John G Ullman & Associates Inc. increased its position in shares of CACI International, Inc. (NYSE:CACI - Free Report) by 40.6% during the 1st quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 20,315 shares of the information technology services provider's stock after purchasing an additional 5,866 shares during the period. CACI International accounts for about 1.1% of John G Ullman & Associates Inc.'s investment portfolio, making the stock its 21st largest holding. John G Ullman & Associates Inc. owned 0.09% of CACI International worth $7,454,000 at the end of the most recent reporting period.

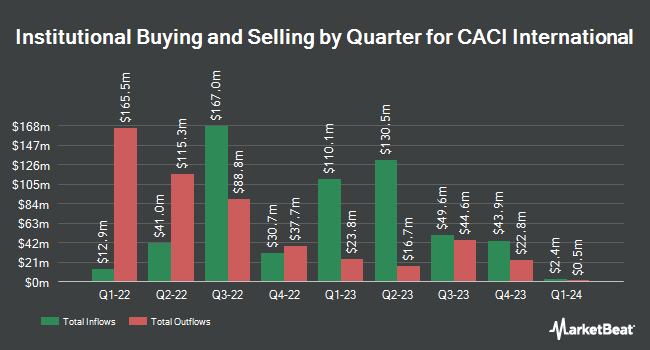

Other hedge funds and other institutional investors have also recently added to or reduced their stakes in the company. Wayfinding Financial LLC purchased a new position in shares of CACI International during the 1st quarter valued at $27,000. GAMMA Investing LLC grew its holdings in shares of CACI International by 150.8% during the 1st quarter. GAMMA Investing LLC now owns 306 shares of the information technology services provider's stock valued at $112,000 after acquiring an additional 184 shares in the last quarter. TD Private Client Wealth LLC grew its holdings in shares of CACI International by 21.0% during the 1st quarter. TD Private Client Wealth LLC now owns 305 shares of the information technology services provider's stock valued at $112,000 after acquiring an additional 53 shares in the last quarter. Applied Finance Capital Management LLC purchased a new position in shares of CACI International during the 4th quarter valued at $219,000. Finally, Cary Street Partners Financial LLC acquired a new stake in shares of CACI International in the 4th quarter valued at $287,000. Institutional investors own 86.43% of the company's stock.

Analysts Set New Price Targets

CACI has been the subject of a number of research analyst reports. Cowen reissued a "buy" rating on shares of CACI International in a research report on Monday, April 28th. William Blair raised shares of CACI International from a "market perform" rating to an "outperform" rating in a research report on Monday, July 7th. Raymond James Financial reiterated a "market perform" rating on shares of CACI International in a research note on Tuesday, July 8th. Barclays lifted their target price on CACI International from $450.00 to $510.00 and gave the stock an "overweight" rating in a research report on Tuesday, April 29th. Finally, Truist Financial lifted their target price on CACI International from $525.00 to $550.00 and gave the stock a "buy" rating in a research report on Thursday. One research analyst has rated the stock with a sell rating, two have assigned a hold rating, twelve have given a buy rating and one has given a strong buy rating to the stock. Based on data from MarketBeat.com, CACI International presently has an average rating of "Moderate Buy" and an average target price of $522.23.

Get Our Latest Report on CACI

CACI International Price Performance

Shares of CACI traded down $17.87 on Monday, hitting $461.98. The company's stock had a trading volume of 141,237 shares, compared to its average volume of 428,621. The company has a market capitalization of $10.16 billion, a PE ratio of 21.61, a PEG ratio of 1.26 and a beta of 0.66. CACI International, Inc. has a fifty-two week low of $318.60 and a fifty-two week high of $588.26. The company has a 50 day moving average price of $463.86 and a 200 day moving average price of $422.86. The company has a debt-to-equity ratio of 0.82, a current ratio of 1.58 and a quick ratio of 1.58.

CACI International Profile

(

Free Report)

CACI International Inc, through its subsidiaries, engages in the provision of expertise and technology to enterprise and mission customers in support of national security in the intelligence, defense, and federal civilian sectors. The company operates through two segments, Domestic Operations and International Operations.

See Also

Before you consider CACI International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CACI International wasn't on the list.

While CACI International currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.