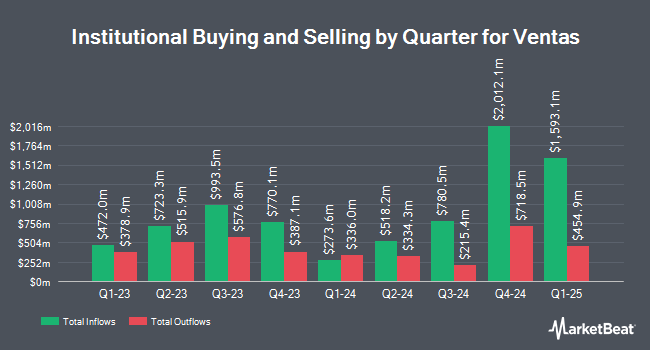

Brasada Capital Management LP cut its stake in Ventas, Inc. (NYSE:VTR - Free Report) by 21.7% in the first quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm owned 15,498 shares of the real estate investment trust's stock after selling 4,290 shares during the period. Brasada Capital Management LP's holdings in Ventas were worth $982,000 as of its most recent filing with the Securities and Exchange Commission.

Other institutional investors and hedge funds have also recently added to or reduced their stakes in the company. Cloud Capital Management LLC acquired a new position in Ventas in the 1st quarter worth $25,000. Larson Financial Group LLC grew its holdings in shares of Ventas by 1,334.6% during the first quarter. Larson Financial Group LLC now owns 373 shares of the real estate investment trust's stock worth $26,000 after buying an additional 347 shares in the last quarter. Franchise Capital Ltd bought a new position in shares of Ventas during the first quarter worth about $32,000. Rossby Financial LCC bought a new position in shares of Ventas during the first quarter worth about $34,000. Finally, Bank Julius Baer & Co. Ltd Zurich bought a new position in shares of Ventas during the first quarter worth about $41,000. 94.18% of the stock is owned by institutional investors and hedge funds.

Ventas Stock Performance

Shares of VTR traded down $0.25 during midday trading on Tuesday, reaching $67.83. 2,650,324 shares of the stock were exchanged, compared to its average volume of 2,371,074. Ventas, Inc. has a twelve month low of $56.68 and a twelve month high of $71.36. The company has a quick ratio of 0.68, a current ratio of 0.68 and a debt-to-equity ratio of 1.13. The company has a market cap of $30.83 billion, a P/E ratio of 157.75, a PEG ratio of 2.51 and a beta of 0.87. The stock's 50 day simple moving average is $66.23 and its 200 day simple moving average is $66.23.

Ventas (NYSE:VTR - Get Free Report) last posted its earnings results on Wednesday, July 30th. The real estate investment trust reported $0.87 earnings per share for the quarter, topping analysts' consensus estimates of $0.85 by $0.02. The company had revenue of $1.42 billion during the quarter, compared to the consensus estimate of $1.37 billion. Ventas had a return on equity of 1.75% and a net margin of 3.61%.The company's revenue was up 18.3% on a year-over-year basis. During the same quarter last year, the firm earned $0.80 earnings per share. Ventas has set its FY 2025 guidance at 3.410-3.46 EPS. On average, sell-side analysts expect that Ventas, Inc. will post 3.4 earnings per share for the current year.

Insider Buying and Selling

In related news, CFO Robert F. Probst sold 29,691 shares of the stock in a transaction that occurred on Monday, August 4th. The stock was sold at an average price of $68.49, for a total transaction of $2,033,536.59. Following the sale, the chief financial officer owned 168,364 shares of the company's stock, valued at $11,531,250.36. This represents a 14.99% decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available through the SEC website. Also, CEO Debra A. Cafaro sold 10,322 shares of the stock in a transaction that occurred on Friday, August 1st. The stock was sold at an average price of $67.40, for a total value of $695,702.80. Following the sale, the chief executive officer directly owned 1,145,695 shares in the company, valued at $77,219,843. This represents a 0.89% decrease in their position. The disclosure for this sale can be found here. Insiders have sold 266,466 shares of company stock worth $17,579,249 in the last three months. 1.00% of the stock is currently owned by company insiders.

Analyst Ratings Changes

A number of equities analysts have recently commented on the stock. Wall Street Zen downgraded shares of Ventas from a "hold" rating to a "sell" rating in a research note on Thursday, May 22nd. JPMorgan Chase & Co. increased their price objective on shares of Ventas from $72.00 to $76.00 and gave the stock an "overweight" rating in a research note on Tuesday, August 26th. Scotiabank increased their price objective on shares of Ventas from $72.00 to $74.00 and gave the stock a "sector perform" rating in a research note on Thursday, August 28th. Argus restated a "buy" rating and set a $75.00 price objective on shares of Ventas in a research note on Tuesday, August 26th. Finally, Morgan Stanley increased their price objective on shares of Ventas from $70.00 to $75.00 and gave the stock an "equal weight" rating in a research note on Friday, August 15th. One research analyst has rated the stock with a Strong Buy rating, nine have assigned a Buy rating and two have issued a Hold rating to the company's stock. According to data from MarketBeat, the stock has an average rating of "Moderate Buy" and a consensus target price of $74.36.

View Our Latest Research Report on VTR

Ventas Company Profile

(

Free Report)

Ventas Inc NYSE: VTR is a leading S&P 500 real estate investment trust focused on delivering strong, sustainable shareholder returns by enabling exceptional environments that benefit a large and growing aging population. The Company's growth is fueled by its senior housing communities, which provide valuable services to residents and enable them to thrive in supported environments.

Featured Stories

Before you consider Ventas, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ventas wasn't on the list.

While Ventas currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.