Breed s Hill Capital LLC purchased a new position in Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX - Free Report) during the fourth quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The fund purchased 1,236 shares of the pharmaceutical company's stock, valued at approximately $498,000.

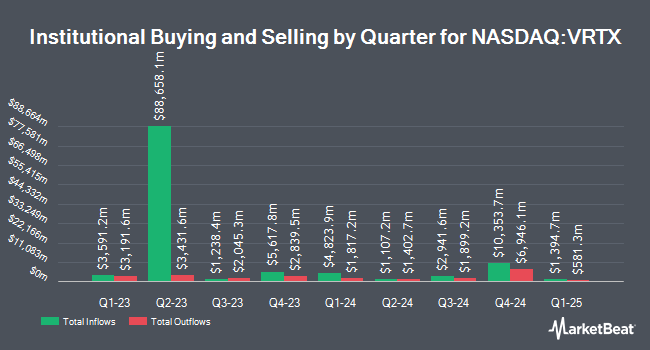

Other hedge funds also recently bought and sold shares of the company. Arkadios Wealth Advisors raised its stake in Vertex Pharmaceuticals by 61.1% during the 4th quarter. Arkadios Wealth Advisors now owns 1,081 shares of the pharmaceutical company's stock valued at $435,000 after buying an additional 410 shares during the last quarter. Koshinski Asset Management Inc. increased its position in Vertex Pharmaceuticals by 3.4% during the fourth quarter. Koshinski Asset Management Inc. now owns 1,357 shares of the pharmaceutical company's stock valued at $546,000 after acquiring an additional 45 shares during the last quarter. Crossmark Global Holdings Inc. lifted its holdings in Vertex Pharmaceuticals by 5.8% in the fourth quarter. Crossmark Global Holdings Inc. now owns 6,207 shares of the pharmaceutical company's stock valued at $2,499,000 after acquiring an additional 341 shares during the period. Atomi Financial Group Inc. boosted its position in Vertex Pharmaceuticals by 13.7% in the fourth quarter. Atomi Financial Group Inc. now owns 2,179 shares of the pharmaceutical company's stock worth $877,000 after purchasing an additional 262 shares during the last quarter. Finally, Simon Quick Advisors LLC grew its stake in shares of Vertex Pharmaceuticals by 1.1% during the 4th quarter. Simon Quick Advisors LLC now owns 2,236 shares of the pharmaceutical company's stock valued at $900,000 after purchasing an additional 24 shares during the period. Institutional investors own 90.96% of the company's stock.

Insiders Place Their Bets

In related news, EVP Ourania Tatsis sold 530 shares of the stock in a transaction that occurred on Thursday, February 27th. The shares were sold at an average price of $475.34, for a total transaction of $251,930.20. Following the completion of the transaction, the executive vice president now owns 58,539 shares of the company's stock, valued at approximately $27,825,928.26. This trade represents a 0.90% decrease in their position. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, EVP David Altshuler sold 3,231 shares of Vertex Pharmaceuticals stock in a transaction that occurred on Monday, March 10th. The shares were sold at an average price of $500.00, for a total transaction of $1,615,500.00. Following the completion of the sale, the executive vice president now owns 26,512 shares of the company's stock, valued at $13,256,000. This trade represents a 10.86% decrease in their position. The disclosure for this sale can be found here. Insiders have sold 3,813 shares of company stock valued at $1,889,514 in the last ninety days. 0.20% of the stock is currently owned by corporate insiders.

Wall Street Analysts Forecast Growth

Several equities analysts have recently weighed in on VRTX shares. Barclays increased their price objective on shares of Vertex Pharmaceuticals from $435.00 to $467.00 and gave the stock an "equal weight" rating in a research note on Tuesday, February 11th. Scotiabank decreased their target price on Vertex Pharmaceuticals from $450.00 to $442.00 and set a "sector perform" rating on the stock in a research report on Tuesday, May 6th. BMO Capital Markets set a $545.00 target price on Vertex Pharmaceuticals in a research report on Friday, January 31st. Cantor Fitzgerald reiterated an "overweight" rating and issued a $535.00 price target on shares of Vertex Pharmaceuticals in a report on Tuesday, May 6th. Finally, Canaccord Genuity Group upgraded shares of Vertex Pharmaceuticals from a "sell" rating to a "hold" rating and increased their price objective for the company from $408.00 to $424.00 in a research note on Tuesday, February 11th. Fourteen research analysts have rated the stock with a hold rating, sixteen have assigned a buy rating and one has issued a strong buy rating to the company. Based on data from MarketBeat.com, Vertex Pharmaceuticals currently has an average rating of "Moderate Buy" and an average target price of $515.04.

Get Our Latest Stock Report on VRTX

Vertex Pharmaceuticals Stock Performance

NASDAQ VRTX traded up $0.70 on Wednesday, reaching $446.70. 490,030 shares of the company's stock traded hands, compared to its average volume of 1,415,467. The stock has a 50 day moving average price of $473.44 and a 200-day moving average price of $461.96. The firm has a market cap of $114.71 billion, a price-to-earnings ratio of -202.87, a P/E/G ratio of 2.11 and a beta of 0.51. The company has a debt-to-equity ratio of 0.01, a quick ratio of 2.35 and a current ratio of 2.69. Vertex Pharmaceuticals Incorporated has a fifty-two week low of $377.85 and a fifty-two week high of $519.88.

Vertex Pharmaceuticals (NASDAQ:VRTX - Get Free Report) last announced its quarterly earnings results on Monday, May 5th. The pharmaceutical company reported $4.06 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $4.29 by ($0.23). Vertex Pharmaceuticals had a negative return on equity of 2.02% and a negative net margin of 4.86%. The firm had revenue of $2.77 billion for the quarter, compared to analysts' expectations of $2.85 billion. During the same period last year, the company posted $4.76 earnings per share. The business's quarterly revenue was up 2.6% on a year-over-year basis. Equities research analysts predict that Vertex Pharmaceuticals Incorporated will post 15.63 EPS for the current fiscal year.

About Vertex Pharmaceuticals

(

Free Report)

Vertex Pharmaceuticals Incorporated, a biotechnology company, engages in developing and commercializing therapies for treating cystic fibrosis (CF). It markets TRIKAFTA/KAFTRIO for people with CF with at least one F508del mutation for 2 years of age or older; SYMDEKO/SYMKEVI for people with CF for 6 years of age or older; ORKAMBI for CF patients 1 year or older; and KALYDECO for the treatment of patients with 1 year or older who have CF with ivacaftor.

Featured Articles

Before you consider Vertex Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vertex Pharmaceuticals wasn't on the list.

While Vertex Pharmaceuticals currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.