AQR Capital Management LLC cut its stake in shares of Cal-Maine Foods, Inc. (NASDAQ:CALM - Free Report) by 18.6% in the first quarter, according to its most recent disclosure with the SEC. The firm owned 59,288 shares of the basic materials company's stock after selling 13,525 shares during the period. AQR Capital Management LLC owned about 0.12% of Cal-Maine Foods worth $5,389,000 at the end of the most recent quarter.

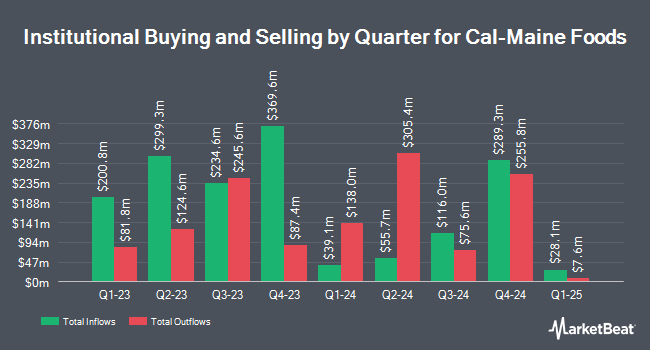

A number of other hedge funds have also modified their holdings of the business. Vanguard Group Inc. raised its position in shares of Cal-Maine Foods by 0.8% in the first quarter. Vanguard Group Inc. now owns 4,945,681 shares of the basic materials company's stock valued at $449,562,000 after buying an additional 40,075 shares during the last quarter. American Century Companies Inc. raised its position in shares of Cal-Maine Foods by 13.4% in the first quarter. American Century Companies Inc. now owns 1,436,943 shares of the basic materials company's stock valued at $130,618,000 after buying an additional 170,322 shares during the last quarter. Northern Trust Corp raised its position in shares of Cal-Maine Foods by 23.5% in the first quarter. Northern Trust Corp now owns 833,054 shares of the basic materials company's stock valued at $75,725,000 after buying an additional 158,719 shares during the last quarter. Charles Schwab Investment Management Inc. raised its position in shares of Cal-Maine Foods by 3.1% in the first quarter. Charles Schwab Investment Management Inc. now owns 664,304 shares of the basic materials company's stock valued at $60,385,000 after buying an additional 20,174 shares during the last quarter. Finally, Bank of New York Mellon Corp raised its position in shares of Cal-Maine Foods by 8.7% in the first quarter. Bank of New York Mellon Corp now owns 562,810 shares of the basic materials company's stock valued at $51,159,000 after buying an additional 45,201 shares during the last quarter. 84.67% of the stock is currently owned by institutional investors and hedge funds.

Cal-Maine Foods Price Performance

Shares of CALM stock opened at $110.64 on Friday. The firm has a market cap of $5.43 billion, a PE ratio of 4.43 and a beta of 0.27. The company has a 50-day moving average of $108.87 and a two-hundred day moving average of $99.15. Cal-Maine Foods, Inc. has a 1-year low of $68.81 and a 1-year high of $126.40.

Cal-Maine Foods (NASDAQ:CALM - Get Free Report) last announced its earnings results on Tuesday, July 22nd. The basic materials company reported $7.04 earnings per share for the quarter, topping the consensus estimate of $5.29 by $1.75. The company had revenue of $1.10 billion during the quarter, compared to analyst estimates of $877.03 million. Cal-Maine Foods had a net margin of 28.63% and a return on equity of 54.81%. Cal-Maine Foods's revenue was up 72.1% compared to the same quarter last year. During the same quarter last year, the firm posted $2.32 earnings per share. Sell-side analysts anticipate that Cal-Maine Foods, Inc. will post 15.59 EPS for the current fiscal year.

Cal-Maine Foods Increases Dividend

The business also recently announced a quarterly dividend, which was paid on Tuesday, August 19th. Shareholders of record on Monday, August 4th were paid a dividend of $3.46 per share. This represents a $13.84 annualized dividend and a yield of 12.5%. This is a boost from Cal-Maine Foods's previous quarterly dividend of $1.49. The ex-dividend date of this dividend was Monday, August 4th. Cal-Maine Foods's payout ratio is 37.76%.

Wall Street Analysts Forecast Growth

A number of brokerages have recently commented on CALM. Wall Street Zen cut shares of Cal-Maine Foods from a "buy" rating to a "hold" rating in a research report on Saturday, August 23rd. BMO Capital Markets increased their target price on shares of Cal-Maine Foods from $100.00 to $105.00 and gave the company a "market perform" rating in a research report on Thursday, July 24th. The Goldman Sachs Group began coverage on shares of Cal-Maine Foods in a research report on Thursday, August 14th. They issued a "neutral" rating and a $110.00 target price for the company. Finally, Stephens increased their target price on shares of Cal-Maine Foods from $108.00 to $115.00 and gave the company an "equal weight" rating in a research report on Thursday, July 24th. Three equities research analysts have rated the stock with a Hold rating, Based on data from MarketBeat.com, the company currently has an average rating of "Hold" and a consensus target price of $110.00.

Get Our Latest Stock Analysis on Cal-Maine Foods

Cal-Maine Foods Company Profile

(

Free Report)

Cal-Maine Foods, Inc, together with its subsidiaries, produces, grades, packages, markets, and distributes shell eggs. The company offers specialty shell eggs, such as nutritionally enhanced, cage free, organic, free-range, pasture-raised, and brown eggs under the Egg-Land's Best, Land O' Lakes, Farmhouse Eggs, Sunups, Sunny Meadow, and 4Grain brand names.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Cal-Maine Foods, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cal-Maine Foods wasn't on the list.

While Cal-Maine Foods currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.