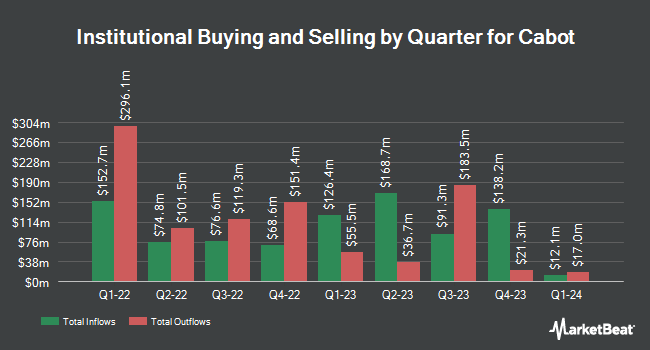

Millennium Management LLC trimmed its holdings in Cabot Corporation (NYSE:CBT - Free Report) by 27.7% in the first quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 252,479 shares of the specialty chemicals company's stock after selling 96,890 shares during the quarter. Millennium Management LLC owned about 0.47% of Cabot worth $20,991,000 as of its most recent SEC filing.

A number of other institutional investors and hedge funds have also recently added to or reduced their stakes in CBT. Ameriprise Financial Inc. boosted its holdings in Cabot by 1.5% in the fourth quarter. Ameriprise Financial Inc. now owns 214,135 shares of the specialty chemicals company's stock valued at $19,553,000 after purchasing an additional 3,240 shares in the last quarter. Captrust Financial Advisors lifted its stake in Cabot by 4.4% in the fourth quarter. Captrust Financial Advisors now owns 9,489 shares of the specialty chemicals company's stock valued at $866,000 after buying an additional 399 shares during the last quarter. Cetera Investment Advisers lifted its stake in Cabot by 60.3% in the fourth quarter. Cetera Investment Advisers now owns 19,241 shares of the specialty chemicals company's stock valued at $1,757,000 after buying an additional 7,235 shares during the last quarter. D. E. Shaw & Co. Inc. lifted its stake in Cabot by 221.1% in the fourth quarter. D. E. Shaw & Co. Inc. now owns 18,346 shares of the specialty chemicals company's stock valued at $1,675,000 after buying an additional 12,633 shares during the last quarter. Finally, Gotham Asset Management LLC lifted its stake in Cabot by 22.3% in the fourth quarter. Gotham Asset Management LLC now owns 26,278 shares of the specialty chemicals company's stock valued at $2,399,000 after buying an additional 4,795 shares during the last quarter. 93.18% of the stock is owned by institutional investors and hedge funds.

Insiders Place Their Bets

In related news, CEO Sean D. Keohane sold 114,436 shares of the company's stock in a transaction on Thursday, August 14th. The stock was sold at an average price of $79.28, for a total transaction of $9,072,486.08. Following the transaction, the chief executive officer owned 361,518 shares of the company's stock, valued at $28,661,147.04. This represents a 24.04% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available at this link. 3.03% of the stock is owned by corporate insiders.

Analyst Ratings Changes

Separately, UBS Group set a $82.00 price objective on Cabot and gave the company a "neutral" rating in a research note on Tuesday, August 5th. One analyst has rated the stock with a Buy rating, one has issued a Hold rating and one has issued a Sell rating to the stock. Based on data from MarketBeat.com, Cabot presently has a consensus rating of "Hold" and a consensus price target of $92.33.

Get Our Latest Report on Cabot

Cabot Price Performance

CBT stock traded up $1.17 on Thursday, reaching $78.14. 234,984 shares of the company's stock were exchanged, compared to its average volume of 286,392. The stock has a fifty day moving average of $78.30 and a 200-day moving average of $78.17. Cabot Corporation has a twelve month low of $70.40 and a twelve month high of $117.46. The firm has a market cap of $4.16 billion, a PE ratio of 10.21 and a beta of 0.90. The company has a quick ratio of 1.41, a current ratio of 2.13 and a debt-to-equity ratio of 0.66.

Cabot (NYSE:CBT - Get Free Report) last announced its quarterly earnings data on Monday, August 4th. The specialty chemicals company reported $1.90 earnings per share for the quarter, topping analysts' consensus estimates of $1.80 by $0.10. Cabot had a return on equity of 25.68% and a net margin of 11.14%.The firm had revenue of $923.00 million for the quarter, compared to analyst estimates of $957.29 million. Cabot has set its FY 2025 guidance at 7.150-7.500 EPS. As a group, equities analysts predict that Cabot Corporation will post 7.57 EPS for the current fiscal year.

Cabot Announces Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Thursday, September 11th. Investors of record on Friday, August 29th were issued a dividend of $0.45 per share. This represents a $1.80 dividend on an annualized basis and a yield of 2.3%. The ex-dividend date of this dividend was Friday, August 29th. Cabot's dividend payout ratio is currently 23.53%.

About Cabot

(

Free Report)

Cabot Corporation operates as a specialty chemicals and performance materials company. The company operates through two segments, Reinforcement Materials and Performance Chemicals. It offers reinforcing carbons that are used in tires as a rubber reinforcing agent and performance additive, as well as in industrial products, such as hoses, belts, extruded profiles, and molded goods; and engineered elastomer composites solutions.

Read More

Before you consider Cabot, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cabot wasn't on the list.

While Cabot currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.