Callan Family Office LLC purchased a new stake in shares of Penske Automotive Group, Inc. (NYSE:PAG - Free Report) in the first quarter, according to the company in its most recent disclosure with the SEC. The institutional investor purchased 1,510 shares of the company's stock, valued at approximately $217,000.

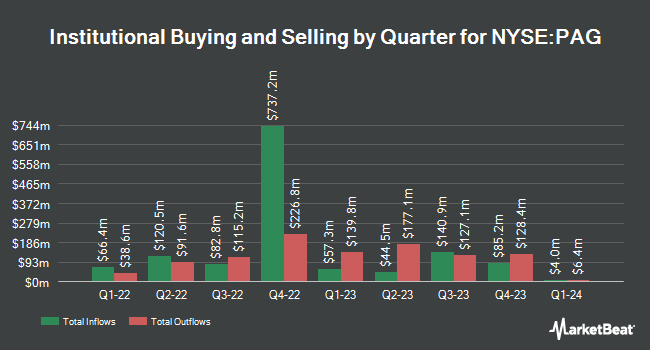

A number of other hedge funds and other institutional investors have also bought and sold shares of the business. Financial Engines Advisors L.L.C. raised its position in Penske Automotive Group by 99.0% during the 1st quarter. Financial Engines Advisors L.L.C. now owns 5,788 shares of the company's stock valued at $833,000 after purchasing an additional 2,879 shares during the last quarter. CCM Investment Group LLC bought a new position in shares of Penske Automotive Group in the 1st quarter worth approximately $297,000. Nuveen LLC bought a new position in shares of Penske Automotive Group in the 1st quarter worth approximately $10,004,000. Invesco Ltd. raised its position in shares of Penske Automotive Group by 3.4% in the 1st quarter. Invesco Ltd. now owns 223,630 shares of the company's stock worth $32,198,000 after acquiring an additional 7,276 shares in the last quarter. Finally, Atlas Capital Advisors Inc. raised its position in shares of Penske Automotive Group by 62.7% in the 1st quarter. Atlas Capital Advisors Inc. now owns 2,418 shares of the company's stock worth $348,000 after acquiring an additional 932 shares in the last quarter. Institutional investors own 77.08% of the company's stock.

Penske Automotive Group Stock Down 0.8%

PAG stock traded down $1.3680 on Thursday, reaching $180.8520. 203,096 shares of the company traded hands, compared to its average volume of 242,810. Penske Automotive Group, Inc. has a one year low of $134.05 and a one year high of $186.55. The company has a debt-to-equity ratio of 0.16, a current ratio of 0.90 and a quick ratio of 0.21. The company has a market cap of $11.94 billion, a P/E ratio of 12.59 and a beta of 0.87. The firm has a fifty day simple moving average of $175.46 and a 200-day simple moving average of $164.69.

Penske Automotive Group (NYSE:PAG - Get Free Report) last posted its quarterly earnings data on Wednesday, July 30th. The company reported $3.78 earnings per share for the quarter, beating analysts' consensus estimates of $3.56 by $0.22. Penske Automotive Group had a return on equity of 17.43% and a net margin of 3.13%.The company had revenue of $7.66 billion during the quarter, compared to analyst estimates of $7.98 billion. During the same quarter last year, the company earned $3.61 EPS. The firm's revenue for the quarter was down .4% on a year-over-year basis. Research analysts anticipate that Penske Automotive Group, Inc. will post 13.86 earnings per share for the current year.

Penske Automotive Group announced that its Board of Directors has approved a stock repurchase plan on Wednesday, May 14th that allows the company to buyback $250.00 million in outstanding shares. This buyback authorization allows the company to repurchase up to 2.3% of its stock through open market purchases. Stock buyback plans are often an indication that the company's management believes its stock is undervalued.

Penske Automotive Group Increases Dividend

The firm also recently announced a quarterly dividend, which will be paid on Wednesday, September 3rd. Shareholders of record on Friday, August 15th will be paid a dividend of $1.32 per share. The ex-dividend date is Friday, August 15th. This represents a $5.28 annualized dividend and a yield of 2.9%. This is a positive change from Penske Automotive Group's previous quarterly dividend of $1.26. Penske Automotive Group's dividend payout ratio (DPR) is 36.74%.

Insider Buying and Selling at Penske Automotive Group

In other Penske Automotive Group news, Director Lisa Ann Davis sold 1,604 shares of the stock in a transaction on Monday, August 18th. The stock was sold at an average price of $180.74, for a total transaction of $289,906.96. Following the sale, the director directly owned 1,529 shares in the company, valued at approximately $276,351.46. This trade represents a 51.20% decrease in their position. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, EVP Shane M. Spradlin sold 3,158 shares of the stock in a transaction on Monday, June 9th. The shares were sold at an average price of $167.10, for a total value of $527,701.80. Following the sale, the executive vice president owned 36,152 shares in the company, valued at approximately $6,040,999.20. This represents a 8.03% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last quarter, insiders sold 84,748 shares of company stock worth $13,748,660. Insiders own 51.70% of the company's stock.

Analysts Set New Price Targets

Several research analysts have recently issued reports on PAG shares. Bank of America increased their target price on Penske Automotive Group from $190.00 to $205.00 and gave the stock a "buy" rating in a research report on Monday, June 16th. JPMorgan Chase & Co. raised Penske Automotive Group from an "underweight" rating to a "neutral" rating and increased their target price for the stock from $155.00 to $175.00 in a research report on Tuesday, August 5th. Morgan Stanley increased their target price on Penske Automotive Group from $180.00 to $190.00 and gave the stock an "overweight" rating in a research report on Thursday, August 14th. Wall Street Zen raised Penske Automotive Group from a "hold" rating to a "buy" rating in a research report on Wednesday, April 23rd. Finally, Stephens reissued an "equal weight" rating and issued a $140.00 target price on shares of Penske Automotive Group in a research report on Wednesday, June 11th. Four investment analysts have rated the stock with a Buy rating and two have given a Hold rating to the stock. Based on data from MarketBeat, the company has an average rating of "Moderate Buy" and an average target price of $181.00.

Get Our Latest Report on Penske Automotive Group

Penske Automotive Group Profile

(

Free Report)

Penske Automotive Group, Inc, a diversified transportation services company, operates automotive and commercial truck dealerships worldwide. The company operates through four segments: Retail Automotive, Retail Commercial Truck, Other, and Non-Automotive Investments. It operates dealerships under franchise agreements with various automotive manufacturers and distributors.

Featured Stories

Before you consider Penske Automotive Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Penske Automotive Group wasn't on the list.

While Penske Automotive Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report