Callan Family Office LLC lifted its stake in shares of Targa Resources, Inc. (NYSE:TRGP - Free Report) by 146.7% in the second quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 5,519 shares of the pipeline company's stock after purchasing an additional 3,282 shares during the period. Callan Family Office LLC's holdings in Targa Resources were worth $961,000 as of its most recent filing with the Securities & Exchange Commission.

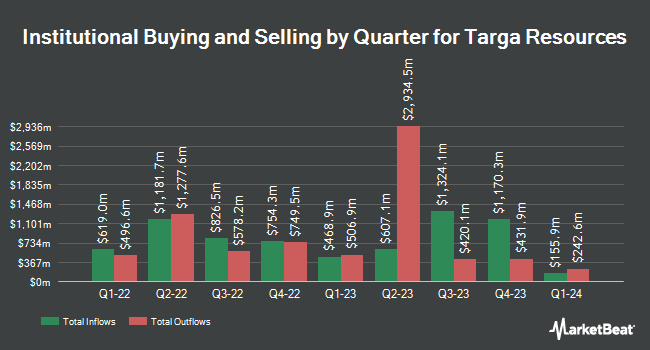

A number of other institutional investors and hedge funds have also modified their holdings of the stock. Vanguard Group Inc. increased its stake in shares of Targa Resources by 1.6% during the first quarter. Vanguard Group Inc. now owns 27,584,275 shares of the pipeline company's stock worth $5,529,820,000 after purchasing an additional 423,667 shares in the last quarter. Wellington Management Group LLP boosted its position in Targa Resources by 7.5% during the first quarter. Wellington Management Group LLP now owns 13,790,955 shares of the pipeline company's stock worth $2,764,673,000 after acquiring an additional 962,631 shares during the last quarter. Invesco Ltd. boosted its position in Targa Resources by 3.2% during the first quarter. Invesco Ltd. now owns 4,565,960 shares of the pipeline company's stock worth $915,338,000 after acquiring an additional 139,780 shares during the last quarter. GQG Partners LLC boosted its position in Targa Resources by 64.0% during the first quarter. GQG Partners LLC now owns 3,614,307 shares of the pipeline company's stock worth $724,560,000 after acquiring an additional 1,410,747 shares during the last quarter. Finally, Price T Rowe Associates Inc. MD boosted its position in Targa Resources by 2.8% during the first quarter. Price T Rowe Associates Inc. MD now owns 2,834,418 shares of the pipeline company's stock worth $568,217,000 after acquiring an additional 77,999 shares during the last quarter. Hedge funds and other institutional investors own 92.13% of the company's stock.

Targa Resources Stock Performance

NYSE:TRGP opened at $152.43 on Monday. The company has a debt-to-equity ratio of 5.93, a current ratio of 0.69 and a quick ratio of 0.56. The firm has a market capitalization of $32.80 billion, a price-to-earnings ratio of 21.56, a PEG ratio of 0.91 and a beta of 1.12. The company's 50-day moving average is $165.04 and its two-hundred day moving average is $167.53. Targa Resources, Inc. has a 1-year low of $150.00 and a 1-year high of $218.51.

Targa Resources (NYSE:TRGP - Get Free Report) last posted its earnings results on Thursday, August 7th. The pipeline company reported $2.87 earnings per share for the quarter, beating the consensus estimate of $1.95 by $0.92. The company had revenue of $4.26 billion for the quarter, compared to analyst estimates of $4.82 billion. Targa Resources had a net margin of 8.99% and a return on equity of 43.35%. Analysts forecast that Targa Resources, Inc. will post 8.15 EPS for the current year.

Analyst Ratings Changes

A number of equities analysts recently weighed in on TRGP shares. Wall Street Zen upgraded shares of Targa Resources from a "hold" rating to a "buy" rating in a research report on Sunday, September 21st. Mizuho lowered their price target on shares of Targa Resources from $212.00 to $207.00 and set an "outperform" rating on the stock in a research report on Friday, August 29th. TD Securities started coverage on shares of Targa Resources in a research report on Monday, July 7th. They set a "hold" rating on the stock. Barclays boosted their price target on shares of Targa Resources from $178.00 to $195.00 and gave the stock an "overweight" rating in a research report on Thursday, July 10th. Finally, BMO Capital Markets started coverage on shares of Targa Resources in a research report on Friday, September 19th. They set an "outperform" rating and a $185.00 price target on the stock. One equities research analyst has rated the stock with a Strong Buy rating, fifteen have issued a Buy rating and three have given a Hold rating to the stock. Based on data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and an average price target of $207.67.

Check Out Our Latest Report on Targa Resources

Targa Resources Company Profile

(

Free Report)

Targa Resources Corp., together with its subsidiary, Targa Resources Partners LP, owns, operates, acquires, and develops a portfolio of complementary domestic midstream infrastructure assets in North America. It operates in two segments, Gathering and Processing, and Logistics and Transportation. The company is involved in gathering, compressing, treating, processing, transporting, and selling natural gas; storing, fractionating, treating, transporting, and selling natural gas liquids (NGL) and NGL products, including services to liquefied petroleum gas exporters; and gathering, storing, terminaling, purchasing, and selling crude oil.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Targa Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Targa Resources wasn't on the list.

While Targa Resources currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.