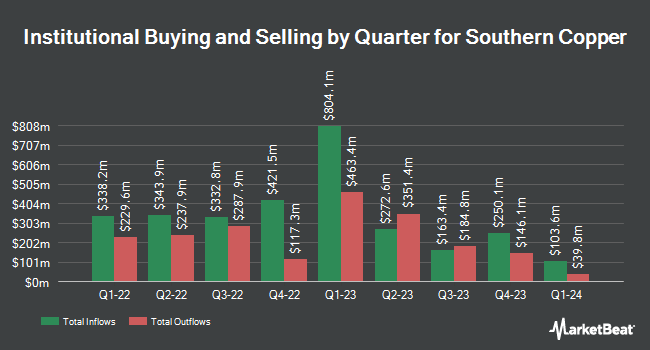

Caisse DE Depot ET Placement DU Quebec raised its stake in Southern Copper Corporation (NYSE:SCCO - Free Report) by 57.7% during the first quarter, according to the company in its most recent Form 13F filing with the SEC. The institutional investor owned 72,185 shares of the basic materials company's stock after buying an additional 26,413 shares during the quarter. Caisse DE Depot ET Placement DU Quebec's holdings in Southern Copper were worth $6,746,000 at the end of the most recent reporting period.

A number of other institutional investors have also recently bought and sold shares of the stock. JPMorgan Chase & Co. lifted its stake in Southern Copper by 26.3% in the first quarter. JPMorgan Chase & Co. now owns 1,551,878 shares of the basic materials company's stock valued at $145,039,000 after buying an additional 322,935 shares in the last quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. lifted its stake in Southern Copper by 10.7% in the fourth quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 1,354,637 shares of the basic materials company's stock valued at $123,448,000 after buying an additional 130,710 shares in the last quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC lifted its stake in Southern Copper by 6.6% in the fourth quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 1,280,286 shares of the basic materials company's stock valued at $116,672,000 after buying an additional 78,769 shares in the last quarter. Northern Trust Corp lifted its stake in Southern Copper by 44.9% in the fourth quarter. Northern Trust Corp now owns 1,146,537 shares of the basic materials company's stock valued at $104,484,000 after buying an additional 355,013 shares in the last quarter. Finally, Driehaus Capital Management LLC lifted its stake in Southern Copper by 26.8% in the fourth quarter. Driehaus Capital Management LLC now owns 1,028,848 shares of the basic materials company's stock valued at $93,759,000 after buying an additional 217,546 shares in the last quarter. Institutional investors own 7.94% of the company's stock.

Analysts Set New Price Targets

A number of research analysts have weighed in on SCCO shares. Wall Street Zen lowered shares of Southern Copper from a "buy" rating to a "hold" rating in a research note on Tuesday, May 20th. Itau BBA Securities upgraded shares of Southern Copper from an "underperform" rating to a "market perform" rating in a report on Wednesday, June 11th. JPMorgan Chase & Co. lowered their price objective on shares of Southern Copper from $83.50 to $79.00 and set a "neutral" rating on the stock in a report on Thursday, July 3rd. UBS Group downgraded shares of Southern Copper from a "buy" rating to a "neutral" rating and set a $105.00 price objective on the stock. in a report on Tuesday, July 1st. Finally, Morgan Stanley reiterated an "underweight" rating and issued a $99.00 price objective (up from $86.00) on shares of Southern Copper in a report on Tuesday, July 15th. Four research analysts have rated the stock with a Hold rating and three have given a Sell rating to the company. According to data from MarketBeat, the stock has an average rating of "Reduce" and a consensus target price of $91.00.

Check Out Our Latest Stock Report on Southern Copper

Insiders Place Their Bets

In related news, Director Bonilla Luis Miguel Palomino sold 414 shares of the business's stock in a transaction on Friday, August 8th. The shares were sold at an average price of $100.00, for a total transaction of $41,400.00. Following the transaction, the director directly owned 2,327 shares in the company, valued at approximately $232,700. The trade was a 15.10% decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Insiders own 0.07% of the company's stock.

Southern Copper Stock Up 0.8%

SCCO traded up $0.81 during trading on Tuesday, reaching $96.90. 433,386 shares of the stock were exchanged, compared to its average volume of 1,404,026. The stock has a market cap of $77.91 billion, a P/E ratio of 21.18, a price-to-earnings-growth ratio of 1.41 and a beta of 0.99. Southern Copper Corporation has a twelve month low of $74.84 and a twelve month high of $121.44. The stock's 50 day moving average price is $98.18 and its two-hundred day moving average price is $94.00. The company has a debt-to-equity ratio of 0.67, a quick ratio of 4.51 and a current ratio of 5.27.

Southern Copper Increases Dividend

The company also recently announced a quarterly dividend, which will be paid on Thursday, September 4th. Investors of record on Friday, August 15th will be issued a dividend of $1.01 per share. The ex-dividend date is Friday, August 15th. This is a positive change from Southern Copper's previous quarterly dividend of $0.62. This represents a $4.04 dividend on an annualized basis and a yield of 4.2%. Southern Copper's dividend payout ratio is presently 70.02%.

About Southern Copper

(

Free Report)

Southern Copper Corporation engages in mining, exploring, smelting, and refining copper and other minerals in Peru, Mexico, Argentina, Ecuador, and Chile. The company is involved in the mining, milling, and flotation of copper ore to produce copper and molybdenum concentrates; smelting of copper concentrates to produce blister and anode copper; refining of anode copper to produce copper cathodes; production of molybdenum concentrate and sulfuric acid; production of refined silver, gold, and other materials; and mining and processing of zinc, copper, molybdenum, silver, gold, and lead.

See Also

Before you consider Southern Copper, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Southern Copper wasn't on the list.

While Southern Copper currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.