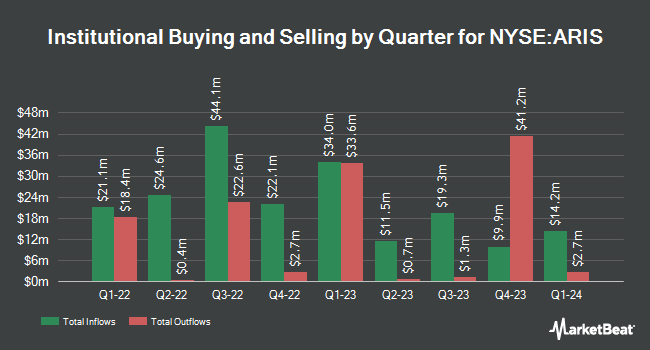

Cambridge Investment Research Advisors Inc. bought a new position in shares of Aris Water Solutions, Inc. (NYSE:ARIS - Free Report) in the first quarter, according to its most recent filing with the Securities & Exchange Commission. The institutional investor bought 27,074 shares of the company's stock, valued at approximately $867,000.

A number of other institutional investors also recently modified their holdings of ARIS. SBI Securities Co. Ltd. purchased a new stake in Aris Water Solutions in the fourth quarter worth about $33,000. Raymond James Financial Inc. purchased a new stake in Aris Water Solutions in the fourth quarter worth about $29,663,000. Larson Financial Group LLC purchased a new stake in Aris Water Solutions in the fourth quarter worth about $28,000. Moors & Cabot Inc. purchased a new stake in Aris Water Solutions in the fourth quarter worth about $352,000. Finally, Sequoia Financial Advisors LLC purchased a new stake in Aris Water Solutions in the fourth quarter worth about $266,000. 39.71% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Upgrades and Downgrades

Several research firms have recently issued reports on ARIS. Wells Fargo & Company lowered their target price on shares of Aris Water Solutions from $29.00 to $23.00 and set an "equal weight" rating for the company in a report on Thursday, May 8th. Citigroup reiterated a "neutral" rating on shares of Aris Water Solutions in a report on Monday, May 12th. The Goldman Sachs Group lowered their target price on shares of Aris Water Solutions from $34.00 to $30.00 and set a "buy" rating for the company in a report on Thursday, May 8th. Finally, Wall Street Zen lowered shares of Aris Water Solutions from a "hold" rating to a "sell" rating in a report on Tuesday, May 13th. One analyst has rated the stock with a sell rating, four have assigned a hold rating and two have issued a buy rating to the company's stock. According to MarketBeat.com, Aris Water Solutions presently has a consensus rating of "Hold" and a consensus target price of $26.00.

View Our Latest Report on ARIS

Aris Water Solutions Stock Down 2.7%

Shares of ARIS traded down $0.64 on Thursday, hitting $22.89. 802,722 shares of the stock traded hands, compared to its average volume of 642,821. The company has a market capitalization of $1.35 billion, a PE ratio of 27.92 and a beta of 1.69. The company has a debt-to-equity ratio of 0.63, a quick ratio of 1.87 and a current ratio of 1.87. The business has a 50 day simple moving average of $23.97 and a 200 day simple moving average of $26.23. Aris Water Solutions, Inc. has a one year low of $13.34 and a one year high of $33.95.

Aris Water Solutions (NYSE:ARIS - Get Free Report) last announced its quarterly earnings results on Tuesday, May 6th. The company reported $0.25 earnings per share for the quarter, beating the consensus estimate of $0.23 by $0.02. The company had revenue of $120.49 million during the quarter, compared to the consensus estimate of $115.72 million. Aris Water Solutions had a net margin of 6.15% and a return on equity of 3.77%. As a group, equities analysts forecast that Aris Water Solutions, Inc. will post 0.91 earnings per share for the current fiscal year.

Aris Water Solutions Dividend Announcement

The company also recently declared a quarterly dividend, which was paid on Wednesday, June 18th. Investors of record on Thursday, June 5th were given a dividend of $0.14 per share. This represents a $0.56 annualized dividend and a dividend yield of 2.45%. The ex-dividend date was Thursday, June 5th. Aris Water Solutions's dividend payout ratio (DPR) is currently 68.29%.

Aris Water Solutions Company Profile

(

Free Report)

Aris Water Solutions, Inc, an environmental infrastructure and solutions company, provides water handling and recycling solutions. The company's produced water handling business gathers, transports, unless recycled, and handles produced water generated from oil and natural gas production. Its water solutions business develops and operates recycling facilities to treat, store, and recycle produced water.

Further Reading

Before you consider Aris Water Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Aris Water Solutions wasn't on the list.

While Aris Water Solutions currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.