Callan Family Office LLC trimmed its holdings in Gilead Sciences, Inc. (NASDAQ:GILD - Free Report) by 13.6% in the 1st quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 26,438 shares of the biopharmaceutical company's stock after selling 4,149 shares during the quarter. Callan Family Office LLC's holdings in Gilead Sciences were worth $2,962,000 as of its most recent SEC filing.

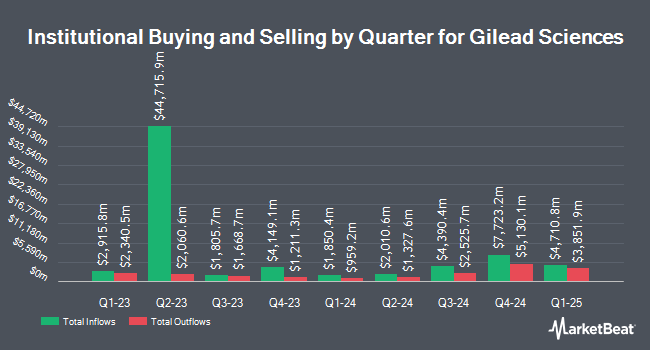

Other hedge funds and other institutional investors have also added to or reduced their stakes in the company. Bridgewater Associates LP boosted its stake in Gilead Sciences by 122.7% in the 4th quarter. Bridgewater Associates LP now owns 460,936 shares of the biopharmaceutical company's stock worth $42,577,000 after purchasing an additional 253,994 shares during the period. Nissay Asset Management Corp Japan ADV boosted its stake in Gilead Sciences by 5.2% in the 4th quarter. Nissay Asset Management Corp Japan ADV now owns 284,243 shares of the biopharmaceutical company's stock worth $26,750,000 after purchasing an additional 14,009 shares during the period. Golden State Wealth Management LLC boosted its stake in Gilead Sciences by 14.5% in the 1st quarter. Golden State Wealth Management LLC now owns 863 shares of the biopharmaceutical company's stock worth $97,000 after purchasing an additional 109 shares during the period. Ontario Teachers Pension Plan Board boosted its stake in Gilead Sciences by 54.6% in the 4th quarter. Ontario Teachers Pension Plan Board now owns 37,051 shares of the biopharmaceutical company's stock worth $3,422,000 after purchasing an additional 13,086 shares during the period. Finally, Mufg Securities Americas Inc. bought a new position in Gilead Sciences in the 4th quarter worth approximately $1,699,000. 83.67% of the stock is currently owned by institutional investors.

Gilead Sciences Trading Down 0.9%

GILD traded down $1.12 during trading on Thursday, reaching $119.02. The company had a trading volume of 5,461,007 shares, compared to its average volume of 8,364,447. The stock has a market cap of $147.68 billion, a P/E ratio of 23.71, a PEG ratio of 0.75 and a beta of 0.33. The business has a 50 day simple moving average of $111.59 and a 200-day simple moving average of $108.00. Gilead Sciences, Inc. has a 52 week low of $72.89 and a 52 week high of $121.83. The company has a quick ratio of 1.15, a current ratio of 1.32 and a debt-to-equity ratio of 1.13.

Gilead Sciences (NASDAQ:GILD - Get Free Report) last released its earnings results on Thursday, August 7th. The biopharmaceutical company reported $2.01 EPS for the quarter, beating analysts' consensus estimates of $1.96 by $0.05. The firm had revenue of $7.08 billion for the quarter, compared to analysts' expectations of $6.95 billion. Gilead Sciences had a return on equity of 50.99% and a net margin of 21.86%. The company's quarterly revenue was up 1.4% on a year-over-year basis. During the same quarter in the prior year, the firm posted $2.01 earnings per share. On average, equities analysts anticipate that Gilead Sciences, Inc. will post 7.95 EPS for the current fiscal year.

Gilead Sciences Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Monday, September 29th. Stockholders of record on Monday, September 15th will be paid a dividend of $0.79 per share. The ex-dividend date of this dividend is Monday, September 15th. This represents a $3.16 dividend on an annualized basis and a dividend yield of 2.7%. Gilead Sciences's dividend payout ratio is currently 62.95%.

Analysts Set New Price Targets

Several research analysts have weighed in on the company. Needham & Company LLC upgraded Gilead Sciences from a "hold" rating to a "buy" rating and set a $133.00 price target for the company in a research note on Friday, July 25th. Truist Financial upgraded Gilead Sciences from a "hold" rating to a "buy" rating and upped their price target for the stock from $108.00 to $127.00 in a research note on Friday, August 8th. Oppenheimer lowered their target price on Gilead Sciences from $132.00 to $125.00 and set an "outperform" rating for the company in a research report on Friday, April 25th. Morgan Stanley raised their target price on shares of Gilead Sciences from $130.00 to $135.00 and gave the company an "overweight" rating in a report on Friday, April 25th. Finally, UBS Group raised their target price on shares of Gilead Sciences from $108.00 to $112.00 and gave the company a "neutral" rating in a report on Friday, August 8th. Seven equities research analysts have rated the stock with a hold rating, sixteen have issued a buy rating and two have given a strong buy rating to the company's stock. According to data from MarketBeat.com, Gilead Sciences presently has an average rating of "Moderate Buy" and an average target price of $114.82.

Read Our Latest Stock Report on Gilead Sciences

Insiders Place Their Bets

In other news, CFO Andrew D. Dickinson sold 2,500 shares of Gilead Sciences stock in a transaction on Tuesday, July 15th. The stock was sold at an average price of $111.03, for a total transaction of $277,575.00. Following the completion of the sale, the chief financial officer directly owned 162,610 shares in the company, valued at approximately $18,054,588.30. This trade represents a 1.51% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Also, Director Jeffrey Bluestone sold 5,000 shares of Gilead Sciences stock in a transaction on Monday, July 14th. The stock was sold at an average price of $109.74, for a total value of $548,700.00. Following the sale, the director owned 8,920 shares of the company's stock, valued at approximately $978,880.80. This trade represents a 35.92% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders sold 79,500 shares of company stock worth $8,734,625. Corporate insiders own 0.27% of the company's stock.

Gilead Sciences Profile

(

Free Report)

Gilead Sciences, Inc, a biopharmaceutical company, discovers, develops, and commercializes medicines in the areas of unmet medical need in the United States, Europe, and internationally. The company provides Biktarvy, Genvoya, Descovy, Odefsey, Truvada, Complera/ Eviplera, Stribild, Sunlencs, and Atripla products for the treatment of HIV/AIDS; Veklury, an injection for intravenous use, for the treatment of COVID-19; and Epclusa, Harvoni, Vemlidy, and Viread for the treatment of viral hepatitis.

Further Reading

Before you consider Gilead Sciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Gilead Sciences wasn't on the list.

While Gilead Sciences currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report