Campbell & CO Investment Adviser LLC acquired a new stake in Suzano S.A. Sponsored ADR (NYSE:SUZ - Free Report) in the first quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The fund acquired 180,044 shares of the company's stock, valued at approximately $1,673,000.

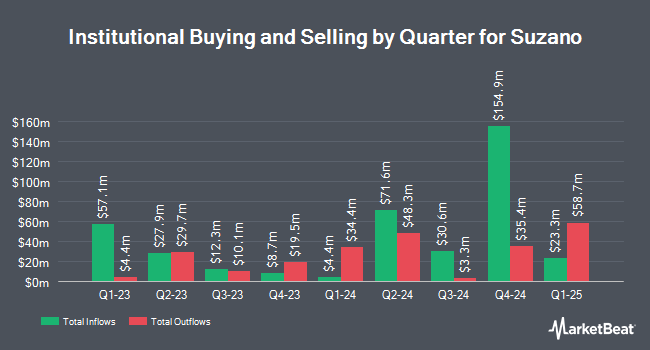

Other institutional investors and hedge funds also recently added to or reduced their stakes in the company. Financial Management Professionals Inc. purchased a new position in Suzano in the first quarter valued at $28,000. GAMMA Investing LLC increased its holdings in Suzano by 311.8% in the first quarter. GAMMA Investing LLC now owns 11,492 shares of the company's stock valued at $107,000 after buying an additional 8,701 shares in the last quarter. Ameriprise Financial Inc. increased its holdings in Suzano by 10.6% in the fourth quarter. Ameriprise Financial Inc. now owns 12,090 shares of the company's stock valued at $126,000 after buying an additional 1,155 shares in the last quarter. Bridgefront Capital LLC purchased a new position in Suzano in the fourth quarter valued at $129,000. Finally, Mariner LLC increased its stake in shares of Suzano by 29.1% during the fourth quarter. Mariner LLC now owns 13,326 shares of the company's stock worth $135,000 after purchasing an additional 3,006 shares in the last quarter. Hedge funds and other institutional investors own 2.55% of the company's stock.

Analyst Upgrades and Downgrades

SUZ has been the subject of a number of research reports. The Goldman Sachs Group raised shares of Suzano from a "neutral" rating to a "buy" rating in a research note on Friday, June 13th. Zacks Research raised shares of Suzano to a "strong-buy" rating in a research note on Friday, August 8th. Finally, Wall Street Zen cut shares of Suzano from a "buy" rating to a "hold" rating in a research note on Tuesday, July 29th. Two investment analysts have rated the stock with a Strong Buy rating and one has issued a Buy rating to the company's stock. Based on data from MarketBeat, the stock has a consensus rating of "Strong Buy".

Read Our Latest Analysis on Suzano

Suzano Price Performance

NYSE SUZ traded down $0.10 during trading hours on Friday, hitting $9.73. 933,266 shares of the company's stock traded hands, compared to its average volume of 1,498,418. Suzano S.A. Sponsored ADR has a 52-week low of $8.41 and a 52-week high of $10.98. The company has a market capitalization of $12.88 billion, a PE ratio of 8.61, a PEG ratio of 0.10 and a beta of 0.85. The company has a debt-to-equity ratio of 2.05, a current ratio of 3.16 and a quick ratio of 2.48. The firm's 50-day moving average is $9.47 and its 200-day moving average is $9.38.

Suzano Company Profile

(

Free Report)

Suzano SA produces and sells eucalyptus pulp and paper products in Brazil and internationally. It operates through Pulp and Paper segments. The company offers coated and uncoated printing and writing papers, paperboards, tissue papers, and market and fluff pulps; and lignin. It also engages in the research, development, and production of biofuel; operation of port terminals; power generation and distribution business; commercialization of equipment and parts; industrialization, commercialization, and exporting of pulp and standing wood; road freight transport; biotechnology research and development; and commercialization of paper and computer materials.

Recommended Stories

Before you consider Suzano, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Suzano wasn't on the list.

While Suzano currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.