Amundi decreased its holdings in Brady Corporation (NYSE:BRC - Free Report) by 18.2% in the first quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 19,594 shares of the industrial products company's stock after selling 4,358 shares during the quarter. Amundi's holdings in Brady were worth $1,363,000 as of its most recent SEC filing.

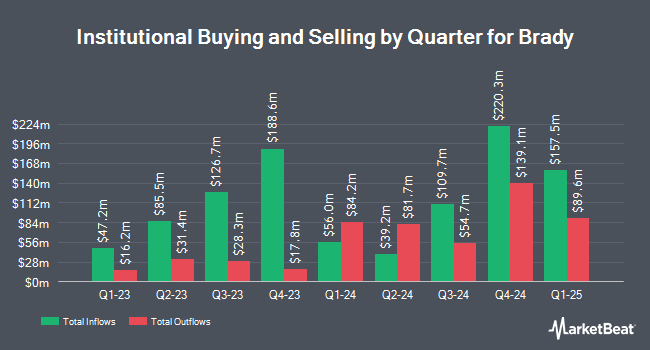

A number of other institutional investors have also recently made changes to their positions in the business. Victory Capital Management Inc. raised its stake in Brady by 1.2% in the 1st quarter. Victory Capital Management Inc. now owns 18,509 shares of the industrial products company's stock worth $1,307,000 after acquiring an additional 215 shares during the last quarter. Quarry LP purchased a new position in Brady in the 1st quarter worth $25,000. Deutsche Bank AG raised its stake in Brady by 22.3% in the 4th quarter. Deutsche Bank AG now owns 3,270 shares of the industrial products company's stock worth $241,000 after acquiring an additional 597 shares during the last quarter. KBC Group NV raised its stake in Brady by 33.7% in the 1st quarter. KBC Group NV now owns 2,391 shares of the industrial products company's stock worth $169,000 after acquiring an additional 602 shares during the last quarter. Finally, Natixis Advisors LLC raised its stake in Brady by 9.0% in the 1st quarter. Natixis Advisors LLC now owns 12,042 shares of the industrial products company's stock worth $851,000 after acquiring an additional 991 shares during the last quarter. Institutional investors and hedge funds own 76.28% of the company's stock.

Brady Stock Performance

Shares of NYSE BRC traded up $1.54 during trading on Thursday, reaching $81.85. 246,178 shares of the company traded hands, compared to its average volume of 189,630. The firm's fifty day simple moving average is $74.03 and its 200 day simple moving average is $71.19. The stock has a market cap of $3.85 billion, a P/E ratio of 20.83 and a beta of 0.83. Brady Corporation has a 12-month low of $62.70 and a 12-month high of $84.03. The company has a current ratio of 1.88, a quick ratio of 1.27 and a debt-to-equity ratio of 0.08.

Brady (NYSE:BRC - Get Free Report) last released its quarterly earnings data on Thursday, September 4th. The industrial products company reported $1.26 earnings per share for the quarter, beating analysts' consensus estimates of $1.24 by $0.02. The business had revenue of $397.28 million during the quarter, compared to analyst estimates of $384.67 million. Brady had a return on equity of 19.29% and a net margin of 12.50%.The company's revenue was up 15.7% on a year-over-year basis. During the same quarter last year, the business posted $1.19 EPS. Brady has set its FY 2026 guidance at 4.850-5.150 EPS. As a group, research analysts anticipate that Brady Corporation will post 4.55 earnings per share for the current fiscal year.

Brady Increases Dividend

The firm also recently declared a quarterly dividend, which will be paid on Friday, October 31st. Investors of record on Friday, October 10th will be paid a $0.245 dividend. The ex-dividend date is Friday, October 10th. This represents a $0.98 annualized dividend and a dividend yield of 1.2%. This is a boost from Brady's previous quarterly dividend of $0.24. Brady's dividend payout ratio (DPR) is presently 24.43%.

Analysts Set New Price Targets

Separately, Wall Street Zen upgraded Brady from a "hold" rating to a "buy" rating in a research note on Friday, August 22nd. One research analyst has rated the stock with a Strong Buy rating, Based on data from MarketBeat, the stock has an average rating of "Strong Buy".

Check Out Our Latest Stock Report on BRC

About Brady

(

Free Report)

Brady Corporation manufactures and supplies identification solutions (IDS) and workplace safety (WPS) products to identify and protect premises, products, and people in the United States and internationally. The company offers materials, printing systems, RFID, and bar code scanners for product identification, brand protection labeling, work in process labeling, finished product identification, and industrial track and trace applications; safety signs, floor-marking tapes, pipe markers, labeling systems, spill control products, lockout/tagout device, and software and services for safety compliance auditing, procedure writing, and training; and hand-held printers, wire markers, sleeves, and tags for wire identification.

Recommended Stories

Before you consider Brady, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Brady wasn't on the list.

While Brady currently has a Strong Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.