Brooklyn FI LLC purchased a new position in shares of Caterpillar Inc. (NYSE:CAT - Free Report) during the 4th quarter, according to its most recent 13F filing with the SEC. The firm purchased 1,944 shares of the industrial products company's stock, valued at approximately $755,000.

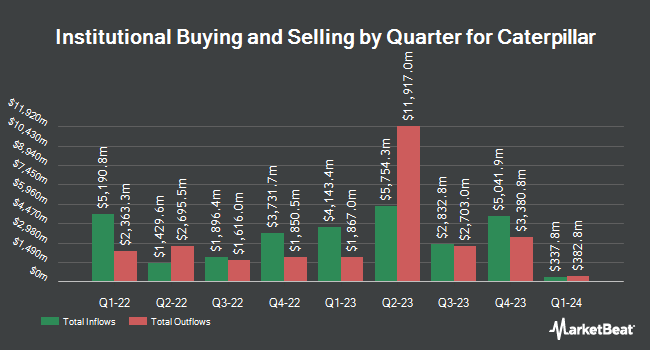

A number of other large investors have also bought and sold shares of CAT. Flagship Wealth Advisors LLC bought a new stake in shares of Caterpillar in the fourth quarter worth about $26,000. Halbert Hargrove Global Advisors LLC purchased a new stake in Caterpillar in the 4th quarter worth approximately $27,000. Cyrus J. Lawrence LLC bought a new stake in shares of Caterpillar in the 4th quarter worth approximately $27,000. Noble Wealth Management PBC purchased a new position in shares of Caterpillar during the fourth quarter valued at approximately $31,000. Finally, Investment Management Corp VA ADV purchased a new position in shares of Caterpillar during the fourth quarter valued at approximately $33,000. 70.98% of the stock is owned by hedge funds and other institutional investors.

Caterpillar Stock Down 1.3%

Shares of CAT traded down $4.69 during mid-day trading on Friday, reaching $347.10. The company had a trading volume of 4,866,359 shares, compared to its average volume of 2,641,053. The company has a debt-to-equity ratio of 1.40, a quick ratio of 0.89 and a current ratio of 1.42. The company has a market capitalization of $163.50 billion, a price-to-earnings ratio of 15.73, a price-to-earnings-growth ratio of 1.87 and a beta of 1.35. The firm has a 50-day moving average price of $319.13 and a 200 day moving average price of $351.46. Caterpillar Inc. has a 52 week low of $267.30 and a 52 week high of $418.50.

Caterpillar (NYSE:CAT - Get Free Report) last released its earnings results on Wednesday, April 30th. The industrial products company reported $4.25 EPS for the quarter, missing the consensus estimate of $4.35 by ($0.10). Caterpillar had a return on equity of 58.18% and a net margin of 16.65%. The company had revenue of $14.25 billion during the quarter, compared to the consensus estimate of $14.64 billion. During the same period last year, the firm posted $5.60 earnings per share. The company's revenue was down 9.8% compared to the same quarter last year. On average, sell-side analysts forecast that Caterpillar Inc. will post 19.86 EPS for the current year.

Caterpillar Dividend Announcement

The company also recently announced a quarterly dividend, which was paid on Tuesday, May 20th. Shareholders of record on Monday, April 21st were issued a $1.41 dividend. The ex-dividend date was Monday, April 21st. This represents a $5.64 annualized dividend and a yield of 1.62%. Caterpillar's dividend payout ratio (DPR) is presently 27.49%.

Insider Transactions at Caterpillar

In other news, Director David Maclennan purchased 375 shares of Caterpillar stock in a transaction that occurred on Wednesday, May 7th. The stock was bought at an average price of $320.70 per share, with a total value of $120,262.50. Following the completion of the transaction, the director now directly owns 6,653 shares of the company's stock, valued at approximately $2,133,617.10. The trade was a 5.97% increase in their ownership of the stock. The acquisition was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Insiders own 0.33% of the company's stock.

Analysts Set New Price Targets

Several analysts recently weighed in on CAT shares. Wall Street Zen cut shares of Caterpillar from a "buy" rating to a "hold" rating in a report on Tuesday, February 25th. Evercore ISI cut their target price on shares of Caterpillar from $375.00 to $373.00 and set an "in-line" rating on the stock in a research note on Monday, May 19th. Morgan Stanley upgraded shares of Caterpillar from an "underweight" rating to an "equal weight" rating and reduced their price target for the company from $300.00 to $283.00 in a research report on Wednesday, April 16th. Citigroup raised their price objective on shares of Caterpillar from $320.00 to $370.00 and gave the stock a "buy" rating in a report on Monday, May 5th. Finally, JPMorgan Chase & Co. cut their price objective on Caterpillar from $490.00 to $380.00 and set an "overweight" rating on the stock in a research report on Monday, April 14th. Six investment analysts have rated the stock with a hold rating, nine have assigned a buy rating and one has given a strong buy rating to the company. According to MarketBeat, the company presently has a consensus rating of "Moderate Buy" and an average target price of $372.92.

Read Our Latest Stock Analysis on CAT

About Caterpillar

(

Free Report)

Caterpillar Inc manufactures and sells construction and mining equipment, off-highway diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives in worldwide. Its Construction Industries segment offers asphalt pavers, compactors, road reclaimers, forestry machines, cold planers, material handlers, track-type tractors, excavators, telehandlers, motor graders, and pipelayers; compact track, wheel, track-type, backhoe, and skid steer loaders; and related parts and tools.

Featured Articles

Before you consider Caterpillar, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Caterpillar wasn't on the list.

While Caterpillar currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.