Brandywine Global Investment Management LLC grew its holdings in shares of Invesco Ltd. (NYSE:IVZ - Free Report) by 16.0% during the first quarter, according to its most recent 13F filing with the SEC. The institutional investor owned 108,480 shares of the asset manager's stock after buying an additional 14,924 shares during the period. Brandywine Global Investment Management LLC's holdings in Invesco were worth $1,646,000 as of its most recent filing with the SEC.

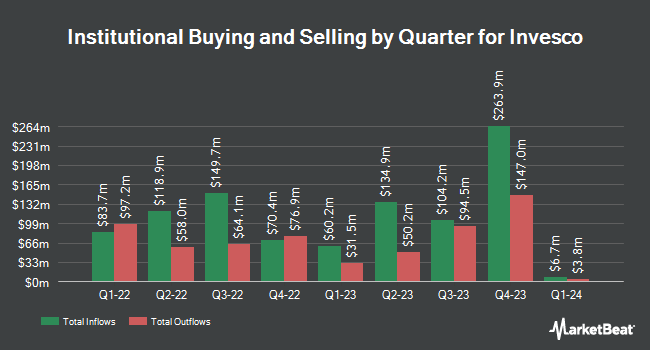

A number of other institutional investors and hedge funds have also recently modified their holdings of the business. Aberdeen Group plc boosted its holdings in shares of Invesco by 122.2% during the 1st quarter. Aberdeen Group plc now owns 68,257 shares of the asset manager's stock worth $1,028,000 after buying an additional 37,543 shares in the last quarter. Resona Asset Management Co. Ltd. boosted its holdings in shares of Invesco by 33.5% during the 1st quarter. Resona Asset Management Co. Ltd. now owns 3,943 shares of the asset manager's stock worth $60,000 after buying an additional 990 shares in the last quarter. Public Sector Pension Investment Board boosted its holdings in shares of Invesco by 110.0% during the 1st quarter. Public Sector Pension Investment Board now owns 244,800 shares of the asset manager's stock worth $3,714,000 after buying an additional 128,215 shares in the last quarter. Independent Advisor Alliance bought a new position in shares of Invesco during the 1st quarter worth approximately $170,000. Finally, Nuveen LLC bought a new position in shares of Invesco during the 1st quarter worth approximately $29,138,000. 66.09% of the stock is currently owned by institutional investors.

Invesco Stock Up 4.2%

Shares of IVZ traded up $0.8650 during trading hours on Friday, reaching $21.5350. The stock had a trading volume of 3,396,187 shares, compared to its average volume of 4,897,425. The company has a current ratio of 1.30, a quick ratio of 1.30 and a debt-to-equity ratio of 0.88. The firm has a 50-day simple moving average of $18.66 and a 200 day simple moving average of $16.37. Invesco Ltd. has a 12 month low of $11.60 and a 12 month high of $21.85. The company has a market capitalization of $9.60 billion, a price-to-earnings ratio of 23.16, a P/E/G ratio of 1.22 and a beta of 1.55.

Invesco (NYSE:IVZ - Get Free Report) last issued its quarterly earnings data on Tuesday, July 22nd. The asset manager reported $0.36 earnings per share for the quarter, missing the consensus estimate of $0.41 by ($0.05). Invesco had a net margin of 10.68% and a return on equity of 8.60%. The company had revenue of $1.10 billion for the quarter, compared to the consensus estimate of $1.09 billion. During the same quarter last year, the business posted $0.43 earnings per share. Invesco's revenue was up 2.2% on a year-over-year basis. Equities research analysts predict that Invesco Ltd. will post 1.87 earnings per share for the current fiscal year.

Invesco Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Tuesday, September 2nd. Shareholders of record on Thursday, August 14th will be paid a dividend of $0.21 per share. The ex-dividend date is Thursday, August 14th. This represents a $0.84 annualized dividend and a yield of 3.9%. Invesco's dividend payout ratio (DPR) is 90.32%.

Analyst Upgrades and Downgrades

A number of equities analysts have issued reports on the company. Morgan Stanley increased their price target on Invesco from $15.00 to $16.00 and gave the stock an "equal weight" rating in a report on Wednesday, July 2nd. TD Cowen upgraded Invesco from a "hold" rating to a "buy" rating and increased their price target for the stock from $17.50 to $25.00 in a report on Monday, July 21st. Wells Fargo & Company upgraded Invesco from an "underweight" rating to an "equal weight" rating and increased their target price for the stock from $14.50 to $18.00 in a report on Friday, July 11th. Barclays increased their target price on Invesco from $17.00 to $22.00 and gave the stock an "equal weight" rating in a report on Wednesday, July 23rd. Finally, Zacks Research upgraded Invesco to a "hold" rating in a report on Tuesday, August 12th. Two equities research analysts have rated the stock with a Buy rating and fourteen have given a Hold rating to the stock. According to data from MarketBeat, Invesco has an average rating of "Hold" and an average target price of $18.78.

Check Out Our Latest Analysis on IVZ

Invesco Company Profile

(

Free Report)

Invesco Ltd. is a publicly owned investment manager. The firm provides its services to retail clients, institutional clients, high-net worth clients, public entities, corporations, unions, non-profit organizations, endowments, foundations, pension funds, financial institutions, and sovereign wealth funds.

See Also

Before you consider Invesco, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Invesco wasn't on the list.

While Invesco currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.