Callan Family Office LLC purchased a new position in shares of CMS Energy Corporation (NYSE:CMS - Free Report) during the 2nd quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor purchased 6,165 shares of the utilities provider's stock, valued at approximately $427,000.

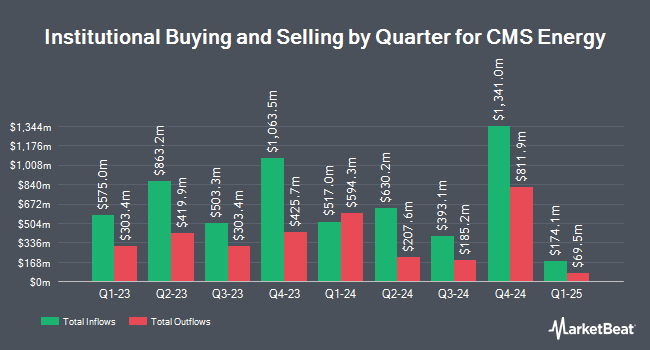

Several other institutional investors and hedge funds have also recently added to or reduced their stakes in the company. AlphaQuest LLC increased its holdings in shares of CMS Energy by 285.5% in the first quarter. AlphaQuest LLC now owns 451 shares of the utilities provider's stock valued at $34,000 after purchasing an additional 334 shares during the last quarter. Trust Co. of Vermont increased its holdings in shares of CMS Energy by 127.7% in the second quarter. Trust Co. of Vermont now owns 535 shares of the utilities provider's stock valued at $37,000 after purchasing an additional 300 shares during the last quarter. WPG Advisers LLC acquired a new position in shares of CMS Energy in the first quarter valued at $47,000. Grove Bank & Trust increased its holdings in shares of CMS Energy by 167.3% in the first quarter. Grove Bank & Trust now owns 1,072 shares of the utilities provider's stock valued at $81,000 after purchasing an additional 671 shares during the last quarter. Finally, TD Private Client Wealth LLC acquired a new position in shares of CMS Energy in the first quarter valued at $82,000. 93.57% of the stock is owned by institutional investors.

Insider Transactions at CMS Energy

In other news, SVP Brandon J. Hofmeister sold 2,000 shares of the firm's stock in a transaction that occurred on Friday, August 8th. The shares were sold at an average price of $73.62, for a total value of $147,240.00. Following the sale, the senior vice president directly owned 68,036 shares in the company, valued at approximately $5,008,810.32. This trade represents a 2.86% decrease in their position. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, SVP Lauren Y. Snyder sold 2,220 shares of the firm's stock in a transaction that occurred on Friday, September 5th. The shares were sold at an average price of $71.26, for a total transaction of $158,197.20. Following the completion of the sale, the senior vice president owned 13,512 shares in the company, valued at approximately $962,865.12. The trade was a 14.11% decrease in their ownership of the stock. The disclosure for this sale can be found here. 0.49% of the stock is currently owned by corporate insiders.

CMS Energy Trading Up 1.1%

CMS opened at $74.36 on Wednesday. CMS Energy Corporation has a twelve month low of $63.97 and a twelve month high of $76.45. The company has a 50-day simple moving average of $72.19 and a 200 day simple moving average of $71.65. The company has a quick ratio of 0.77, a current ratio of 1.00 and a debt-to-equity ratio of 1.93. The stock has a market capitalization of $22.26 billion, a price-to-earnings ratio of 22.00, a P/E/G ratio of 2.80 and a beta of 0.40.

CMS Energy (NYSE:CMS - Get Free Report) last posted its quarterly earnings data on Thursday, July 31st. The utilities provider reported $0.71 earnings per share for the quarter, topping the consensus estimate of $0.67 by $0.04. CMS Energy had a net margin of 12.76% and a return on equity of 12.07%. The business had revenue of $1.84 billion during the quarter, compared to analysts' expectations of $1.68 billion. During the same quarter in the prior year, the business posted $0.66 earnings per share. CMS Energy's revenue was up 14.4% compared to the same quarter last year. CMS Energy has set its FY 2025 guidance at 3.540-3.600 EPS. Analysts predict that CMS Energy Corporation will post 3.59 EPS for the current fiscal year.

CMS Energy Dividend Announcement

The company also recently disclosed a quarterly dividend, which was paid on Friday, August 29th. Investors of record on Friday, August 8th were given a dividend of $0.5425 per share. The ex-dividend date of this dividend was Friday, August 8th. This represents a $2.17 annualized dividend and a yield of 2.9%. CMS Energy's dividend payout ratio is currently 64.20%.

Wall Street Analysts Forecast Growth

Several equities analysts have commented on CMS shares. Wolfe Research reiterated a "peer perform" rating on shares of CMS Energy in a report on Monday, July 7th. Weiss Ratings reiterated a "buy (b-)" rating on shares of CMS Energy in a report on Wednesday, October 8th. Barclays upped their price objective on shares of CMS Energy from $77.00 to $78.00 and gave the company an "overweight" rating in a report on Tuesday, July 22nd. Morgan Stanley decreased their price objective on shares of CMS Energy from $73.00 to $71.00 and set an "equal weight" rating on the stock in a report on Thursday, September 25th. Finally, Wall Street Zen downgraded shares of CMS Energy from a "hold" rating to a "sell" rating in a research note on Saturday, July 26th. Seven investment analysts have rated the stock with a Buy rating and five have issued a Hold rating to the stock. According to data from MarketBeat, CMS Energy has a consensus rating of "Moderate Buy" and an average price target of $77.90.

View Our Latest Report on CMS Energy

About CMS Energy

(

Free Report)

CMS Energy Corporation operates as an energy company primarily in Michigan. The company operates through three segments: Electric Utility; Gas Utility; and Enterprises. The Electric Utility segment is involved in the generation, purchase, transmission, distribution, and sale of electricity. This segment generates electricity through coal, wind, gas, renewable energy, oil, and nuclear sources.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider CMS Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CMS Energy wasn't on the list.

While CMS Energy currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.