was up 9.9% compared to the same quarter last year. Jack Henry & Associates has set its FY 2026 guidance at EPS. Equities analysts expect that Jack Henry & Associates, Inc. will post 5.83 earnings per share for the current fiscal year.

Jack Henry & Associates Dividend Announcement

The company also recently announced a quarterly dividend, which was paid on Friday, September 26th. Shareholders of record on Friday, September 5th were given a $0.58 dividend. The ex-dividend date of this dividend was Friday, September 5th. This represents a $2.32 dividend on an annualized basis and a yield of 1.5%. Jack Henry & Associates's payout ratio is presently 37.18%.

Jack Henry & Associates Profile

(

Free Report)

Jack Henry & Associates, Inc is a financial technology company, which engages in the provision of technology solutions and payment processing services. It operates through the following segments: Core, Payments, Complementary, and Corporate and Other. The Core segment provides core information processing platforms to banks and credit unions which consist of integrated applications required to process deposit, loan, and general ledger transactions, and maintain centralized customer and member information.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Jack Henry & Associates, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Jack Henry & Associates wasn't on the list.

While Jack Henry & Associates currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.