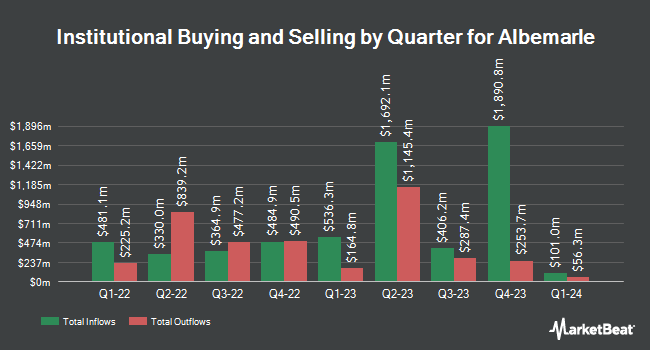

Bridge Creek Capital Management LLC boosted its stake in Albemarle Corporation (NYSE:ALB - Free Report) by 14.2% during the 2nd quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 25,624 shares of the specialty chemicals company's stock after acquiring an additional 3,195 shares during the period. Bridge Creek Capital Management LLC's holdings in Albemarle were worth $1,606,000 at the end of the most recent reporting period.

Several other large investors have also added to or reduced their stakes in the stock. Vanguard Group Inc. boosted its stake in Albemarle by 0.5% in the 1st quarter. Vanguard Group Inc. now owns 14,672,272 shares of the specialty chemicals company's stock worth $1,056,697,000 after purchasing an additional 77,773 shares in the last quarter. Dimensional Fund Advisors LP boosted its stake in Albemarle by 28.7% in the 1st quarter. Dimensional Fund Advisors LP now owns 1,538,706 shares of the specialty chemicals company's stock worth $110,814,000 after purchasing an additional 343,210 shares in the last quarter. Manning & Napier Advisors LLC boosted its stake in Albemarle by 17.4% in the 1st quarter. Manning & Napier Advisors LLC now owns 1,167,520 shares of the specialty chemicals company's stock worth $84,085,000 after purchasing an additional 173,441 shares in the last quarter. Charles Schwab Investment Management Inc. boosted its stake in Albemarle by 3.1% in the 1st quarter. Charles Schwab Investment Management Inc. now owns 1,072,921 shares of the specialty chemicals company's stock worth $77,272,000 after purchasing an additional 31,951 shares in the last quarter. Finally, Empower Advisory Group LLC boosted its stake in Albemarle by 4.9% in the 1st quarter. Empower Advisory Group LLC now owns 778,118 shares of the specialty chemicals company's stock worth $56,040,000 after purchasing an additional 36,634 shares in the last quarter. Institutional investors own 92.87% of the company's stock.

Albemarle Price Performance

ALB stock traded up $1.44 during midday trading on Tuesday, hitting $81.82. The company's stock had a trading volume of 863,280 shares, compared to its average volume of 3,571,514. The company has a quick ratio of 1.47, a current ratio of 2.31 and a debt-to-equity ratio of 0.38. The firm has a market capitalization of $9.63 billion, a price-to-earnings ratio of -8.78 and a beta of 1.64. Albemarle Corporation has a 12 month low of $49.43 and a 12 month high of $113.91. The company has a 50 day moving average of $77.95 and a two-hundred day moving average of $68.16.

Albemarle (NYSE:ALB - Get Free Report) last posted its earnings results on Wednesday, July 30th. The specialty chemicals company reported $0.11 EPS for the quarter, beating analysts' consensus estimates of ($0.83) by $0.94. The firm had revenue of $1.33 billion during the quarter, compared to the consensus estimate of $1.23 billion. Albemarle had a negative return on equity of 1.87% and a negative net margin of 18.61%.The company's quarterly revenue was down 7.0% compared to the same quarter last year. During the same period in the prior year, the company earned $0.04 EPS. Albemarle has set its FY 2025 guidance at EPS. On average, analysts expect that Albemarle Corporation will post -0.04 EPS for the current year.

Albemarle Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Wednesday, October 1st. Stockholders of record on Friday, September 12th will be given a dividend of $0.405 per share. This represents a $1.62 dividend on an annualized basis and a dividend yield of 2.0%. The ex-dividend date is Friday, September 12th. Albemarle's dividend payout ratio is currently -17.38%.

Analyst Upgrades and Downgrades

A number of equities analysts have weighed in on the company. Baird R W lowered Albemarle from a "hold" rating to a "strong sell" rating in a research report on Tuesday, July 29th. JPMorgan Chase & Co. boosted their target price on Albemarle from $60.00 to $80.00 and gave the stock a "neutral" rating in a research report on Monday, August 18th. Wells Fargo & Company decreased their target price on Albemarle from $75.00 to $70.00 and set an "equal weight" rating for the company in a research report on Friday, August 1st. Deutsche Bank Aktiengesellschaft set a $74.00 target price on Albemarle and gave the stock a "hold" rating in a research report on Monday, August 4th. Finally, Wall Street Zen raised Albemarle from a "sell" rating to a "hold" rating in a research report on Saturday, August 16th. Three analysts have rated the stock with a Buy rating, eleven have given a Hold rating and four have assigned a Sell rating to the company. According to data from MarketBeat.com, the company presently has an average rating of "Reduce" and an average price target of $85.83.

Get Our Latest Research Report on Albemarle

About Albemarle

(

Free Report)

Albemarle Corporation develops, manufactures, and markets engineered specialty chemicals worldwide. It operates through three segments: Energy Storage, Specialties and Ketjen. The Energy Storage segment offers lithium compounds, including lithium carbonate, lithium hydroxide, and lithium chloride; technical services for the handling and use of reactive lithium products; and lithium-containing by-products recycling services.

See Also

Before you consider Albemarle, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Albemarle wasn't on the list.

While Albemarle currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.