Caliber Wealth Management LLC KS purchased a new stake in shares of The Charles Schwab Corporation (NYSE:SCHW - Free Report) in the first quarter, according to its most recent filing with the Securities & Exchange Commission. The firm purchased 2,846 shares of the financial services provider's stock, valued at approximately $223,000.

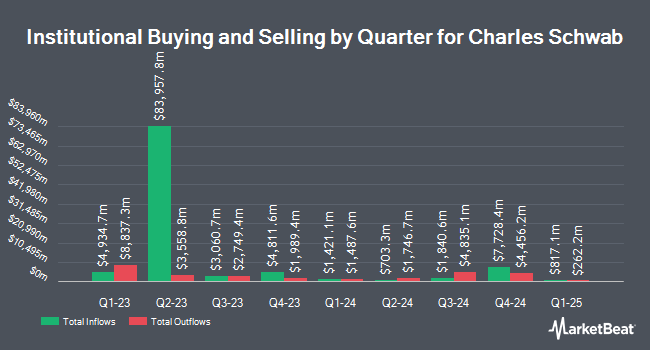

A number of other institutional investors have also made changes to their positions in the stock. HM Payson & Co. increased its position in shares of Charles Schwab by 0.7% during the first quarter. HM Payson & Co. now owns 19,271 shares of the financial services provider's stock valued at $1,509,000 after acquiring an additional 130 shares during the last quarter. Cornerstone Wealth Management LLC increased its position in shares of Charles Schwab by 2.1% during the first quarter. Cornerstone Wealth Management LLC now owns 6,551 shares of the financial services provider's stock valued at $513,000 after acquiring an additional 132 shares during the last quarter. Journey Strategic Wealth LLC increased its position in shares of Charles Schwab by 3.1% during the first quarter. Journey Strategic Wealth LLC now owns 4,486 shares of the financial services provider's stock valued at $351,000 after acquiring an additional 135 shares during the last quarter. Premier Path Wealth Partners LLC increased its position in shares of Charles Schwab by 1.8% during the first quarter. Premier Path Wealth Partners LLC now owns 7,817 shares of the financial services provider's stock valued at $612,000 after acquiring an additional 140 shares during the last quarter. Finally, Sutton Place Investors LLC increased its position in shares of Charles Schwab by 1.6% during the first quarter. Sutton Place Investors LLC now owns 8,677 shares of the financial services provider's stock valued at $679,000 after acquiring an additional 140 shares during the last quarter. 84.38% of the stock is currently owned by institutional investors and hedge funds.

Insider Transactions at Charles Schwab

In related news, Director Paula A. Sneed sold 8,647 shares of the company's stock in a transaction on Tuesday, May 27th. The shares were sold at an average price of $88.06, for a total value of $761,454.82. Following the completion of the sale, the director owned 105,654 shares in the company, valued at $9,303,891.24. This represents a 7.57% decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Also, insider Jonathan S. Beatty sold 2,850 shares of the company's stock in a transaction on Friday, May 30th. The shares were sold at an average price of $87.57, for a total transaction of $249,574.50. Following the completion of the sale, the insider owned 15,219 shares of the company's stock, valued at approximately $1,332,727.83. This trade represents a 15.77% decrease in their position. The disclosure for this sale can be found here. Insiders have sold 116,313 shares of company stock worth $10,264,091 over the last 90 days. Company insiders own 6.30% of the company's stock.

Wall Street Analysts Forecast Growth

SCHW has been the subject of a number of recent analyst reports. Cowen reiterated a "buy" rating on shares of Charles Schwab in a research report on Tuesday, May 20th. Truist Financial lifted their price objective on shares of Charles Schwab from $100.00 to $107.00 and gave the company a "buy" rating in a report on Monday, July 21st. Barclays lifted their price objective on shares of Charles Schwab from $106.00 to $113.00 and gave the company an "overweight" rating in a report on Friday, July 18th. JMP Securities lifted their price objective on shares of Charles Schwab from $106.00 to $110.00 and gave the company a "market outperform" rating in a report on Monday, July 21st. Finally, Morgan Stanley restated an "overweight" rating and issued a $117.00 price objective (up previously from $83.00) on shares of Charles Schwab in a report on Tuesday, July 15th. Two research analysts have rated the stock with a sell rating, four have issued a hold rating and sixteen have given a buy rating to the company. According to MarketBeat.com, the company presently has an average rating of "Moderate Buy" and an average target price of $98.65.

Get Our Latest Analysis on SCHW

Charles Schwab Trading Up 0.6%

Shares of Charles Schwab stock opened at $97.05 on Friday. The company has a fifty day simple moving average of $90.34 and a 200-day simple moving average of $82.81. The Charles Schwab Corporation has a 12-month low of $61.15 and a 12-month high of $98.28. The company has a current ratio of 0.53, a quick ratio of 0.53 and a debt-to-equity ratio of 0.53. The stock has a market cap of $176.33 billion, a price-to-earnings ratio of 26.09, a PEG ratio of 0.93 and a beta of 0.93.

Charles Schwab (NYSE:SCHW - Get Free Report) last issued its earnings results on Friday, July 18th. The financial services provider reported $1.14 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.10 by $0.04. Charles Schwab had a net margin of 33.68% and a return on equity of 19.73%. The business had revenue of $5.85 billion during the quarter, compared to analysts' expectations of $5.64 billion. During the same quarter in the prior year, the business posted $0.73 EPS. The company's revenue for the quarter was up 24.8% on a year-over-year basis. On average, equities analysts forecast that The Charles Schwab Corporation will post 4.22 EPS for the current fiscal year.

Charles Schwab announced that its board has approved a stock repurchase plan on Thursday, July 24th that allows the company to repurchase $20.00 billion in shares. This repurchase authorization allows the financial services provider to reacquire up to 11.6% of its stock through open market purchases. Stock repurchase plans are generally an indication that the company's board of directors believes its shares are undervalued.

Charles Schwab Announces Dividend

The firm also recently declared a quarterly dividend, which will be paid on Friday, August 22nd. Investors of record on Friday, August 8th will be given a $0.27 dividend. The ex-dividend date of this dividend is Friday, August 8th. This represents a $1.08 annualized dividend and a yield of 1.11%. Charles Schwab's dividend payout ratio (DPR) is 29.03%.

Charles Schwab Company Profile

(

Free Report)

The Charles Schwab Corporation, together with its subsidiaries, operates as a savings and loan holding company that provides wealth management, securities brokerage, banking, asset management, custody, and financial advisory services in the United States and internationally. The company operates in two segments, Investor Services and Advisor Services.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Charles Schwab, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Charles Schwab wasn't on the list.

While Charles Schwab currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report